Weekly Market Commentary

The Fed’s road to 2% annual inflation took a curious turn last week, disappointing some investors that had been expecting continued progress on inflation.

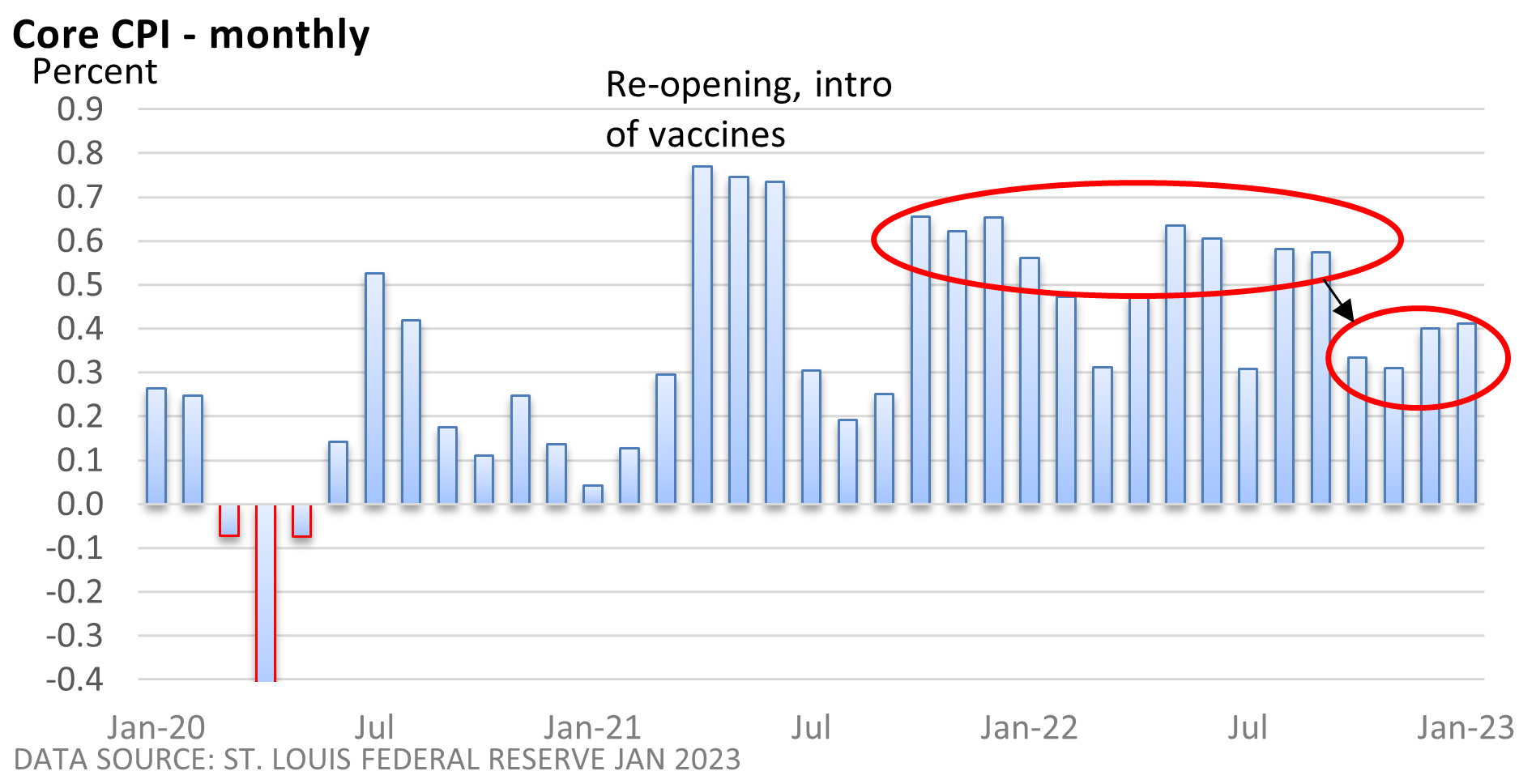

The U.S. Bureau of Labor Statistics reported that the January Consumer Price Index rose 0.5% in January, while the core rate, which excludes food and energy, rose 0.4%.

The numbers are down from last year’s peak, but they have edged above the recent low. The core rate of inflation is up over the last two months, averaging about 0.4% per month. It’s well above the Fed’s annual target of 2%.

