Weekly Market Commentary

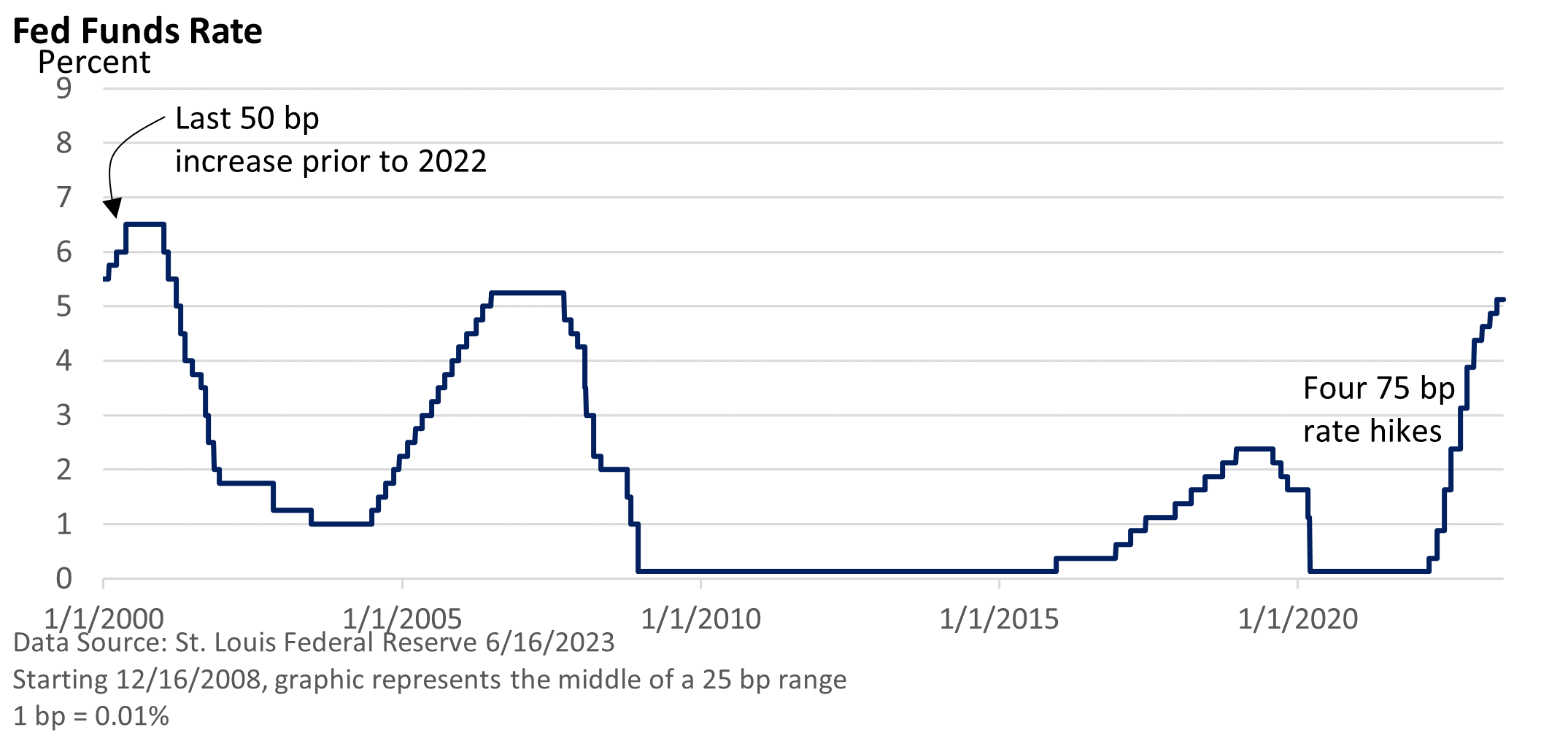

The Federal Reserve held the fed funds rate at 5.00–5.25% following ten consecutive rate increases that began in March 2022. The move was anticipated as policymakers had previously expressed their intention, allowing them time to assess the impact of previous rate hikes.

However, several more weeks of data may not provide that much clarity, and the pause seems inconsistent with recent messaging on inflation. Given still-high inflation, the Fed’s forecast signals it is mulling two more 25 basis point (bp, 1 bp = 0.01%) rate hikes by year-end.

Most analysts viewed the Fed meeting as a “hawkish pause.” Why? Investors expected the Fed would skip in June and hike one more time in July.

Two more projected rate hikes this year seemed to come as a surprise at Wednesday’s meeting. The phrasing is relative since it’s much less aggressive than last year’s torrid pace.

Yet, Thursday’s rally suggests investors are skeptical about two more increases this year.

But it’s important to acknowledge that investors have been too optimistic on rates before. Much will depend on the economy and inflation, which has defied predictions of a sharper slowdown.

That said, this isn’t the Volcker Fed of the early 1980s when then-Fed Chief Paul Volcker pushed rates into the stratosphere, causing a steep recession that broke the back of inflation.

The Fed’s current approach to restoring price stability differs from the early 1980s. Back then, the focus was getting double-digit inflation under control via a recession. Now, the Fed is taking a more balanced approach, as it hopes to achieve its goal of stable prices.

This marks a shift from last year, which was solely inflation. For now, a kinder, gentler Fed, an expanding economy, and the artificial intelligence craze have fueled the recent rally in stocks.

The $5 Trillion Dollar Question

Part of the problem lies in the difficulty of forecasting metrics such as unemployment and inflation. The other part of the problem: modeling a shutdown and reopening of the economy.

During the pandemic, the economy received an unprecedented injection of $5 trillion in stimulus. This, combined with closures and reopenings, has disrupted conventional forecasting models. It’s a new challenge for the Fed and economists.