At first glance, June’s Consumer Price Index (CPI) was reassuring. The US Bureau of Labor Statistics reported that the CPI rose 0.3% in June as expected, while the core CPI, which excludes food and energy, rose a smaller-than-forecast 0.2%, per the Wall Street Journal.

On an annual basis, the closely followed core rate increased 2.9% in June vs. 2.8% in May.

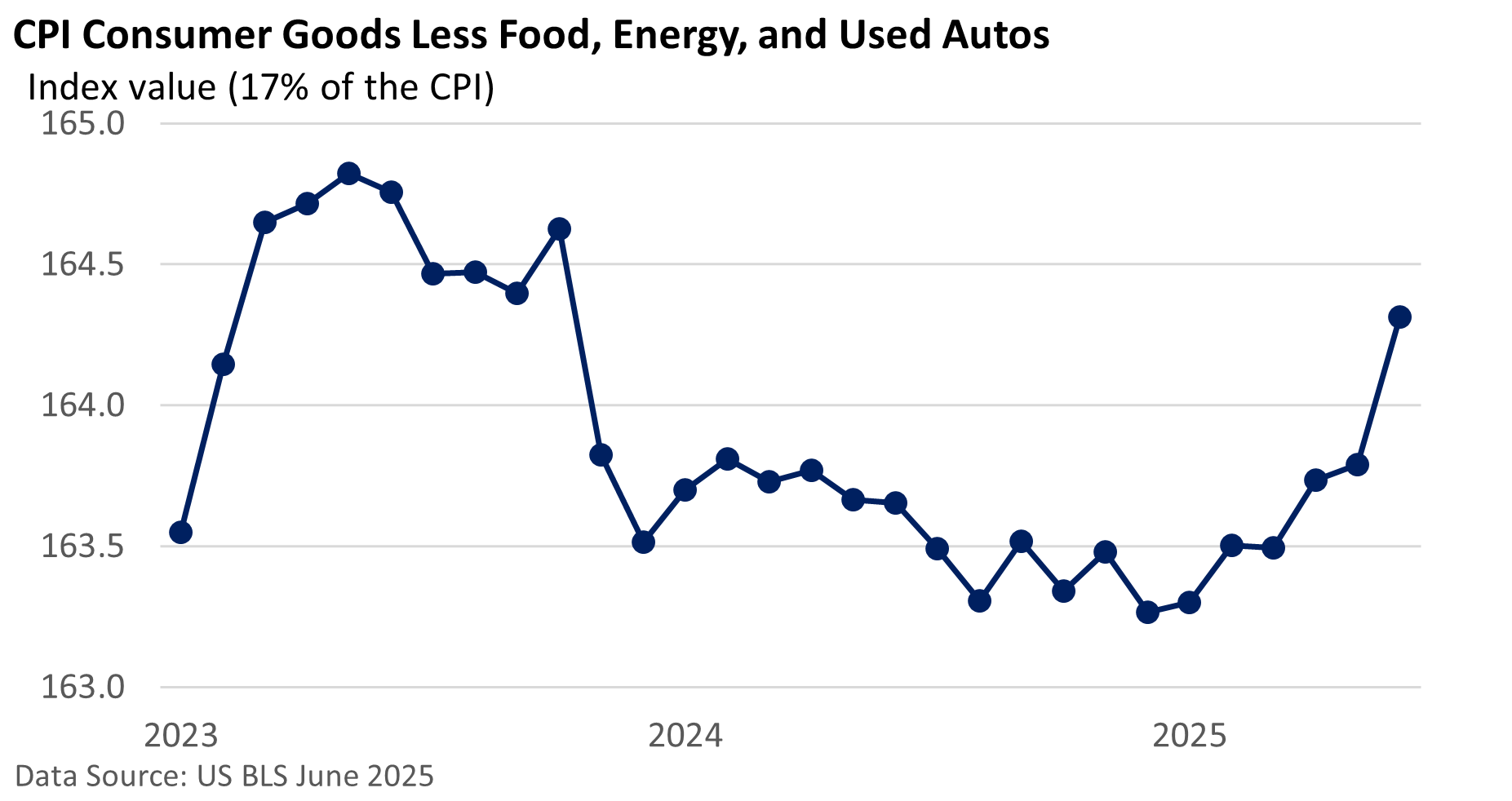

However, if we dig through the report, we are beginning to see some impact from higher tariffs on imports.

Consumer goods less food, energy, and used cars—the everyday items you might buy online or at the store—rose 0.3% in June, the largest increase since February 2003.

Notably, new and used car prices fell, which helped muffle the rise in consumer goods. According to Bloomberg, consumer goods excluding all autos, food, and energy climbed 0.55% in June, the biggest monthly advance since November 2021.

Some of the increases are highlighted below.

| Monthly change in select items | |

| Men’s shirts and sweaters | 4.3% |

| Window, floor coverings, linens | 4.2 |

| Nonelectric cookware/tableware | 3.7 |

| Appliances | 1.9 |

| Toys | 1.8 |

Source: US BLS June 2025

Although a broad-based increase in inflation has not yet materialized, tariff-related costs are beginning to surface at the retail level.

Bottom line

June marks the first clear indication that tariffs are beginning to noticeably show up in the CPI. As such, it’s reasonable to expect further increases to emerge in the coming months. So far, however, the impact appears concentrated to a limited set of goods.

Still, it is unclear who will ultimately shoulder the burden of rising costs.

As Fed Chief Jay Powell opined last month, “There’s the manufacturer, exporter, importer, retailer, and consumer. And each one of those is going to be trying not to be the one to pay for the tariff. But together they will all pay. Or maybe one party will pay it all.

“But that process is very hard to predict. And we haven’t been through a situation like this.”

Moreover, it’s unclear whether this will be a brief price spike in a few select items, the beginning of a more sustained increase that could trigger a secondary wave of inflation, or whether non-tariffed services might mask or help offset increases we could see elsewhere in the CPI.

Investors generally dismissed early signs of tariff-related inflation. Still, trade tensions remain a point of contention, as markets continue to wrestle with the implications of potential levies.

For now, those concerns appear to be sidelined, with investors focused on the expanding economy, AI, and Q2 earnings.