Weekly Market Commentary

The 30-year fixed mortgage averaged 3.04% in 2020 and 2021, according to Freddie Mac’s weekly survey. The 15-year rate: 2.44%. Housing money was almost free…almost. Through June 22, the average 30-year fixed rate was 6.43%, a substantial increase.

High home prices and the jump in rates have locked some prospective buyers out of the market. Last week, the National Association of Realtors (NAR) reported that existing home sales (this excludes newly built homes), which account for almost 90% of all housing sales, were down 20% versus one year ago (through May).

You’d expect a big drop in prices, but the NAR said the median home price for existing homes is down just 3% nationally compared to a year ago. Redfin said through mid-June that the median U.S. home price of about $383,000 is 44% higher than in January 2020.

What’s going on? Lending standards have improved significantly since the 2000s. Nowadays, buyers are making bigger down payments, undergoing a more rigorous underwriting process, and are sporting higher credit scores, which means they are less likely to abandon a recently purchased home. This has resulted in much fewer distressed sales.

Plus, many homeowners are experiencing what’s known as the “golden handcuffs.” They purchased or refinanced their homes when interest rates were low, and now they are hesitant to list and buy at today’s higher rates.

As of mid-June, Redfin reported a 24% decrease in housing listings compared to the previous year. Fewer homes for sale translate into lower inventories, which supports prices.

More housing, please

Freddie Mac estimates the nation faces a housing shortfall of about 3.8 million units.

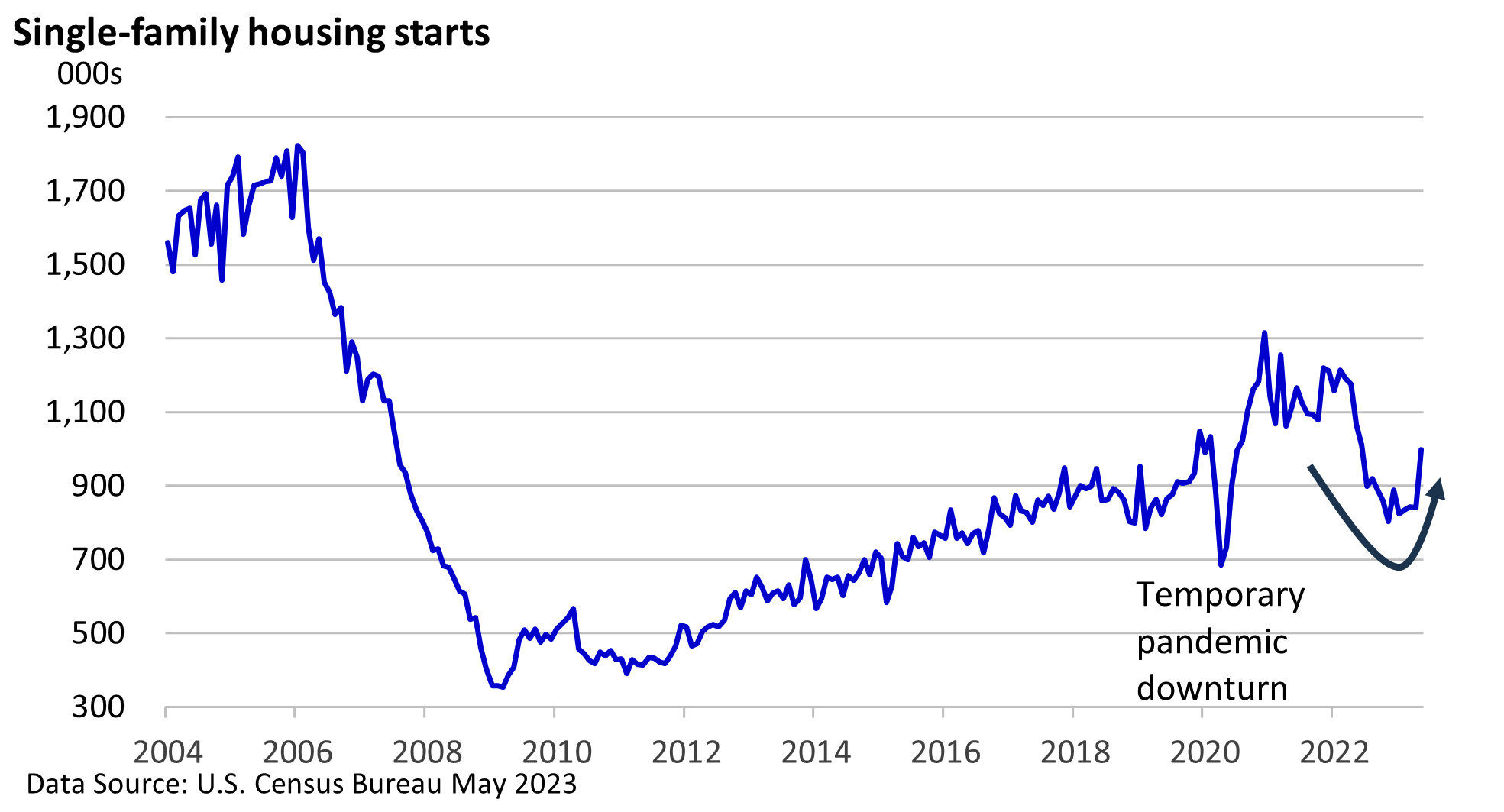

Due to the shortage, some folks are opting for newly constructed homes, and builders are slowly ramping up production. We’re nowhere near the bubble days of the 2000s, but housing starts have perked up, even with today’s high rates.

Home sales are nowhere near the 2020 and 2021 levels, but prior talk of a price collapse has yet to materialize. Still, higher mortgage rates, high prices, and a shortage of homes are adding up to new headaches for first-time buyers.