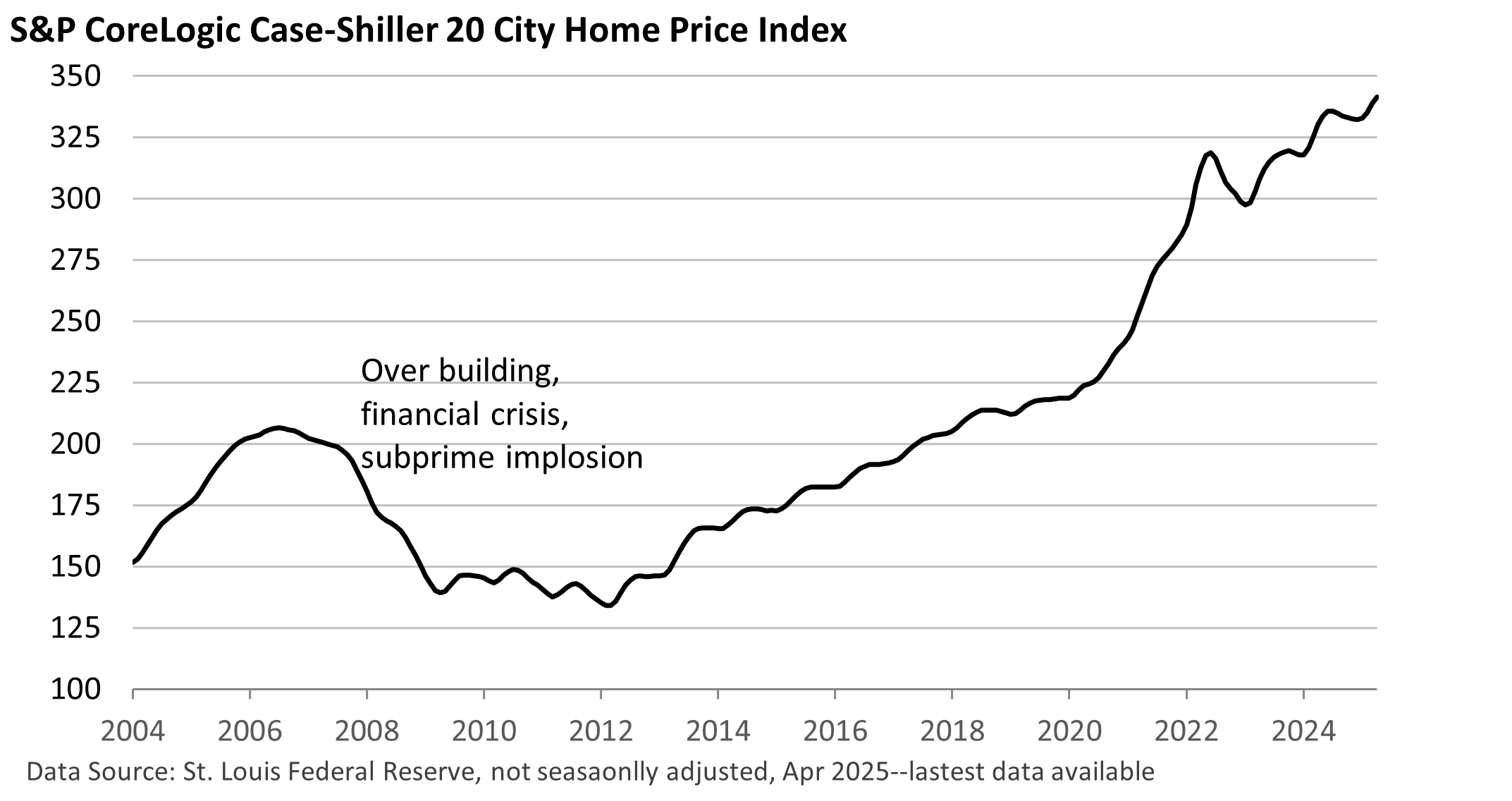

Home sales have fallen sharply over the last three years, with sales near the levels we last saw in 2008, according to the National Association of Realtors. Yet, unlike in 2008, housing prices haven’t collapsed this time around.

Over the past 15 years, lending standards have improved significantly, and buyers are now making larger down payments, both of which help reduce the risk of homeowners walking away at the first sign of financial stress.

But today’s high prices, coupled with high mortgage rates, have discouraged or simply shut some buyers out of the market.

