Prosperity Partners Blog

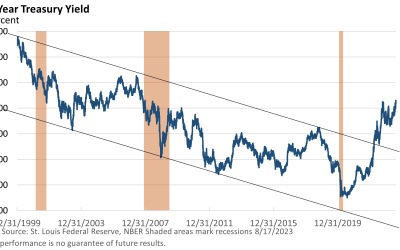

Treasury Yields Drift Higher

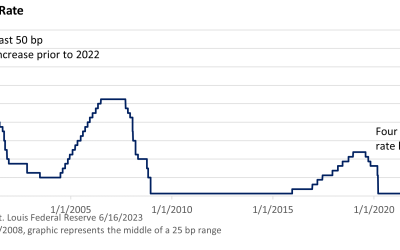

Recession talk earlier this year and a belief that the Federal Reserve was nearly finished hiking interest rates kept a lid on longer-term Treasury yields. That’s changed. Last Thursday, the 10-year Treasury yield closed at 4.30%, according to the U.S. Treasury. It was the highest close since late 2007 (St. Louis Federal Reserve Treasury data).

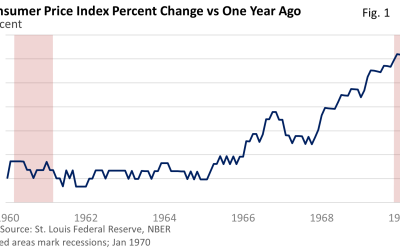

Lessons from the 1960s

Fed Chief Jay Powell, along with other Fed officials, have been open about discussing the lessons they learned and the errors made during the 1970s. The Consumer Price Index (CPI) jumped to an annual rate of over 12% in 1974 before falling back to 5% by 1976, per data from the St. Louis Federal Reserve. However, the Fed became complacent, and it was forced to chase a rising rate of inflation, with the CPI hitting nearly 15% by 1980.

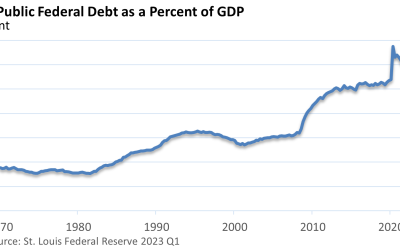

Fitch Strips USA of Triple-A Credit Rating

Fitch Ratings downgraded U.S. government debt last week by one notch from its prized top rating of ‘AAA’ to ‘AA+.’ Fitch said its decision “reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden,” and repeated political brinkmanship surrounding the debt ceiling debates.

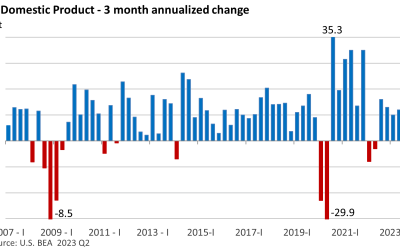

Defying Expectations

Gross Domestic Product (GDP) is a very broad measure of the value of goods and services in the economy over a certain period. Last week, the U.S. Bureau of Economic Analysis reported that GDP rose at an annual pace of 2.4% in Q2, accelerating from Q1’s 2.0% and topping the forecast of 2.0% (Wall Street Journal).

This Year’s Surprising Market Rally

The S&P 500 Index is up 18.15% since the end of last year. It has advanced 26.82% since bottoming on October 12, 2022 (through 7/21/23; data St. Louis Fed, MarketWatch). Both metrics exclude dividends reinvested. The S&P 500 Index covers about 80% of available market capitalization, per S&P DJ Indices.

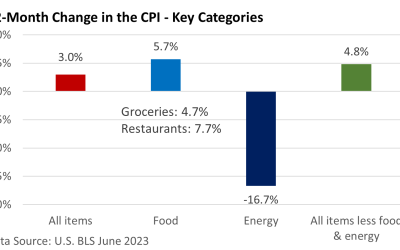

Red-Hot Inflation Cools

Inflation has bedeviled consumers and investors for over a year. The Federal Reserve waited far too long in responding to high prices, and its abrupt reversal in 2022 pushed equities into a bear market. But the Fed’s kinder, gentler approach this year and a resilient economy have helped shares rally off last year’s low.

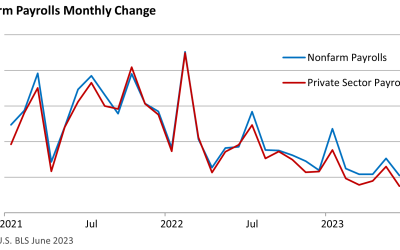

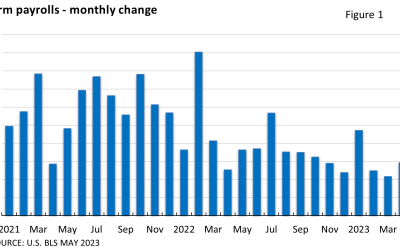

Cracks Appear in the Labor Market

It has been a surprising year for the labor market, as job growth has been much more resilient than anticipated. According to CNBC, the U.S. Bureau of Labor Statistics’ monthly nonfarm payrolls report has surpassed analyst expectations for 14-straight months, that is, until June’s report came up short.

9 Fun Facts About the Declaration of Independence

As we commemorate the 247th anniversary of the signing of the Declaration of Independence, let’s take a moment to appreciate some interesting facts about this treasured document. Here are nine fun facts to enjoy!

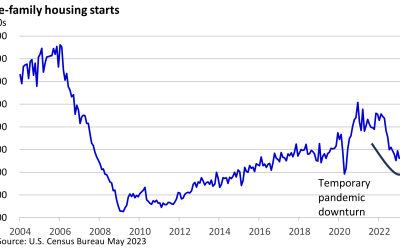

Report of Housing’s Demise are Greatly Exaggerated

High home prices and the jump in rates have locked some prospective buyers out of the market. Last week, the National Association of Realtors (NAR) reported that existing home sales (this excludes newly built homes), which account for almost 90% of all housing sales, were down 20% versus one year ago (through May).

The Fed Presses the Pause Button

The Federal Reserve held the fed funds rate at 5.00–5.25% following ten consecutive rate increases that began in March 2022. The move was anticipated as policymakers had previously expressed their intention, allowing them time to assess the impact of previous rate hikes.

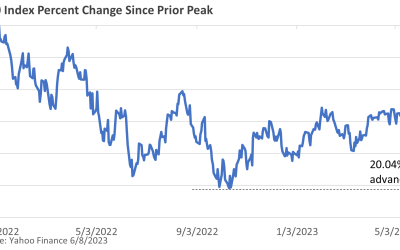

A New Bull Market

The S&P 500 Index, which tracks 500 large publicly traded companies, entered a new bull market last Thursday, according to the general definition of a 20% rise from the most recent low. The index hit an all-time high of 4,797 on January 3, 2022. It proceeded to decline 25.4% to the most recent low of 3,577 on October 12th. A bear market is typically defined as a 20% or greater drop from the closing peak to the closing trough.

Defying Expectations

May nonfarm payrolls surged past economists’ projections of 190,000 per DJ Newswires, soaring by 339,000 (see Figure 1) as reported by the U.S. Bureau of Labor Statistics (BLS). Surprised? Despite its strength, payrolls have mostly exceeded expectations in the past year. This serves as another reminder of the challenges of economic forecasting.