Weekly Market Commentary

Smaller hikes but longer to the peak.

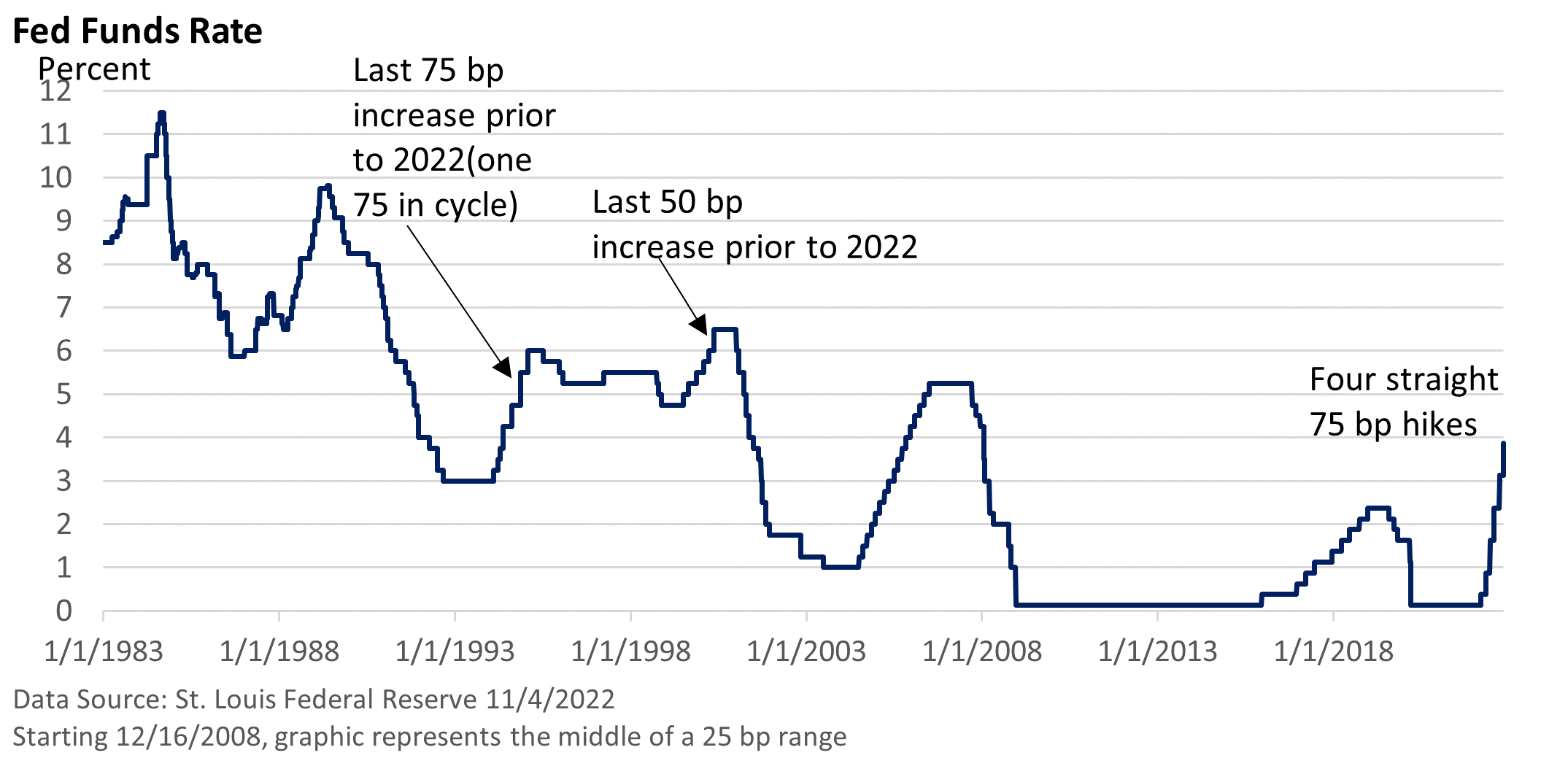

That was the message from Fed Chief Jay Powell after the Federal Reserve hiked the fed funds rate by 75 basis points (bp, 1 bp =0.01%) to a range of 3.75—4.00% on Wednesday.

The Fed may dial back the size of its rate increases—75 bp increases began in June—but the peak in the fed funds rate, what analysts are calling the terminal rate, could be higher than previously expected. And the Fed could maintain that level for a while.

Even then, Powell said no decision was made regarding December. Much will depend on the inflation data. There are two important inflation numbers coming out before the next meeting.

No pivot, not even a pivot lite

A more flexible approach, which the Wall Street Journal highlighted late last month, did not materialize.

Let’s look at several key remarks from Powell at his press conference.

1. “It’s very premature, in my view, to be thinking about or talking about pausing.”

- It’s a pretty definitive comment that the Fed isn’t planning to go on hold early next year.

2. “We still have some ways to go… we have some ground to cover with interest rates before we get to that level of interest rates we think are sufficiently restrictive.”

- It’s a signal that more rate hikes are in the pipeline.

3. “Incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected.”

- The Fed has been relentless in upping rate forecasts. In other words, don’t mistake a slower pace of rate hikes with a lower peak.

Powell also fretted that not doing enough to snuff out inflation would be worse than over-tightening.

In summary, it was a forceful tone, but the ultimate path will depend on the economic data. The Fed has done a poor job of forecasting inflation and rates, was slow to raise rates, and felt it needed to play catchup this year with the most aggressive series of rate hikes since 1980.