Weekly Market Commentary

The road to price stability was never expected to be a straight line. The latest numbers show that the road isn’t even paved.

Investors hit an unexpected pothole after the U.S. Bureau of Labor Statistics (BLS) reported January’s Consumer Price Index (CPI).

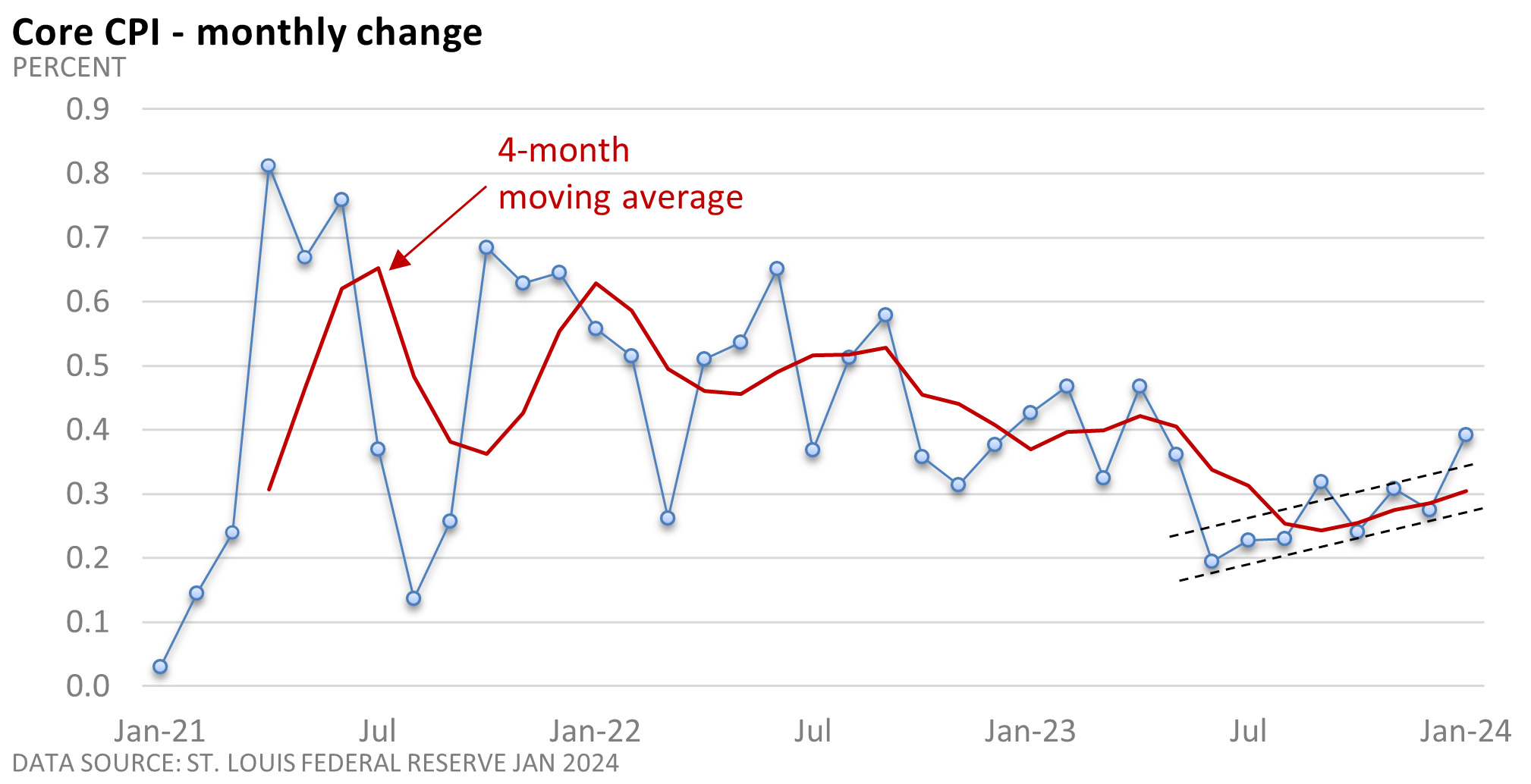

The CPI rose 0.3% in January. It slowed from 3.4% year-over-year in December to 3.1% in January. The core CPI, which minuses out food and energy, rose 0.4% in January. The annual rate held at 3.9%.

In both cases, the monthly rate came in 0.1 percentage points above expectations, per the Wall Street Journal. The core rate rose at the fastest pace since last April, according to the U.S. BLS.

Why do analysts emphasize the core rate, which excludes food and energy?

Food and energy can sometimes be volatile. The core rate provides a better picture of underlying inflation trends.

Progress has almost stalled over the last 5 months if we view it from a year-over-year perspective. It has taken 5 months for the core rate to slow from 4.1% to 3.9%. It’s slowing at a snail’s pace.

Reviewing inflation from a monthly perspective makes the data look less sanguine. As the graphic highlights, the monthly rate is up, versus the prior month, in 5 of the last 7 months.

If we briefly look under the hood, we see the tale of two economies. The data show that prices are stable or even falling for consumer goods, while service-sector inflation jumped during January.

Maybe it was simply the “January effect,” as some firms used the calendar to hike prices. We won’t get a clearer picture until next month or April.

While the narrative could change by spring, January’s hotter-than-expected inflation reading will reinforce the idea that the Fed is in no hurry to cut rates.

At a minimum, January highlights that the road to 2% inflation is uneven and, in places, unpaved.