Weekly Market Commentary

Fed Chief Jay Powell, along with other Fed officials, have been open about discussing the lessons they learned and the errors made during the 1970s.

The Consumer Price Index (CPI) jumped to an annual rate of over 12% in 1974 before falling back to 5% by 1976, per data from the St. Louis Federal Reserve.

However, the Fed became complacent, and it was forced to chase a rising rate of inflation, with the CPI hitting nearly 15% by 1980.

But what about the lessons of the 1960s? And how might they relate to our current situation?

Let’s start with last week’s report. The CPI and the core CPI, which excludes food and energy, both rose 0.2% in July, according to the U.S. Bureau of Labor Statistics.

It is encouraging to note that before rounding up, the monthly core rate increased by just 0.16% in June and July.

On an annual basis, the CPI increased 3.2% in July, up from 3.0% in June, while the core rate slowed from 4.8% to 4.7%. Both are still too high but are moving in the right direction.

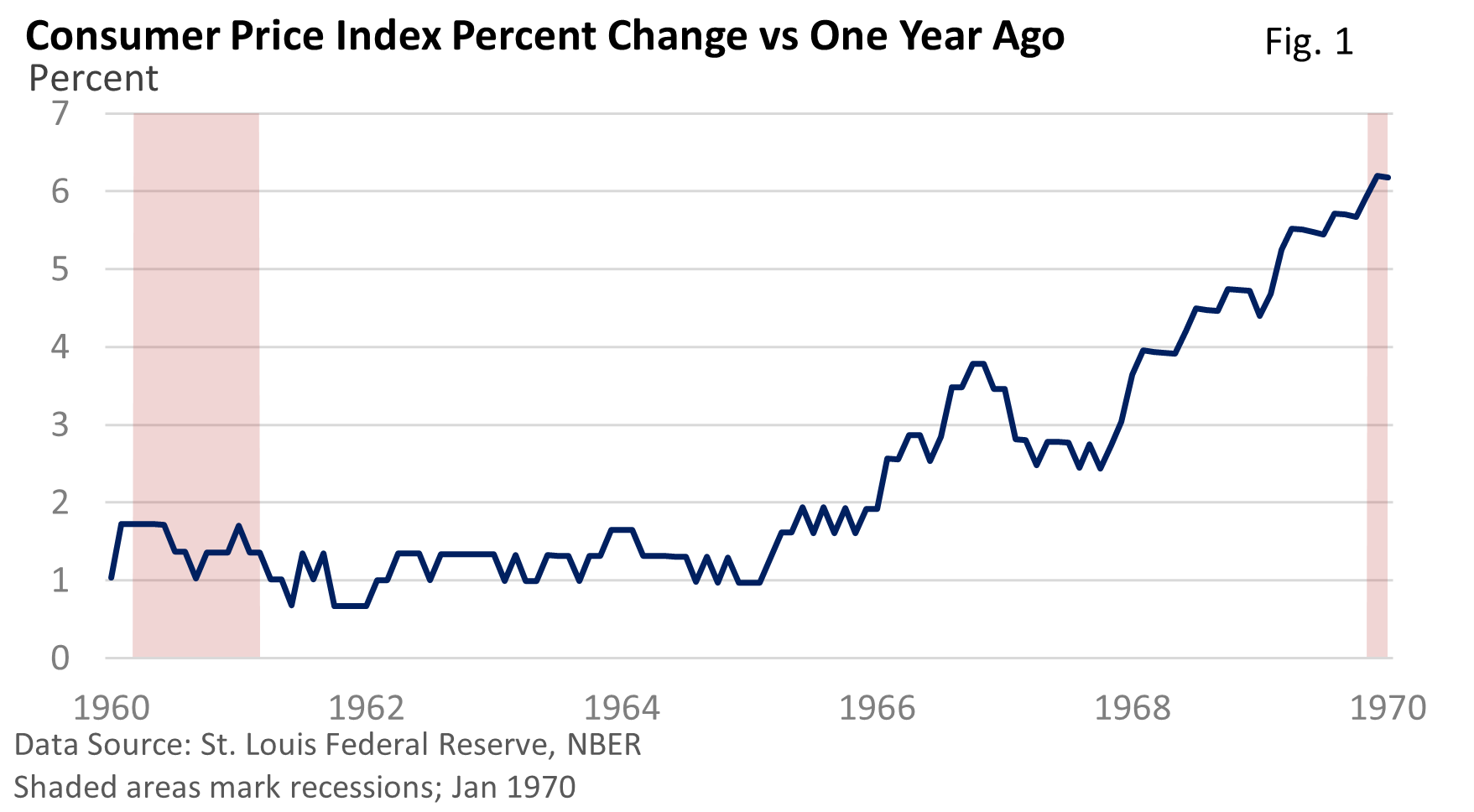

Back to our original question—what about the lessons of the 1960s? The rate of inflation doubled between early and late 1966. However, the CPI slowed significantly in 1967, which we’re seeing today—see Figure 1.

Why did the rate briefly slow in the 1960s? The Fed engineered the perfect soft landing—a slowdown in economic growth, a stable jobless rate, and the avoidance of a recession.

Among other things, it was a triumph for monetary policy and the Fed.

However, the victory over inflation proved to be temporary, as prices resumed their upward march in the late 1960s.

While there are some similarities between the 1960s and the present day, it’s also important to recognize that there are differences, too. Besides, we don’t want to downplay recent progress on inflation.

But a repeat of the 1960s is best avoided.