Weekly Market Commentary

What is consumer spending? Loosely defined, consumer spending is the ‘stuff’ we buy. It is the goods and services we purchase. It is groceries, clothes, entertainment, health care, auto repair, insurance, appliances, utilities, wireless service, and much more.

Why is consumer spending important to the economy? Well, spending by consumers accounts for almost 70% of total economic activity in the U.S., according to the U.S. Bureau of Economic Analysis (BEA).

The monthly release of consumer spending is much broader than the monthly retail sales report. Retail sales, as the name suggests, tallies the amount of goods purchased at retailers. You know, the stuff you’d buy at the store or online.

Consumer spending includes goods and services. According to the U.S. BEA, the dollar amount spent on services tops goods. Therefore, it is a comprehensive report.

Unlike monthly retail sales, consumer spending is adjusted for inflation. To clarify, if a business sells ten items for $10 in one month, its sales are $100. If it raises the price next month to $11 and sells ten items, its sales will be $110. However, when we adjust for inflation, sales are unchanged, as we exclude the price hike.

This is a very high-level explanation. The straightforward example helps explain how the data are adjusted for inflation. You see, economists aim to capture changes in volume/quantity.

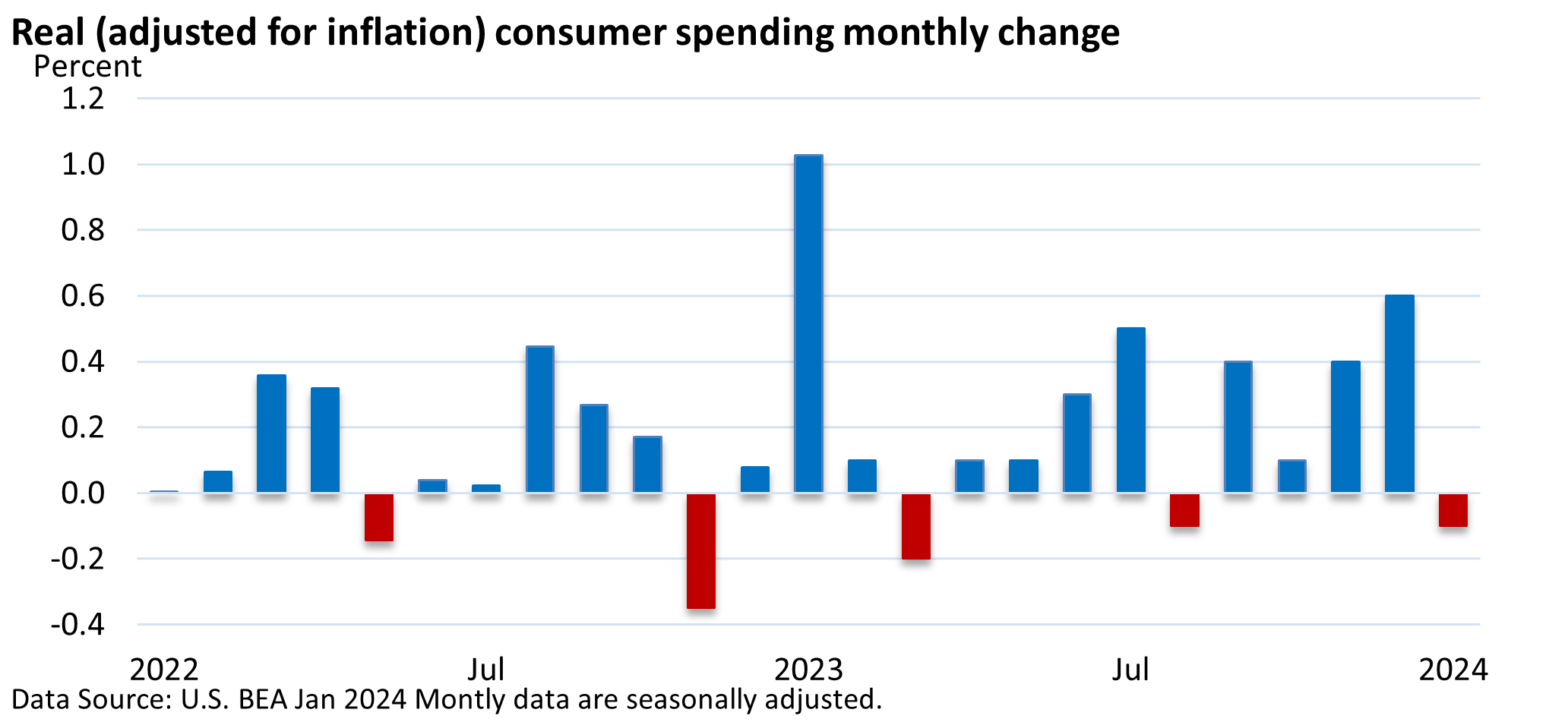

That said, let’s review what’s been happening over the past couple of years. As the graphic illustrates, spending has been rising.

We occasionally get pullbacks, as in January, but pullbacks have been minor. Spending has been up in eight of the last ten months. A similar pattern existed in 2022.

The widely expected recession in 2023 never materialized, as illustrated above. It’s been four steps forward and a small step back over the last year.

A recession will eventually occur. It’s inevitable. However, the consumer has been resilient in the face of higher prices and interest rates.

Those waiting for the other shoe to drop, well, are still waiting.