For starters, the title is a simplified five-word summary of the labor market. Recall that last week, we explored the low level of layoffs. This week, we shift the focus to hiring trends. But first, let’s take a closer look at the numbers from the latest jobs report.

The US BLS reported that nonfarm payrolls rose just 22,000 in August, below the forecast of 75,000, according to the Wall Street Journal. Revisions to the last two months were minor.

The unemployment rate ticked up from 4.2% in July to 4.3% in August, the highest since October 2021.

When it comes to job creation, most of what we see is occurring in health care. Since the beginning of the year, 456,000 net new jobs have been added in health care, which accounts for the lion’s share of private sector jobs. There has been a net gain of 511,000 in private sector jobs, per US BLS data.

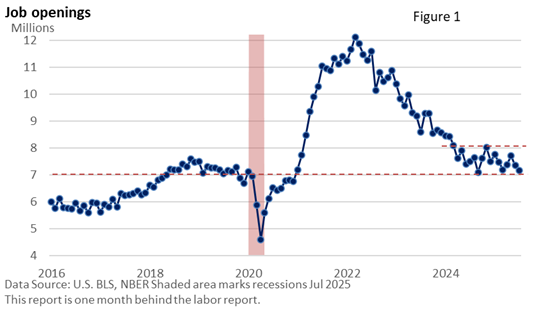

There are jobs that are available, as evidenced by Figure 1, though they have declined.

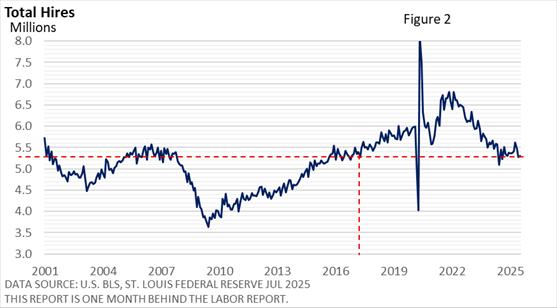

But hiring has slowed—Figure 2. Please note that total hires include all hires, not just net new jobs. It reflects gross (total) hiring activity, which is naturally much larger than net job growth (nonfarm payrolls).

What does last Friday’s jobs report mean for investors?

The data strengthens the case for a rate cut at the Federal Reserve’s upcoming two-day meeting on September 16–17. Signs of a cooling labor market are evident, and the Fed will likely feel compelled to act.

The key question now is how aggressive that action will be. Will the Fed opt for a modest 0.25 percentage-point cut, or will it take a bolder step with a 0.50 percentage-point reduction in the federal funds rate?

Yet, it’s not as though the economy appears to be teetering on the brink of recession.

The Atlanta Fed’s GDPNow model—a real-time estimate of economic growth—is projecting 3.0% annualized GDP growth for Q3 (September 4 is the latest projection).

While it’s still early in the quarter and the model currently reflects mostly July’s data, the current projection suggests that economic momentum hasn’t stalled. But the Fed’s focus is shifting away from still-elevated inflation and toward the risks that appear to be rising in the labor market.