Weekly Market Commentary

There has been meaningful progress on the inflation front. The annual rate of inflation has slowed, and the ever-visible price of gasoline is well off last year’s high. But as every child has asked on a long road trip, “Are we there yet?”

In other words, are we at or near the Fed’s 2% annual inflation target? Are rate hikes over? The short answer is no. Fed officials are still talking about higher interest rates and are touting the idea that it’s too soon to be discussing rate cuts.

Their fear is simple: declare victory too soon and a resurgence in inflation may ensue.

Let’s quickly review the numbers from last week’s Consumer Price Index (CPI), which was released by the U.S. Bureau of Labor Statistics.

The CPI slowed from 7.1% annually in November to 6.5% in December, matching expectations, according to CNBC.

The core CPI, which excludes food and energy, slowed from an annual rate of 6.0% in November to 5.7% in December, also in line with expectations.

On a monthly basis, the CPI fell 0.1% in December, matching expectations, as food rose 0.3%, and energy fell 4.5%. The core CPI rose 0.3%, matching expectations.

The monthly CPI has come in below the core CPI in 5 of the last 6 months amid the drop in energy. That’s encouraging. We’re also seeing some moderation in core inflation, too.

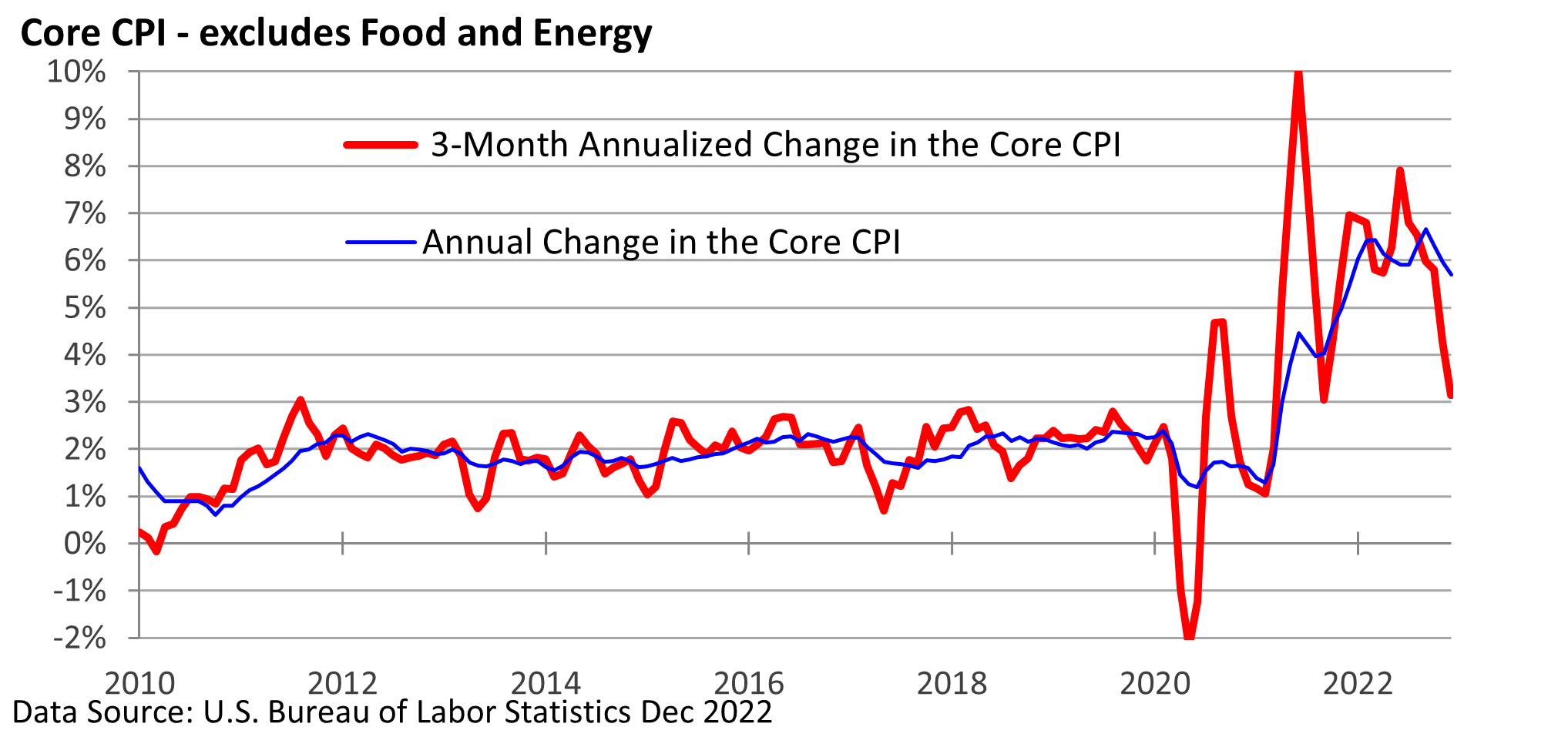

Let’s review the graphic below, which illustrates the annual change in the core CPI (blue line) and contrasts it with the 3-month annualized rate in core inflation (red line). The same gauge is being used, but the two metrics are calculated in different ways, providing different perspectives.

The annual rate is backward-looking and less volatile. The 3-month annual rate is more forward-looking. It’s quicker to pick up on trends, but it’s noisier and can give false signals.

At 3.1%, the 3-month annual rate has fallen dramatically from a recent June high of 7.9%.

Including food and energy, the 3-month annualized CPI was 1.8% in December.

Going forward, progress may be uneven. We may get some encouraging inflation numbers and some setbacks. But recent market gains suggest investors are on board with the idea that the rate of inflation is receding.

For now, the Fed appears set to slow its pace of rate increases, but it’s not fully satisfied with the current level of inflation, as it remains well above its 2% annual goal.