Weekly Market Commentary

Fitch Ratings downgraded U.S. government debt last week by one notch from its prized top rating of ‘AAA’ to ‘AA+.’ Fitch said its decision “reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden,” and repeated political brinkmanship surrounding the debt ceiling debates.

The decision didn’t come as a surprise since Fitch had warned in May, when lawmakers were battling over the nation’s debt ceiling, that the ‘AAA’ rating was under the microscope.

U.S. debt was last downgraded in 2011 when Standard & Poor’s cut its triple-A rating to ‘AA+.’ Only Moody’s maintains its triple-A rating on U.S. debt.

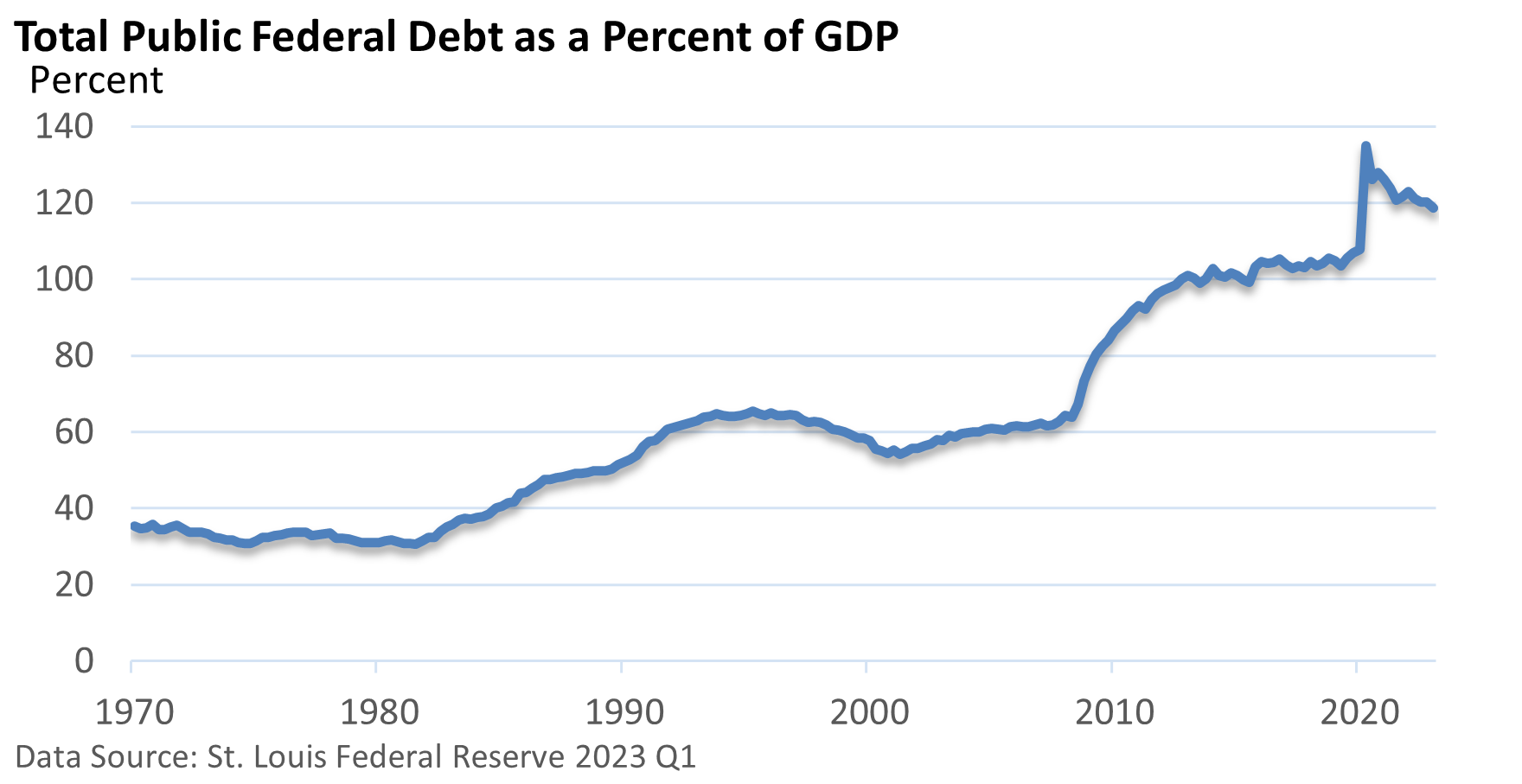

To some extent, it’s difficult to completely disregard the reasoning behind the downgrade. The federal deficit as a percent of Gross Domestic Product (GDP) has more than tripled over the last 40 years.

Due to higher interest rates, interest payments on the debt are nearing an annualized pace of $1 trillion, up from $530 billion two years ago, according to Bloomberg.

Despite low unemployment and an expanding economy, Fitch projects that this year’s annual deficit will rise to 6.3% of GDP, up from 3.7% in 2022.

There is also a concern over the increase in Treasury debt that will be issued over the next few months, which could hang over the Treasury market, according to Bloomberg.

There was a modest selloff in stocks and an uptick in Treasury yields in the wake of the news. Yet, the downgrade was not without criticism from some prominent economists.

To begin with, there have been no significant economic changes in the period leading up to the decision. The downgrade was not unexpected, and it is unlikely to have any impact on the use of Treasuries as a fundamental asset in the U.S. and around the world.

Fitch noted several structural strengths, including a large-well diversified U.S. economy, a dynamic business environment, and the preeminence of the U.S. dollar, which gives the government extraordinary financing flexibility.

Although the downgrade may have had some validity, it is important to point out that the foundational aspects of the U.S. economy are still strong.