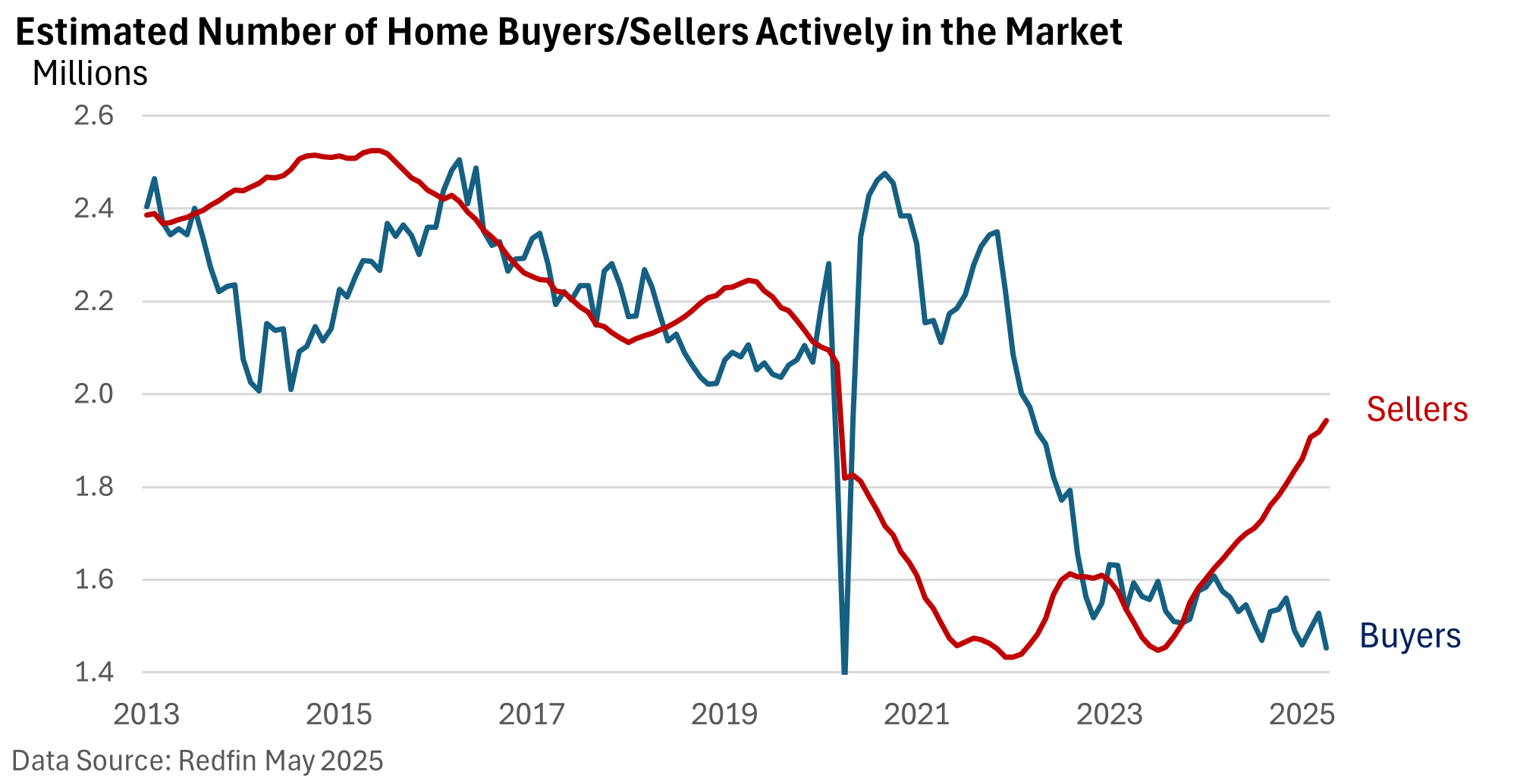

Further, the rise in mortgage rates brought an unintended—and, in hindsight, unwelcome—side effect: some homeowners who might have listed their properties chose to stay put, reluctant to give up the ultra-low mortgage rates they locked in when borrowing costs were at or below 3%.

Up until now, that has restricted supply and supported prices. That, however, may be changing.

I would like to sell vs I need to sell

As life’s circumstances change, the desire to move is replaced with the necessity to move, and homeowners list their homes and enter the market for a new one.

According to data from Redfin, sellers now outnumber buyers by nearly 500,000, the widest since at least 2013. And the growing imbalance between buyers and sellers could put downward pressure on prices.

How much pressure? Any forecast is simply an educated guess, but Redfin believes home prices in the US could drop 1% year over year by the end of 2025.

A sharp drop in mortgage rates would likely draw potential buyers that have been on the sidelines.

But it could also prompt hesitant homeowners to list their properties and make long-delayed moves, easing some of the inventory constraints in today’s tight housing market.