Weekly Market Commentary

The latest jobs report did little to alter the economic outlook. Instead, it was a steady-as-she-goes report.

Nonfarm payrolls grew by 199,000 in November, according to the U.S. Bureau of Labor Statistics (BLS). It was nearly in line with the consensus forecast among economists of 190,000 (CNBC). The unemployment rate fell to 3.7% in November from 3.9% in October.

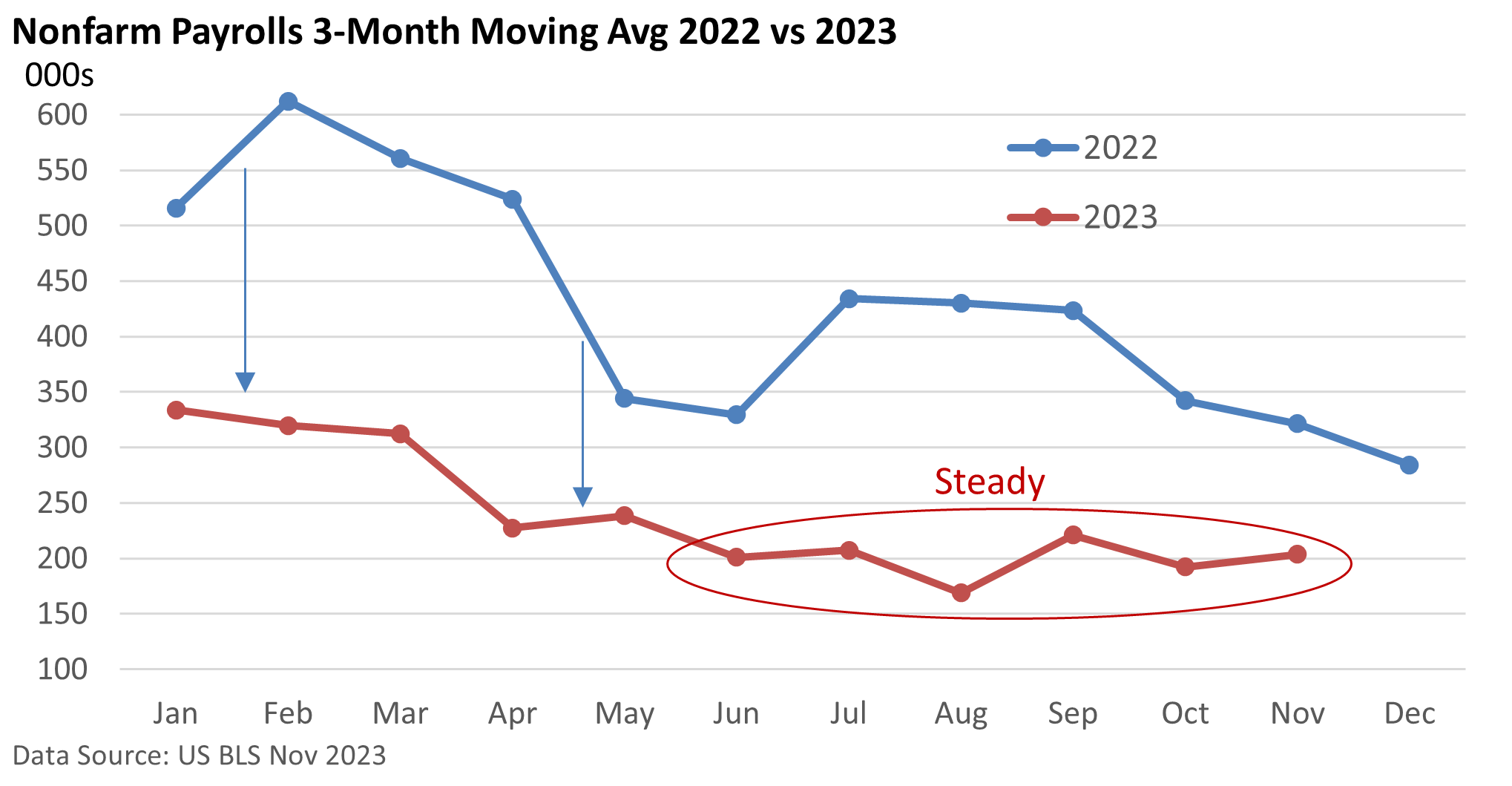

The graphic below reviews the 3-month moving average for nonfarm payrolls in 2022 and 2023. A 3-month average helps smooth away some of the volatility and noise you sometimes get in monthly numbers.

What is a 3-month moving average? For November (204,000), we average the monthly payrolls numbers for September, October, and November. For October, we average August, September, and October, until we get back to January 2022.

The graphic illustrates that job growth has moderated but not to a level that would be concerning. Moreover, the last six months have been in a steady, narrow range: not too hot, but not too cold.

While there are challenges in finding work in some industries, there’s nothing here to suggest that economic growth is about to stall.

For the Federal Reserve, growth is more sustainable, as the labor market slowly comes into balance. It helps bolster the case that the rate-hike cycle is probably over, but nothing that might encourage the Fed to contemplate lower rates.

For investors, it was a bit of a disappointment. You see, they wanted a smaller rise in jobs, as they believe it would bolster their case for rate cuts.

A few weeks ago, investors had shifted into the “higher for longer” camp on interest rates. But over the last month, sluggish economic data pushed Treasury bond yields down sharply. Now investors expect an aggressive round of rate cuts next year—up to 5 rate cuts. At least that is the current consensus provided by closely watched data from the CME Group. And, the sharp drop in yields sparked a furious rally in stocks last month.

Investors have front-run rate cuts before. November’s employment numbers offered little for those who believe the Fed will start cutting rates early next year.