Weekly Market Commentary

Last year, the economy appeared to be headed toward one of two scenarios.

There was a narrow path to what is called a ‘soft landing.’

A soft landing is a slowdown in economic growth that leads to a slowdown in inflation. It’s accomplished without a recession. If a recession occurs, it’s minor and the rise in the unemployment rate is manageable.

A ‘hard landing’ was the wider path. It is a recession and a big rise in the jobless rate. But inflation would be expected to slow, possibly at a fast pace.

‘No landing’ is a recently coined term that implies the economy won’t slow. The term is now being used amid an unexpected pickup in economic activity.

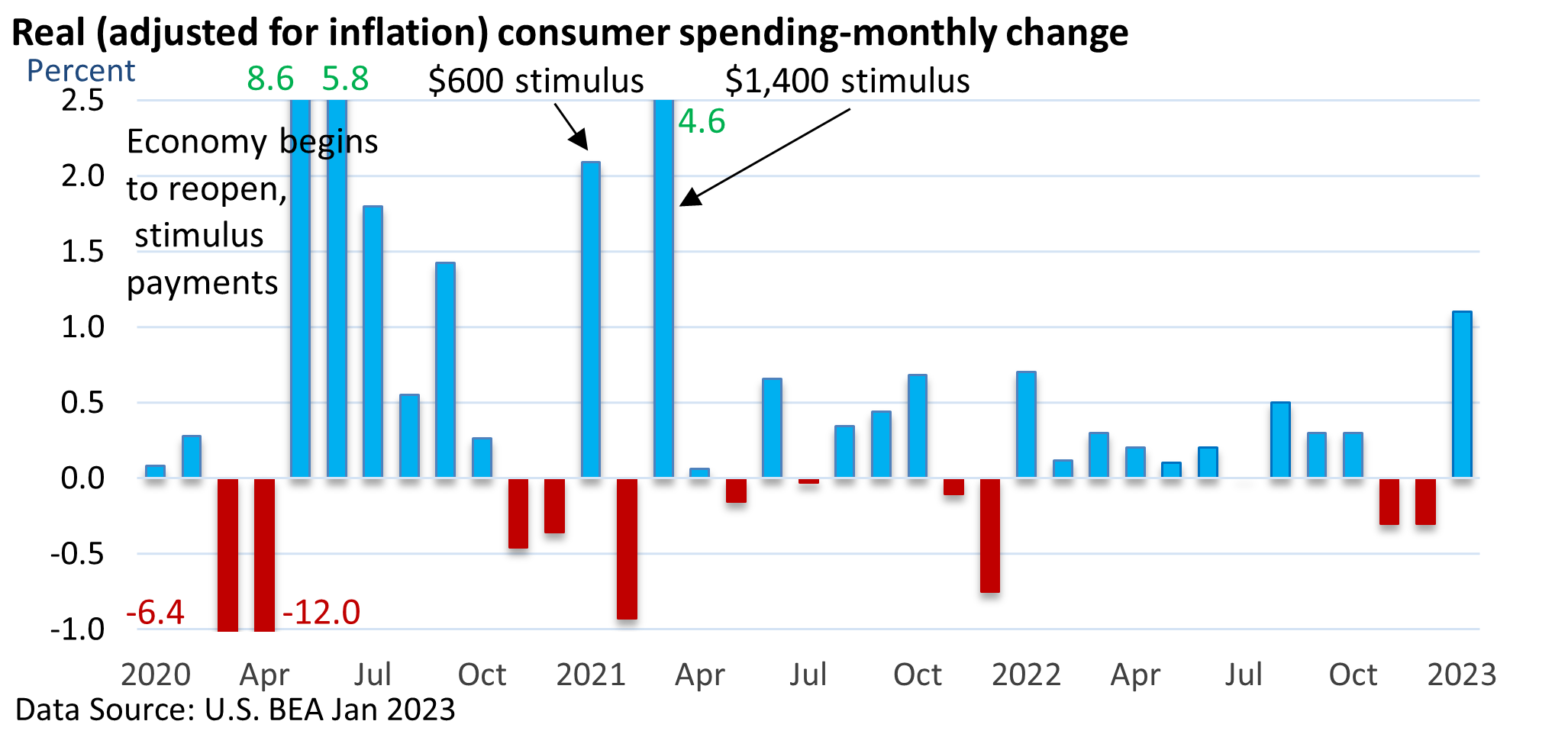

It is early and month-to-month economic data is rarely even, but January started out strong. Total jobs jumped by over 500,000 in January (U.S. Bureau of Labor Statistics), first-time claims for jobless benefits remain unusually low (Dept of Labor), and seasonally adjusted consumer spending (70% of the economy) soared in January.

Unfortunately, the rate of inflation has not softened as much as initially reported, according to a key pricing gauge put out by the U.S. Bureau of Economic Analysis (BEA).

The graphic also highlights that generous stimulus checks and jobless benefits aided the economy. But strong consumer spending also exacerbated inflation.

Let’s be careful not to blame today’s inflation completely on fiscal stimulus. The Federal Reserve kept rates too low for too long, and supply chain problems brought on by the pandemic created upward pressure on prices, too.

Thoughts

It’s unlikely that consumer spending will continue to rise at such a robust pace, and it’s possible it may turn out to be a one-month aberration. However, a big gain in total income helped drive spending last month.

In part, the Social Security Administration implemented an 8.7% rise in Social Security payments last month. It’s the annual cost-of-living adjustments that occur each year. Various wage hikes tied to the calendar also played a role.

In addition, taxes withheld from paychecks fell in January, as tax brackets are adjusted for inflation at the beginning of each year.

Coupled with stimulus cash that’s still in the bank, powerful support for spending remains, which is currently offsetting signals from leading indicators that point to a recession.

If the no-landing scenario plays out (that’s far from guaranteed), it complicates the Fed’s job, as stronger economic growth could lead to significantly more rate hikes than were expected at the beginning of the year.