Weekly Market Commentary

Inflation was uppermost on the minds of investors, Fed officials, and policymakers until the failure of Silicon Valley Bank (SVB) forced price stability to play second fiddle to banking stability.

The banking crisis has eased amid tentative signs that actions taken by the U.S. Treasury, the FDIC, and the Federal Reserve are having their intended effect: preventing contagion.

While the impact of SVB’s failure on U.S. economic activity is uncertain, inflation has yet to go into hibernation.

Unlike the better-known Consumer Price Index, the PCE Price Index is not a household name. But it’s like the CPI, and it’s the Fed-favored gauge for measuring inflation.

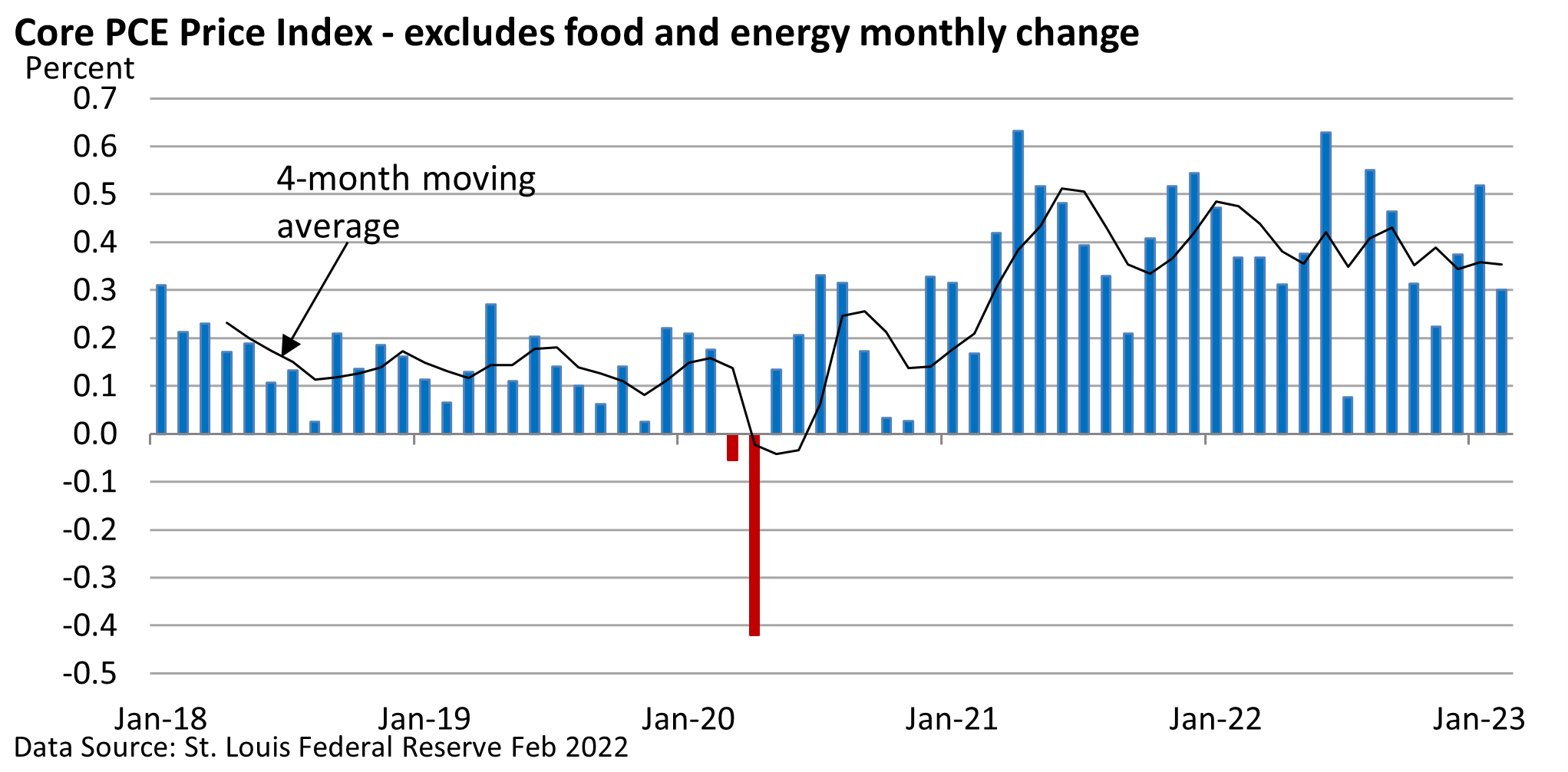

The graphic below highlights the monthly change in the core PCE Price Index. The core excludes food and energy prices.

The 0.3% rise in February is encouraging, but inflation remains above the Fed’s 2% annual goal.

The headline PCE Price Index in February is up 5.0% versus one year ago, slowing from 5.3% in January. The Core PCE Price Index is up 4.6% vs 4.7% in January.

The four-month average, which smooths away monthly volatility and seasonal quirks that may pop up in the data, suggests progress on the pricing front remains slow.

While anxieties over the banks have eased, it’s unknown how March’s banking tremors will ripple through the economy.

If banks raise the bar for who might get loans, the banking crisis does the Fed’s job for it. Economic growth slows, and inflation would probably ease, too. But the economy could slide into a recession.

For investors, Fed’s reaction will depend on how the banking system stabilizes (and initial signs are cautiously positive), incoming data on inflation, and the general economy.