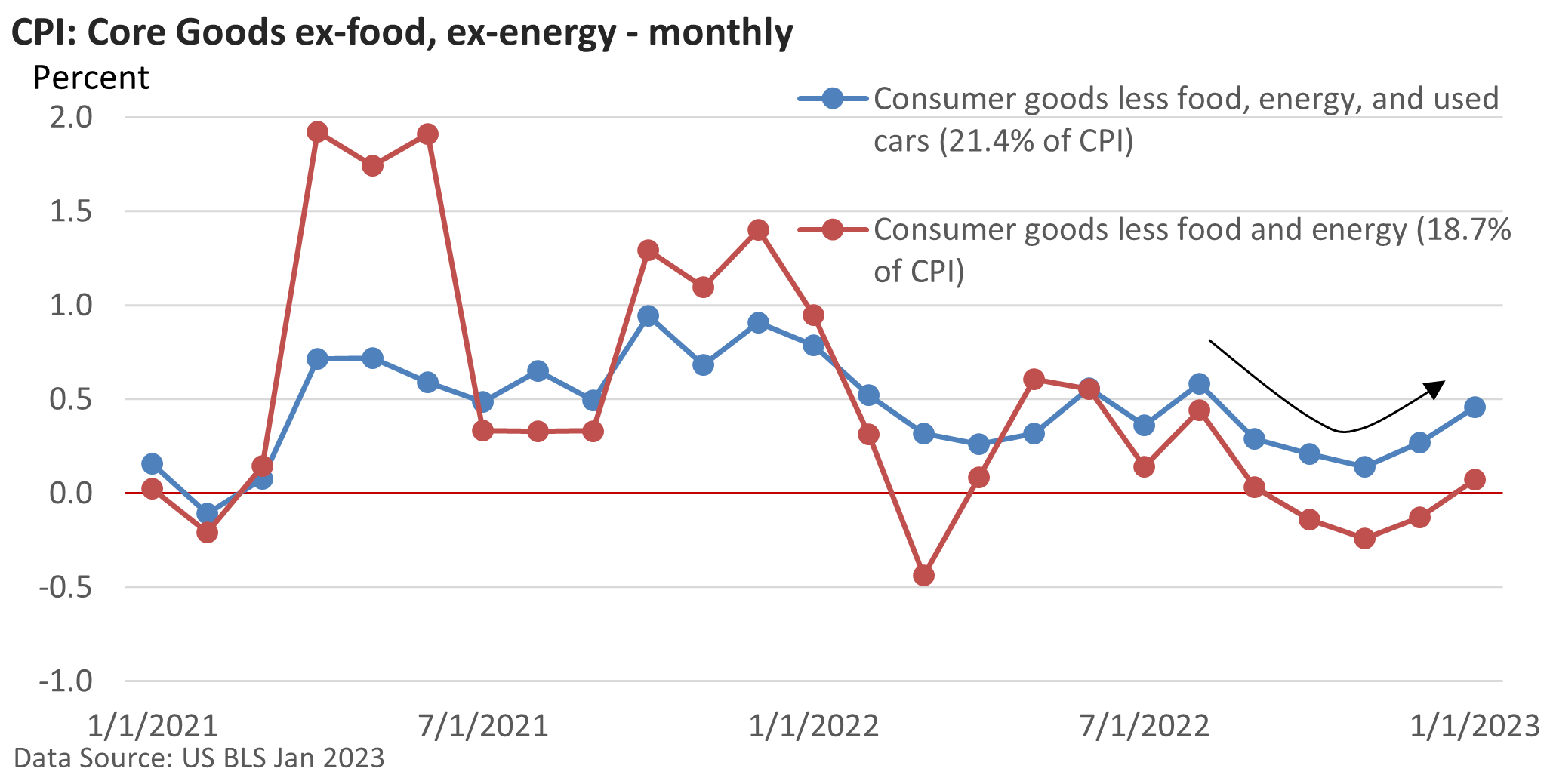

Services continue to rise at a fast pace, but consumer goods, which had been a bright spot, unexpectedly rose.

Fed Chief Jerome Powell said earlier in the month that it is too soon to declare victory on inflation, but he touted progress, pointing to the disinflationary trend in consumer goods. In fact, he used the term disinflation 11 times at his February 1 press conference.

Let’s not confuse disinflation with deflation. Disinflation simply means that the rate of inflation is slowing. Deflation is defined as an actual decline in prices.

If Powell had last week’s data then, his cautiously optimistic tone may have been more subdued.

Perhaps what we are seeing is lumpy data—weakness in November and December followed by strength in January. In other words, the long-term upward trend in the economy is intact, but month-to-month activity is uneven.

It’s also a new year and some firms may have taken advantage of the calendar to raise prices.

But given the inflation data last week, January’s blockbuster payroll number, and the upturn in consumer spending last month, investor expectations of a near-term peak in rates have receded.