Reciprocal tariffs were announced Wednesday afternoon.

In most cases, they are far higher than expected and varied considerably. Vietnam at 46%, the European Union at 20%, China at 54% (20% existing + 34% reciprocal), and the United Kingdom at 10%, according to the White House.

All imported goods are taxed at a minimum of 10%, including countries where the U.S. has a trade surplus in goods, such as Argentina, Brazil, the U.K., and Australia, according to the U.S. Census.

According to Fitch Ratings, it’s the highest level since 1910.

The math

How did the Trump administration devise the tariff rates?

This is taken verbatim from the Office of the U.S. Trade Representative:

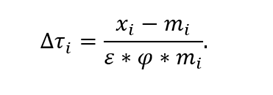

Consider an environment in which the U.S. levies a tariff of rate τ_i on country i and ∆τ_i reflects the change in the tariff rate. Let ε<0 represent the elasticity of imports with respect to import prices, let φ>0 represent the passthrough from tariffs to import prices, let m_i>0 represent total imports from country i, and let x_i>0 represent total exports.

Then the decrease in imports due to a change in tariffs equals ∆τ_i*ε*φ*m_i<0. Assuming that offsetting exchange rate and general equilibrium effects are small enough to be ignored, the reciprocal tariff that results in a bilateral trade balance of zero satisfies:

Confused? So were economists. Instead, let’s review an example from the Wall Street Journal in plain language.

Divide the U.S.’s 2024 goods-trade deficit with China of $295 billion by U.S. imports from China of $439 billion. You get 67%.

The White House set the new tariff rate at half of the calculated amount. Continuing with our example, China’s levy is 34%.

The math works for at least 71 of the 184 nations. In most of those cases, the U.S. is charging a new tariff of about half the rate calculated.

A country with a calculation below 20% incurs a minimum tariff of 10%.

Ok, that’s great (and wonky), but what does it mean to me?

Although manufacturing accounts for a small portion of the economy, consumer spending accounts for almost 70% of economic activity, according to the U.S. Bureau of Economic Analysis.

The sharp rise in tariffs is expected to slow economic growth and contribute to higher inflation, affecting a wide range of products, including cars, auto parts, smartphones, clothing, household goods, TVs, PCs, appliances, and more.

If you see it at Walmart (WMT $83), it will probably rise in price, at least to some degree, because many goods we buy are imported.

Products made in the USA often have parts sourced from abroad, so we anticipate some price increases for USA-assembled goods.

Furthermore, the likelihood of a recession is rising due to the considerable amount of uncertainty that U.S. businesses must navigate IF the tariffs remain in effect.

That is why we experienced a steep selloff in stocks this week – an extremely high level of economic uncertainty, the unknown effect on corporate profits, and higher expected inflation.

No one wins an extended trade war. U.S. exporters are likely to face higher barriers to overseas markets. China announced higher tariffs on U.S. goods on Friday morning. While there has been some saber-rattling from other nations, they have thus far refrained from retaliating.

Meanwhile, retailers cannot absorb such a tax and will do their utmost to either negotiate some of the tariffs away with foreign suppliers or pass along as much of the tax as possible.

Yet, the situation is fluid. On the one hand, a trade war that tips the economy into a recession would likely create additional selling pressure.

However, if tariffs are removed, negotiated away, delayed, suspended, or reduced, sellers could quickly turn into buyers.

Final thoughts

Volatility crops up from time to time. This is one of those times.

However, Treasury bonds have rallied (yields and prices move in opposite directions) as investors seek safe havens.

In turn, that has helped reduce volatility in a well-diversified portfolio.

A big decline in stocks can rattle some investors, and understandably so. However, it has rarely been advisable to sell simply based on market action.

Evaluate your risk tolerance. That is to say, how do you emotionally manage market downturns that are an inevitable part of investing?

Heavy volatility can serve as a wake-up call to reassess one’s risk tolerance. Others take it in stride, fully expecting markets to eventually recover.

Your tolerance for volatility can be reviewed at any time.