Weekly Market Commentary

Economists have been warning for quite some time that Fed rate hikes will slow economic growth. Whether it results in a soft landing, which is the preferred outcome for investors, or a hard landing (recession), the rate hikes would be expected to blunt economic activity, at least to some degree.

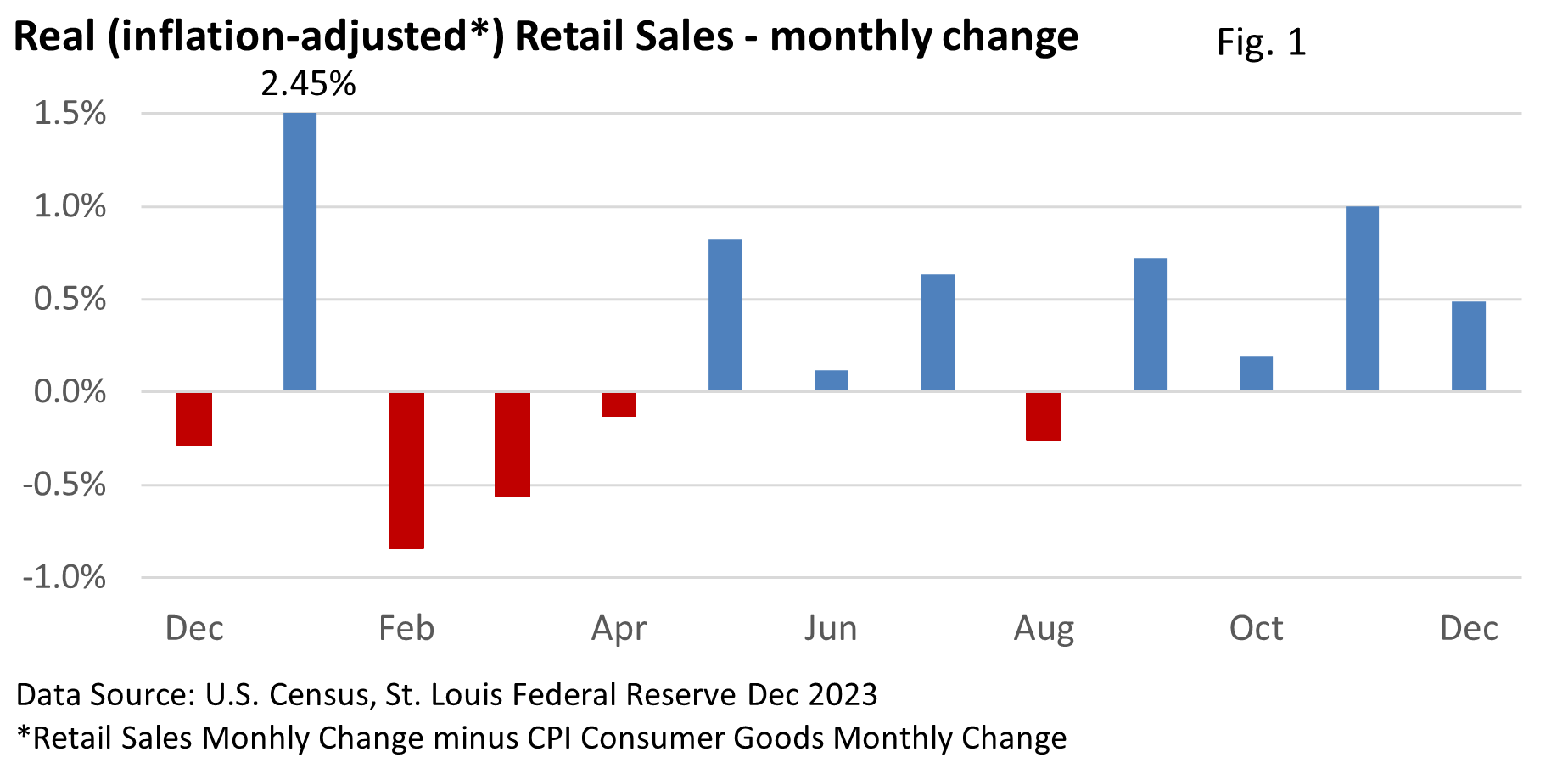

However, much of the recent economic data suggests the economy continues to expand at a modest pace. For example, retail sales have been upbeat through December—Figure 1.

Retail sales are released monthly by the U.S. Census Bureau. The data are adjusted for seasonality, such as Christmas, but not adjusted for inflation. Using the Consumer Price Index for Goods, a subcomponent of the CPI, we can subtract out the monthly change in total retail sales and approximate inflation-adjusted sales (excluding the effect of a change in prices).

