As you are probably aware, the new tax law is a mixed bag for contractors in California. While there are certain provisions that are helpful to small businesses, the loss of the “SALT” deductions (state and local taxes) has most likely increased the total tax burden for high income individuals. What is certain is that the new Tax Cuts and Jobs Act brings the most significant tax changes since 1986 and if you haven’t done so already, you should have a discussion with your CPA and ask for modeling to better understand your individual circumstances and the impact on your business.

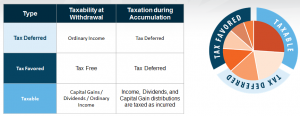

This article will address the most advantageous places to save and invest given the new tax law. Fundamentally, you should be maximizing all of your pre-tax savings vehicles and then look to maximize “tax favored” vehicles. The least efficient choice will be fully taxable vehicles like CDs and after-tax stock and bond portfolios. Let’s break down the three buckets individually:

BUCKET #1 – TAX DEFERRED

Qualified Retirement Savings Vehicles – The primary savings vehicles in this bucket include IRAs, SEP-IRAs, 401k plan, profit-sharing and defined benefit plans. The contributions made to these plans are fully deductible from your taxable income and are sheltered from creditors. You have complete tax deferral of growth on the money until accessed. There is limited ability to borrow the funds prior to age 59 ½. Significant tax penalties will result if money is withdrawn early. You may defer up to age 70 ½, but then you must begin to take income. All income out of this bucket is fully taxable as ordinary income. Years ago the consensus thinking was that you will most likely be in a lower tax bracket, so deferring is good. Unfortunately, with rising Federal deficits adding pressure to raise taxes, the potential of being in a lower tax bracket has been reduced significantly. The tax benefits of these plans are obvious; however, what you give up in exchange is that all of the money will be fully taxable at ordinary rates.

Tax Deferred Annuities – If you say the word “annuity”, you are likely to get all sorts of negative reactions. They are very much misunderstood. When used properly, annuities can provide significant tax benefits and lifetime guarantees. Like qualified plans, annuities offer tax deferral of gains; however, all contributions are made on an after-tax basis. Eventually you will pay ordinary income on the gains when accessed. Some annuities will allow you to spread the gain over your expected lifetime – similar to current IRA Required Minimum Distribution rules.

BUCKET #2 – TAX FAVORED

The savings vehicles in this bucket require you to contribute after-tax dollars; however, all of the growth may be rec eived in a tax-favored basis when withdrawn. Furthermore, you have complete tax deferral during the accumulation phase. Three examples include:

College Education 529 Plans – Anyone can establish a 529 plan for the benefit of the another individual. They are most often used for parents and grandparents to fund a child’s college education. Strict rules govern the access of the funds; however, the tax benefits can be substantial over time. The Tax Cuts and Jobs Act provided additional benefits to these plans by allowing the dollars to be used for elementary or secondary public, private, or religious schools. These work best when individuals can lump-sum a large amount and let compounding work over time. The current annual limit is equal to the ongoing annual gifting limit of $15,000 or a $100,000 pre-paid lump-sum.

Municipal Bond Portfolio – Municipal bonds are issued by state and local governments to raise money for public works projects and are one of the safest long-term investments available. Because they’re so secure, they usually carry interest rates that average a percentage point or two below the going rate for Treasury bills. The big new about “Munis” is that the interest paid is exempt from federally, state and local income taxes if you live in the issuing municipality (i.e. California issued bonds).

Life Insurance – Most business owners need life insurance for liquidity, funding a buy-sell agreement or for personal income replacement purposes. If structured properly, an investment grade life insurance policy that allows for access to the stock and bond markets will allow you to completely tax defer all of the gains. Additionally, if income is taken as a combination of withdrawals and loans, then it is possible to shelter all of the gain from income tax. Life insurance can effectively work like a ROTH IRA for high net worth individual, however, life insurance, doesn’t have a maximum annual funding level so you may contribute significantly more dollars and do so with no income phase-out limitations.

ROTH IRA – This vehicle allows for after-tax contributions, however, all of the gain may be accessed tax free. This is similar to a properly designed life insurance plan, however, there are very small maximums allowed in these plans (currently $5,500 plus $1,000 catch up after age 50).

BUCKET #3 – TAXABLE

This bucket is basically everything else that isn’t included in the other two buckets. This bucket utilizes after-tax money for funding and may have a combination of lower capital gains rates and ordinary income tax rates when the money is accessed. One potential negative with this bucket is the concept of “phantom income”. This means that you receive a 1099 annually and have to pay taxes on gains in the account even though you didn’t withdraw or utilize the money. The additional drag of current taxation on phantom income is a real concern for high tax payers. Types of vehicles where money is invested include a traditional stock and bond portfolio, mutual funds, managed accounts, CDs and treasuries.

TAKEAWAYS

• The devil is in the details, so look carefully at all of the details before moving forward with a particular approach.

• Explore all of the buckets and keep an open mind.

• There are other possibilities that I haven’t outlined. This is not intended to be a complete list.

• Assume that we are going into a higher taxed environment and make your choices based on that assumption.

• Utilize a professional to help guide you through the different buckets so that you arrive at an optimal solution given your unique financial circumstances.