Our weekly Insights offers updates on pertinent financial and economic topics that educate and inform. They focus on what is important to investors. These may include inflation, the economy, interest rates, the Federal Reserve, and corporate profits.

We analyze a range of economic and financial indicators through a focused perspective (a narrow lens), particularly regarding how sensitive matters may impact investors.

This focused approach closely aligns with our expertise in financial advising and planning.

That leads us to this week’s topic: tariffs. Our goal is to strip out the political angle and view the potential for new tariffs through the narrow lens of the market, i.e., investors.

Last week, President Trump announced a 25% tariff on all goods imported from Mexico and Canada and a smaller 10% tariff on Canadian energy.

Additionally, he placed a 10% tariff on all goods imported from China, according to a White House press release.

Trump quickly postponed his threat to impose tariffs on Mexico and Canada by one month but maintained tariffs against China.

Meanwhile, China responded with tariffs on U.S. exports, as the Wall Street Journal reported, but China’s reaction was more measured and targeted select U.S. exports.

Why did stocks react negatively on Monday but pare losses into the close when Trump delayed the new duties by one month?

For starters, tariffs may mean higher prices at home as businesses pass along higher costs.

Moreover, U.S. exporters are harmed when countries subjected to new tariffs retaliate against U.S. exports.

Additionally, the uncertainty steep tariffs might create could slow U.S. business spending, which could further hamper U.S. economic growth.

Since the U.S. is not as dependent on exports as most nations, and the U.S. runs a trade deficit with most countries, the conventional wisdom suggests that the U.S. is probably in a better position to withstand a trade war.

Still, there is a fear that unwanted economic issues at home won’t be averted.

While the market subscribes to that point of view, the concern remains that tariffs would dent U.S. economic growth and raise prices—both viewed as negative headwinds for equity markets.

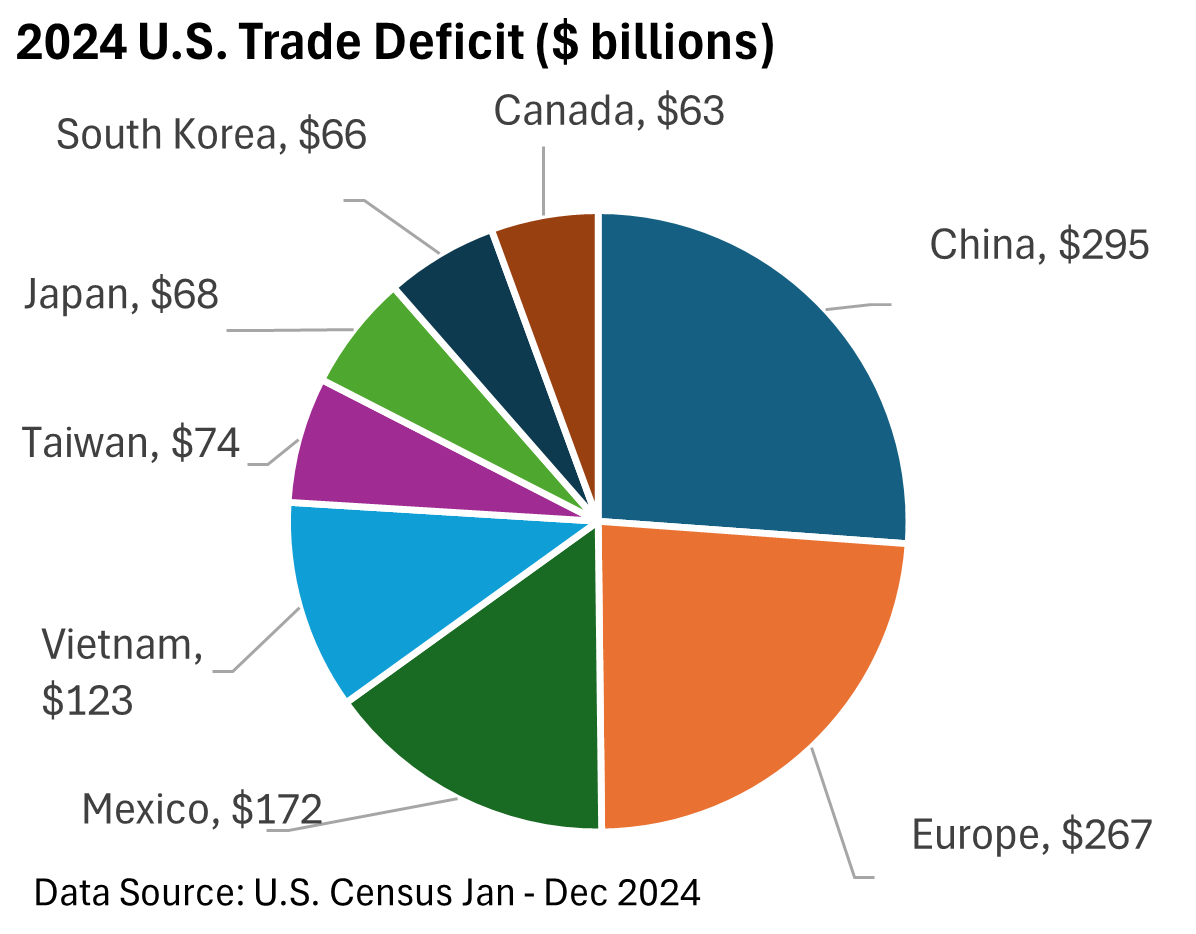

The graphic below reflects the 2024 U.S. trade deficit with larger U.S. trading partners.

Europe is lumped into one category. If we break out the top four, Ireland led last year with an annual trade gap of $87 billion, followed by Germany at $85 billion, Italy at $44 billion, and Switzerland at $38 billion.

The minority view

Some argue that tariffs do not lead to significant inflation.

They reference Trump’s more measured approach during his first term, noting that higher inflation did not occur as wholesalers and some countries absorbed a portion of the new tariffs.

It’s not the conventional view, and there is some speculation that the president doesn’t have the authority to levy broad tariffs.

Nonetheless, investors remain on edge as to whether the president intends to move forward with tariffs or simply plans to use them as a negotiating tool.

Once more, this analysis merely explores why the markets reacted negatively to the president’s threat to impose new tariffs on Mexico and Canada.