Weekly Market Commentary

The U.S. Bureau of Labor Statistics reported another respectable employment number on Friday, illustrating that modest economic growth and a still-high number of job openings are boosting payrolls.

But it was a smaller-than-forecast rise in wages that caught the attention of investors, and stocks rallied.

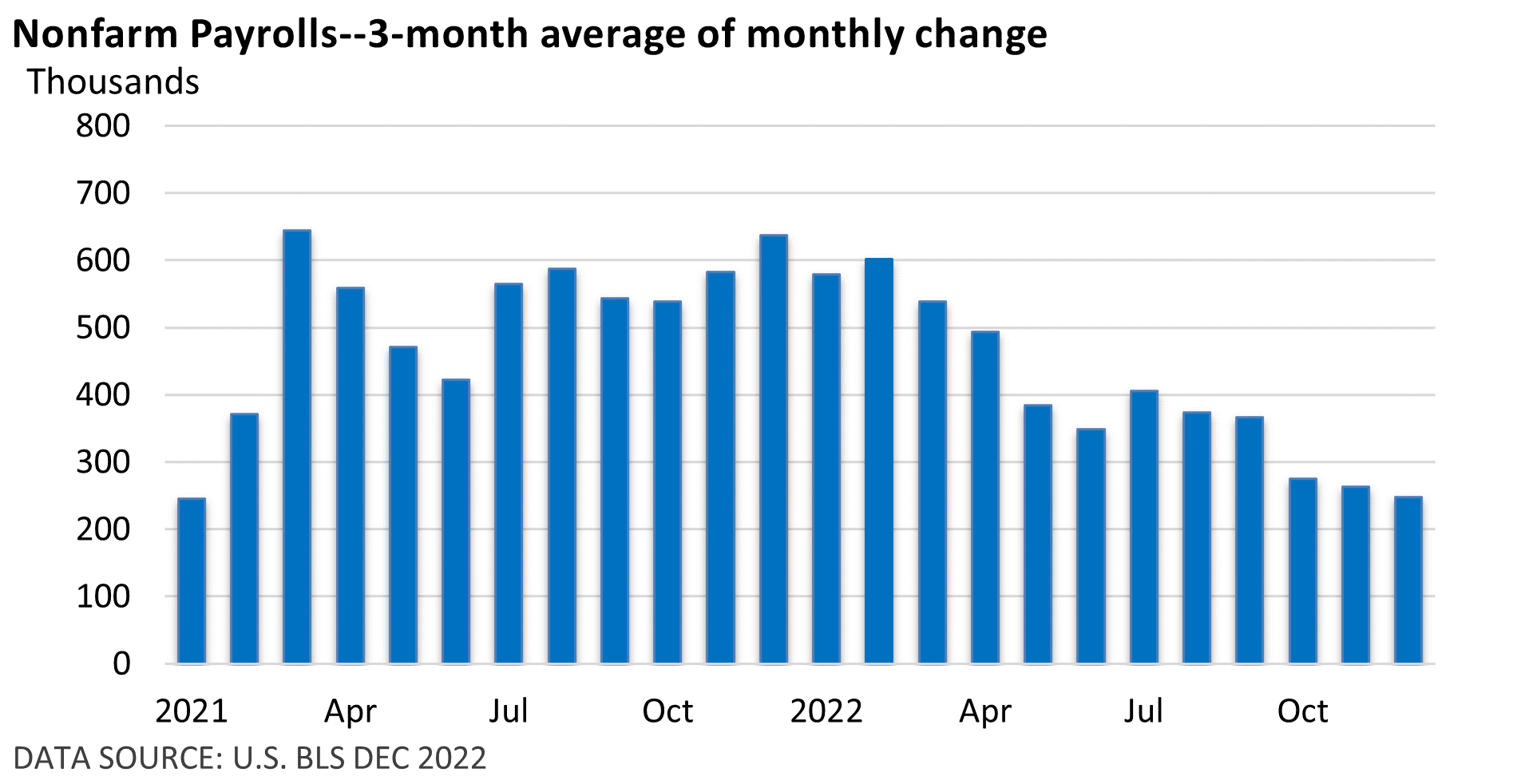

First, nonfarm payrolls grew by 223,000 in December, and the unemployment rate fell to 3.5% in December from 3.6% in November. The jobless rate hasn’t strayed above the narrow range of 3.5% to 3.7% since March.

Payroll growth is moderating but remains solid. That’s not surprising given the high number of job openings, which makes finding a job easier.

As the chief economist for ADP pointed out last week, “The labor market is strong but fragmented, with hiring varying sharply by industry and business size. Business segments that hired aggressively in the first half of 2022 have slowed hiring and, in some cases, cut jobs in the last month of the year.”

So, some folks are doing well. Others, however, aren’t as sanguine.