Sales have been up in seven of the last eight months. Increases have topped or matched 0.5% in five of the last eight and three of the last four months (Figure 1).

Consumers are spending amid job growth and modest increases in wages.

Through December, there’s little evidence to suggest that higher prices or economic anxieties are discouraging shoppers or confirming talk that shoppers favor experiences/travel over goods.

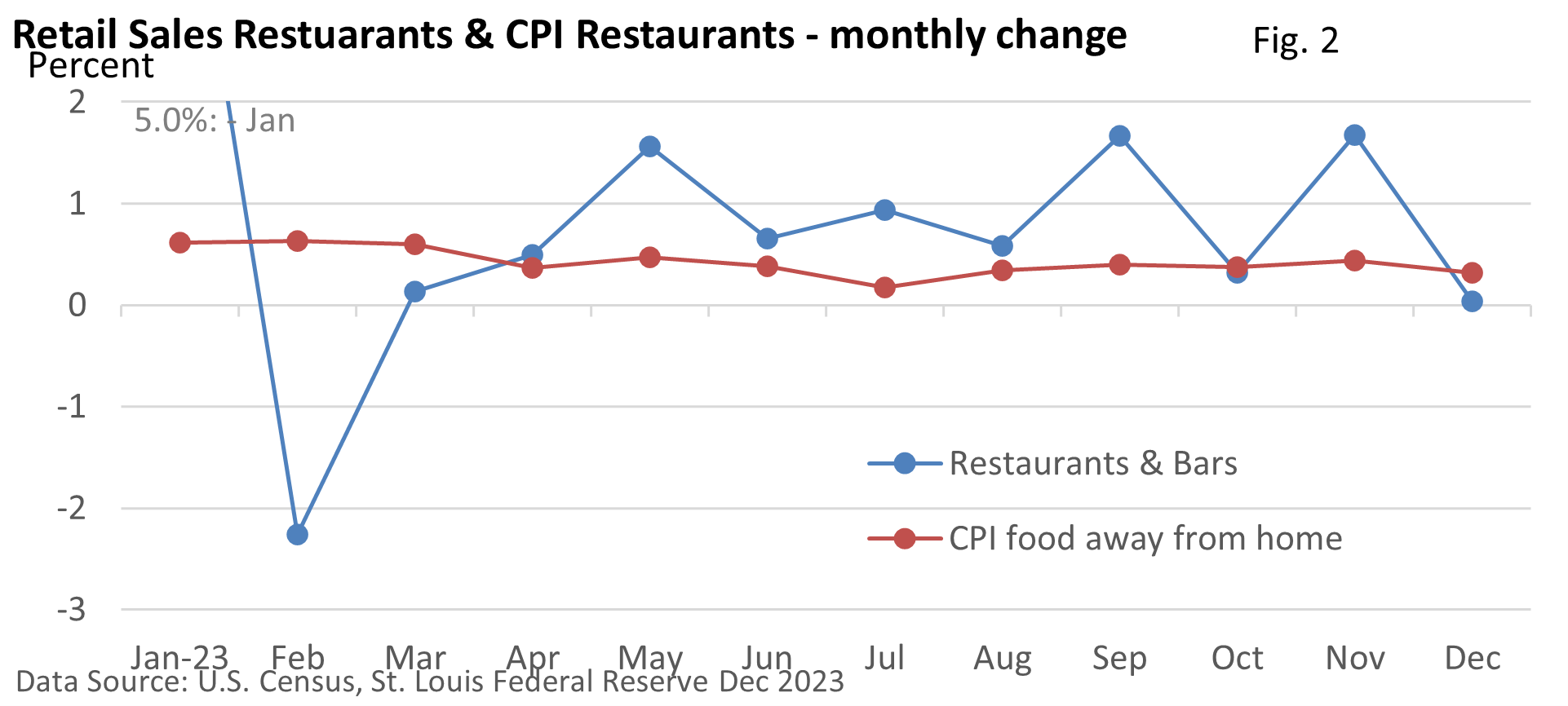

Restaurants, which have been among the price-hike leaders, haven’t discouraged most folks from eating out, as sales are topping inflation over the period surveyed—Figure 2. When economic storm clouds gather, we’d expect dining out to take a back seat to saving money.

We’ll get a clearer economic picture when Q4 Gross Domestic Product is released this week. On Friday, the S&P 500 Index eclipsed its early 2022 high and closed at a record (see table of returns). Please let me know if you have questions or would like to discuss any other matters.