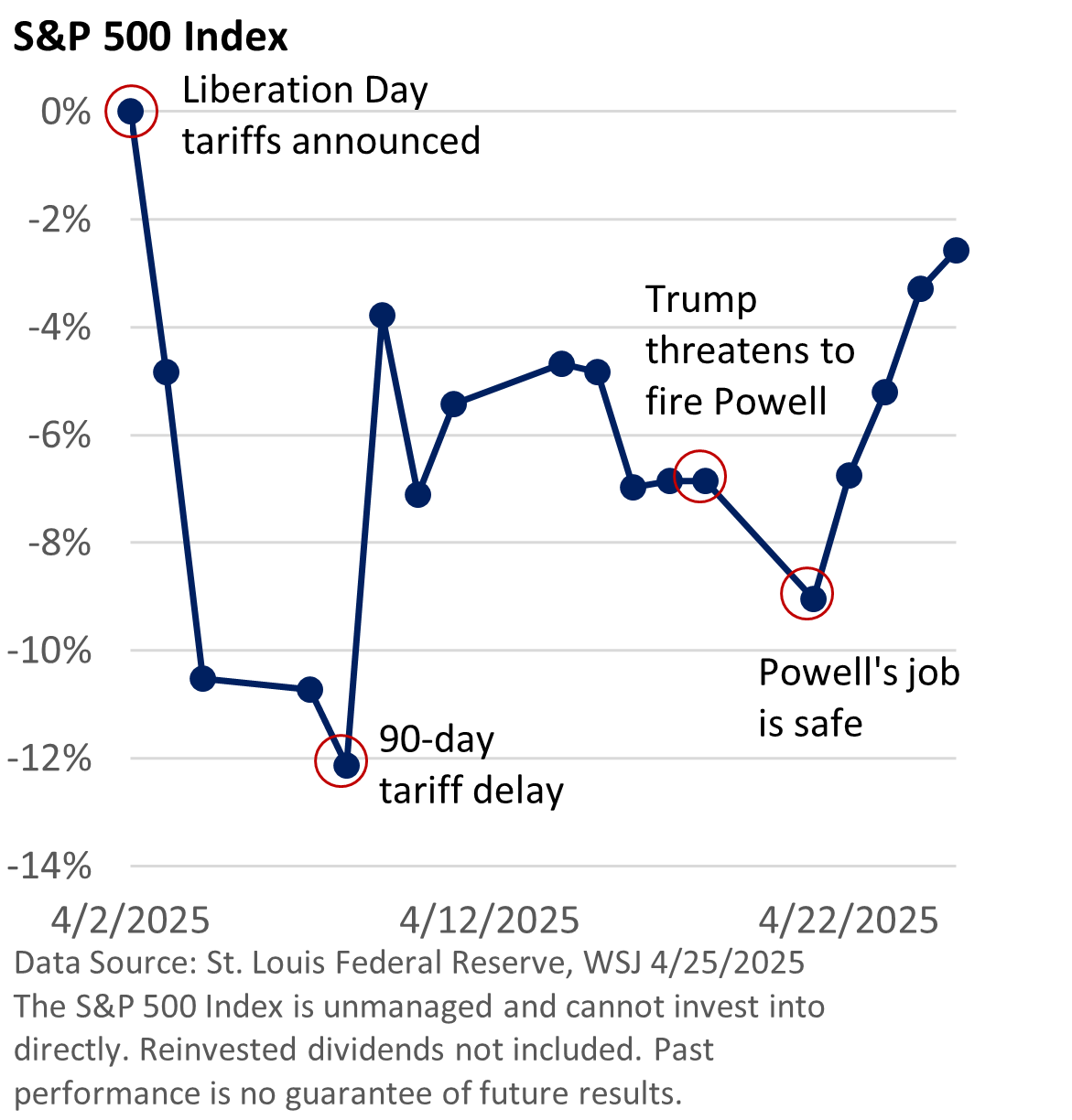

The graphic below chronicles trading in the S&P 500 Index following the late-day announcement on April 2, referred to as “Liberation Day” by the president, regarding reciprocal tariffs.

What’s behind last week’s choppy action?

Early in the week, investors responded unfavorably to President Trump’s warning that he might dismiss Fed Chief Jay Powell a year before the end of his term.

While the president has previously urged the Fed to lower rates, he raised the possibility of terminating the Fed chair in a recent social media post.

Many legal scholars question whether the president has the authority to terminate Powell, but the potential uncertainty surrounding such a decision led to a big drop in stock prices on Monday.

Why do U.S. and global investors prize an independent Federal Reserve?

Although the Fed does not operate in a political vacuum, “A politicized central bank opens the door to higher inflation, higher interest rates (bond yields), and a loss of confidence in the American financial system,” Morningstar said last Monday.

“If the US financial and political system is perceived as unstable, foreign investors may demand a higher return on their money to compensate for those risks,” the firm added.

In addition, many investors fear that a highly politicized Fed would maintain a low fed funds rate, which they worry could lead to a lasting rise in inflation and elevated bond yields.

This concern is not limited to just one political party.

On Tuesday, the president said he does not intend to remove Powell, which lifted stocks as the uncertainty surrounding Powell’s tenure receded.

A ratcheting down of U.S.-China trade tensions also contributed to positive sentiment.

Moreover, first-quarter earnings released through April 25 have exceeded expectations, per LSEG, further supporting share prices.