Weekly Market Commentary

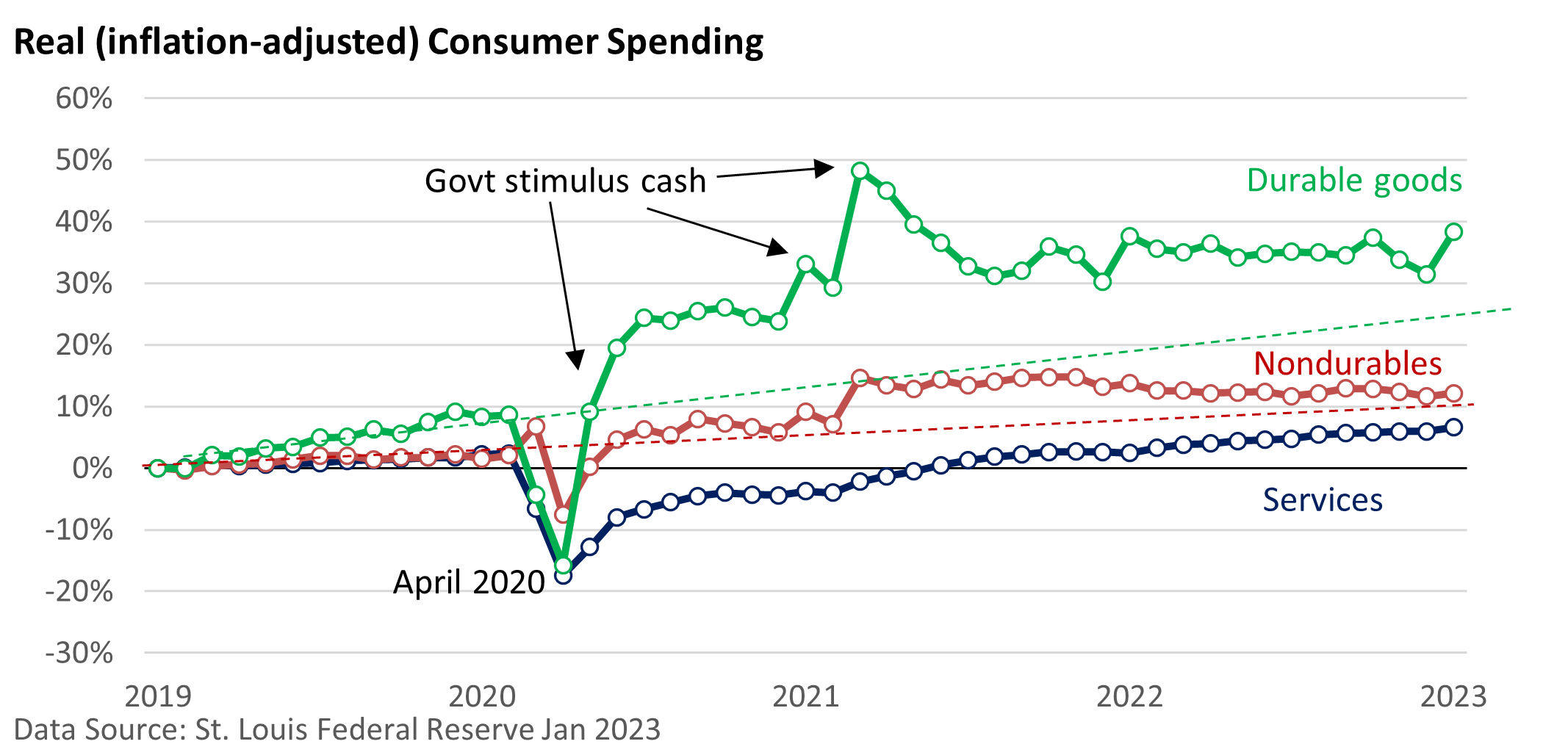

The economic distortions tied to that pandemic and the government’s massive response to prop up the economy have been far-reaching.

Before continuing, let’s look at some facts and definitions. Consumer spending accounts for 70% of the total economy, according to the U.S. Bureau of Economic Analysis (BEA).

The U.S. BEA breaks up consumer spending into three major categories: durable goods, nondurable goods, and services.

- Durable goods are manufactured goods designed to last at least three years. They include autos, furniture, household appliances, and kitchen cabinets and countertops.

- Nondurable goods include any item that might be used over a short period of time—think soap, household cleaners, toothpaste, clothes, and paper products.

- Services include travel, entertainment, sporting events, hotels, utilities, health insurance, and auto repair.

Stuck at home, some folks took their government payments and plowed the cash back into their homes. Spending has leveled off but remains well above pre-pandemic levels.

As many service businesses were closed or offered limited access during the pandemic, spending on services was slow to recover. As the economy reopened, spending has been strong and continues to improve, as consumers shift dollars toward experiences such as travel.

These distortions remain with us. Further, supply chain woes, coupled with support from the federal government and the Federal Reserve, have exacerbated inflation.

While January’s jump in spending was likely tied to mild weather in parts of the country, cost-of-living pay increases, and quirky seasonal adjustments that centered around the beginning of the year (something we saw last year, too), another surge in February and March seems unlikely.

But it has put investors on notice that the Fed is eyeing more rate hikes.