Weekly Market Commentary

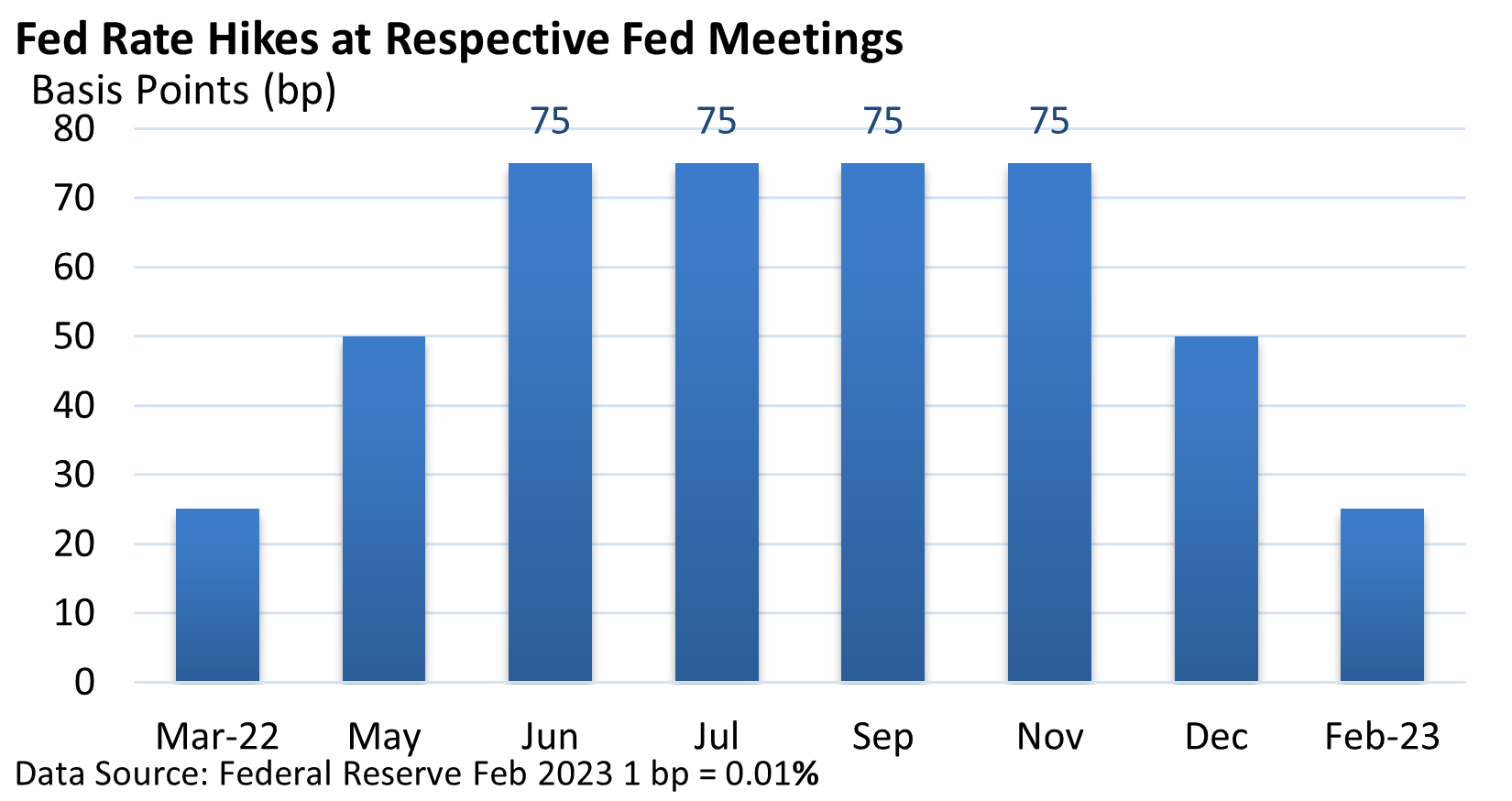

Last year, the Federal Reserve and Fed Chief Powell’s bite were probably worse than the bark. Rhetoric and commentary were forceful and were matched by a nearly unprecedented series of rate hikes, including four-straight 75 basis point (bp, 1 bp = 0.01%) increases.

Last year, the Fed front-loaded rate hikes. Recently, it has signaled a more mellow pace.

On Wednesday, the Federal Reserve raised its key lending rate, the fed funds rate, by 25 bp to a range of 4.50—4.75%, as expected.

Rhetorically, however, Powell picked up where he left off last year, bringing up the Fed’s 2% annual inflation goal six times in his opening statement. He emphasized it’s too early to declare victory on inflation, fretted over not doing enough, and suggested additional rate increases (plural) are on the horizon.

But he was much more open to acknowledging the recent slowdown in inflation. He conceded that inflation could slow faster than the Fed expects, and seemed less inclined to push back against investor expectations that rates will peak next month.

That’s not the forceful tone we heard from Powell in December and much of 2022.

Meanwhile, investors have been backing away from the idea that we might see a recession this year as the global outlook has improved.

In summary, these are variables that have aided the market in the new year.

Payroll Bonanza

Friday’s announcement from the U.S. Bureau of Labor Statistics of 517,000 net new jobs last month was a shocker and far above the CNBC consensus of 187,000. Further, the jobless rate fell to a 53-year low of 3.4% from 3.5% in January.

In part, the economy is expanding. In part, the huge number of job openings has not yet abated, even as companies in some industries continue to backfill open positions that should have been filled months ago.

One must wonder whether Powell’s modest rhetorical shift would have occurred if the Fed had met after January’s red-hot jobs report.