Over the past month, we have approached the issue of tariffs from the market’s perspective, specifically that of investors.

Let’s take a different approach today. We’ll examine the issue from the perspective of domestic manufacturers and manufacturing workers.

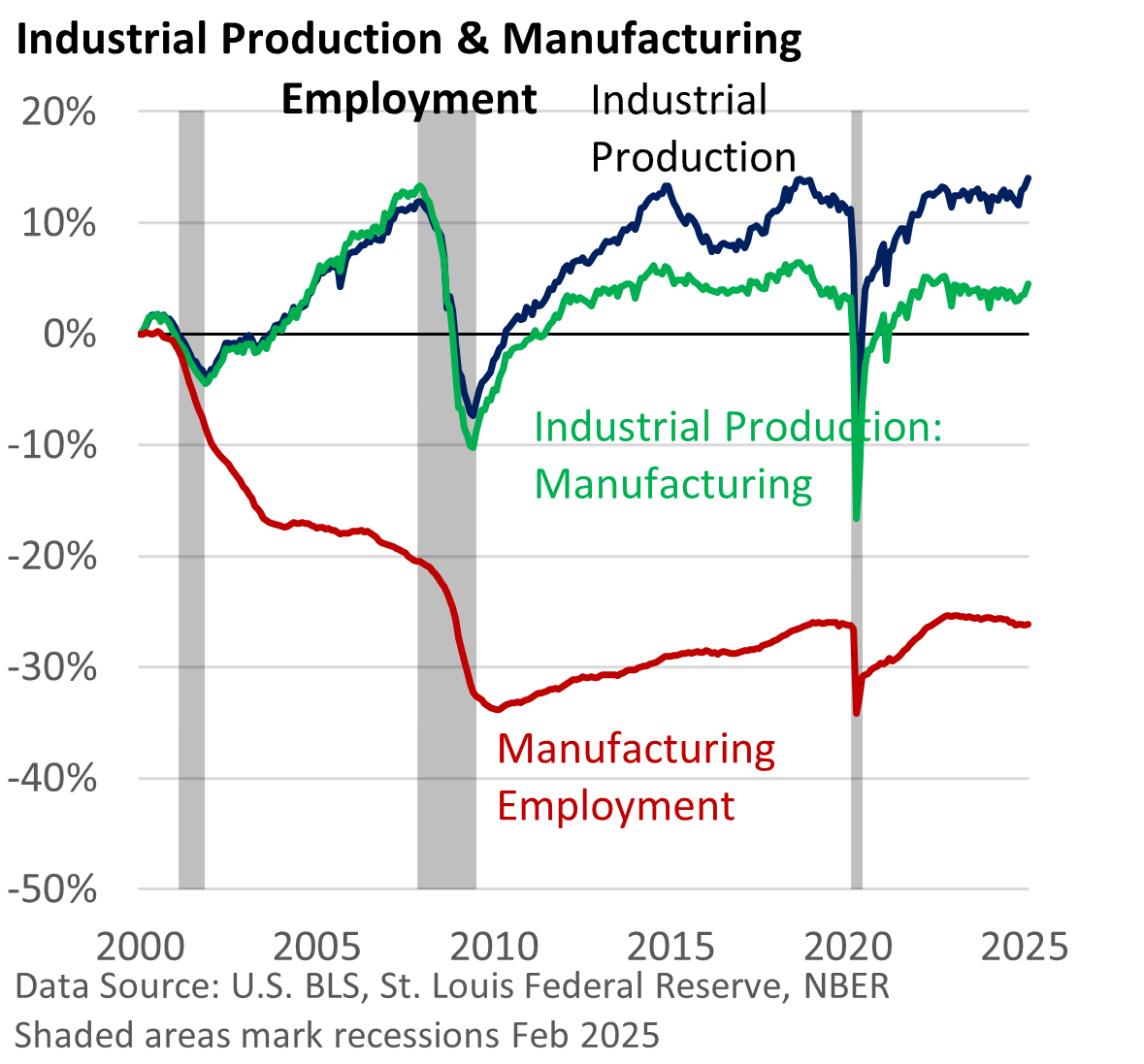

The graphic below effectively summarizes the point.

Since 2000, industrial production has risen by 14%. It lags significantly behind a 70% rise in Gross Domestic Product over the same period.

Manufacturing is a subset of industrial production. It excludes mining and utility production, accounting for 75% of industrial production according to the Federal Reserve.

It’s up by a scant 4.4%.

That’s right. Over the past quarter century, manufacturing production has expanded by less than 5%! Moreover, it remains well below the peak achieved nearly 20 years ago.

Plus, thanks to efficiency gains and productivity, manufacturing employment has declined by a whopping 26%!

Let’s throw out one more statistic. During the period surveyed, total U.S. employment increased from 131 million to 159 million, according to the U.S. Bureau of Labor Statistics.

Manufacturing employment, however, fell from 17.2 million to 12.8 million.

While a few select U.S. manufacturing sectors are thriving, others struggle to profitably produce goods domestically.

Some have simply given up and closed their shops or moved production overseas.