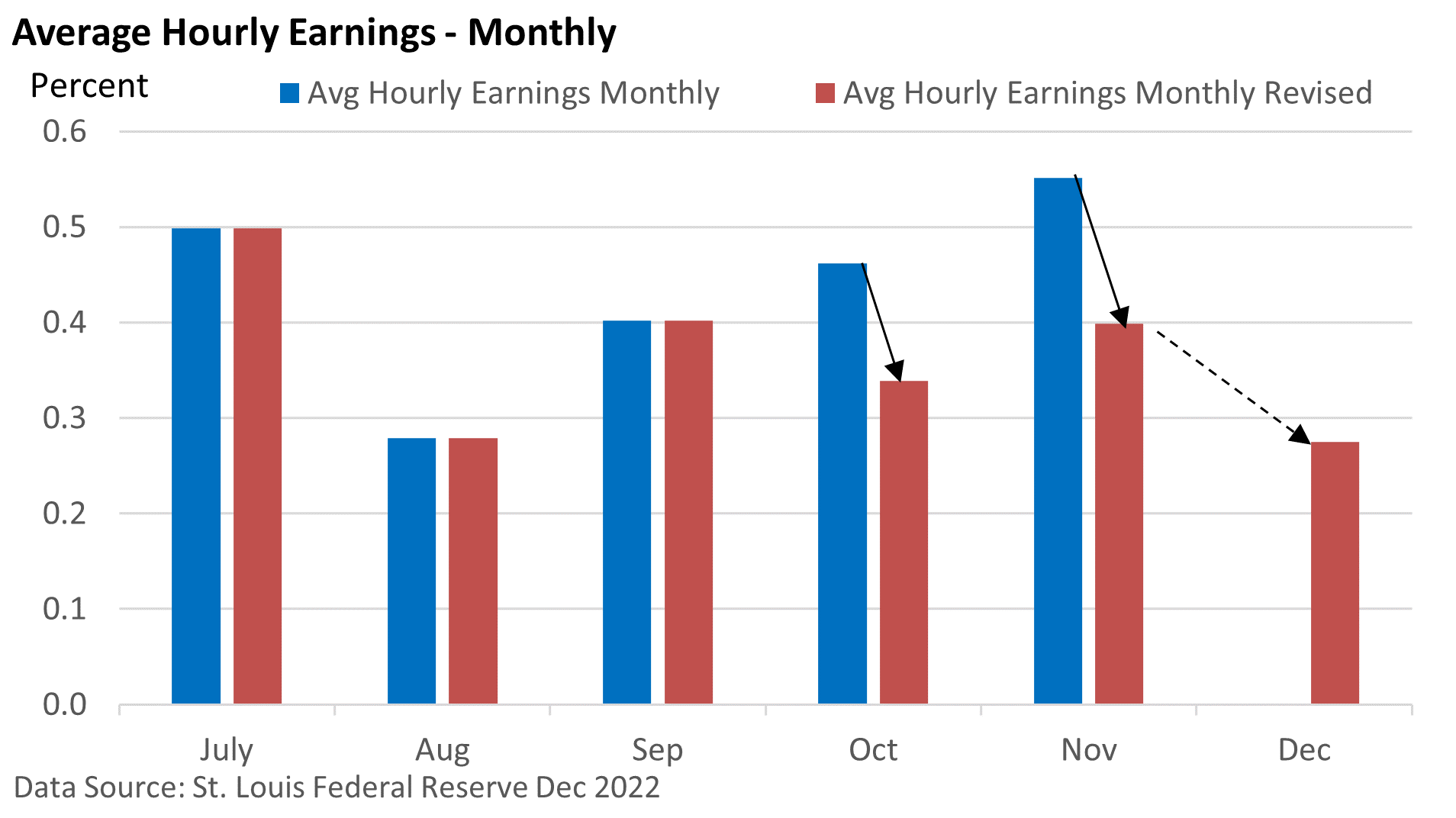

Let’s turn to the wage component, which sparked the big rally on Friday.

Average hourly earnings rose by less than 0.3% in December, and there were significant downward revisions to October and November.

Here’s where things get tricky. Investors view economic data through a very narrow lens. They celebrated the slowdown in wage growth because smaller wage hikes put less upward pressure on inflation and could eventually reduce the need for Fed rate hikes.

Investors are rooting for a continued slowdown in wage growth and a loosening in the tight labor market but not an outright recession, which would hamper corporate profits.

Wages are still rising too quickly for the Fed’s comfort and aren’t compatible with its 2% annual inflation goal.

Workers, however, benefit from higher wages, as many have not kept pace with the spike in prices.

Bottom line

It’s just one report. Just as November’s wage data was too hot for investors, the downward revisions in December may or may not hold.

Still, shorter-term investors liked what they saw. Progress for investors occurs in inches, not yards, and stocks finished the week on an up note.