In a speech given nearly 70 years ago, then-Federal Reserve Chairman William McChesney Martin Jr. made a now-famous analogy when he said that during an expanding economy, the Fed should “remove the punch bowl” before the party gets out of hand.

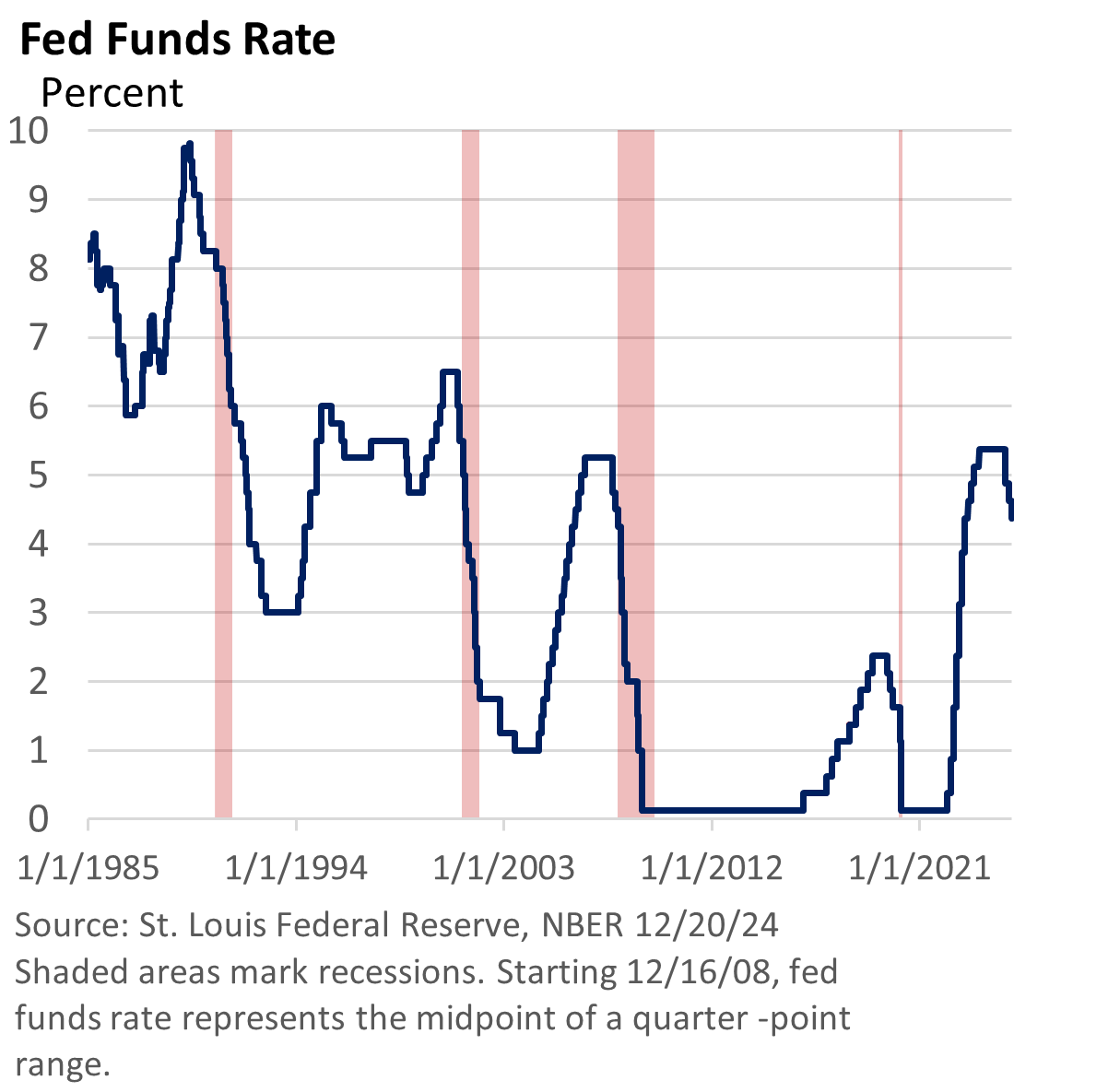

First things first, on Wednesday, the Fed reduced its key rate, the fed funds rate, by a quarter of a percentage point to 4.25 – 4.50%, as expected. It’s the third Fed rate cut in as many meetings.

So, why did the major indexes fall after the rate cut? The Wall Street Journal reported a drop in the Dow of over 1,100 points and a decline of nearly 3% for the S&P 500 Index.

While the Fed didn’t threaten to pull the punch bowl, the quarter-point rate cut was framed as a ‘hawkish’ rate cut.

The Fed didn’t threaten to raise rates, but Fed Chief Jay Powell signaled that the public shouldn’t expect rate cuts at consecutive meetings.

At his press conference, he said the Fed would be ‘cautious’ six times when discussing future rate cuts. The Fed is seeking “further progress on inflation” before additional reductions.

Released quarterly, the Fed now expects two rate cuts next year compared to four in September, according to its Economic Projections.

And the Fed raised its forecast for inflation next year.

And this is where things got confusing. If the economy is expanding at a respectable pace (Powell called it “remarkable”), and inflation has overshot expectations in recent months, why did the Fed move to cut rates again in December?

His explanation was nuanced and somewhat confusing, and stocks turned sharply lower on Wednesday.

As we’ve seen in the past, when equities are priced for perfection, a disappointment can lead to a pullback.

That leads us to the next question. Why the rebound on Friday? Well, the U.S. Bureau of Economic Analysis reported a soft inflation number for November.

Perspective

Stocks rarely move in a straight line. They go up, and they go down. But over the longer term, the major U.S. indexes have trended higher.

Second, stocks don’t need Fed rate cuts to move higher. More importantly, the economy is in decent shape, and corporate profits have been robust.

Third, the Fed hasn’t completely removed the punchbowl as it did in 2022.