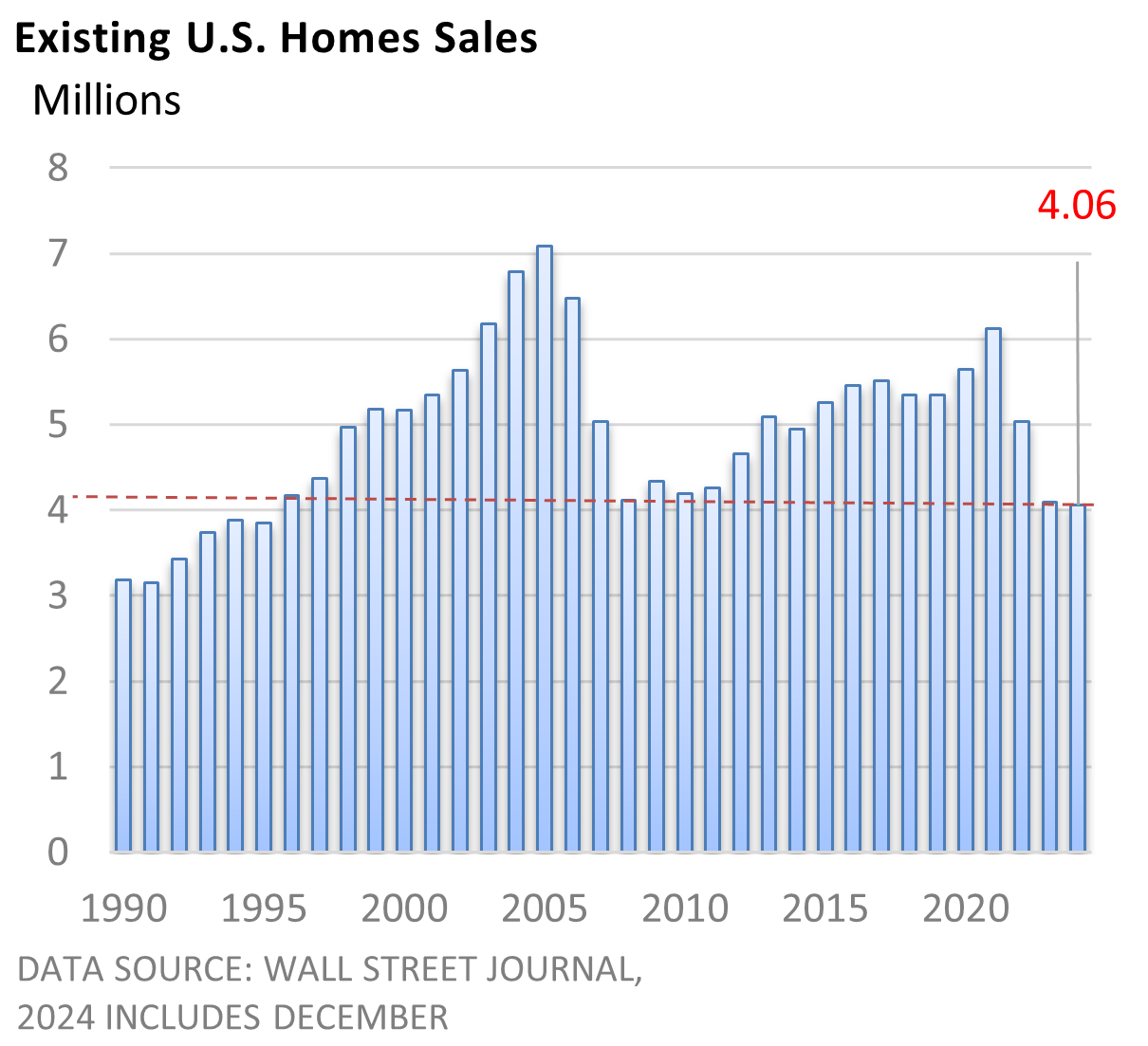

It is not much of a stretch to say that home sales are in the basement. In 2024, the annual number of existing homes sold fell slightly to 4.06 million, the lowest since 1995.

It’s important to note that 2024 came in lower than we observed during the height of the financial crisis in 2008 and 2009.

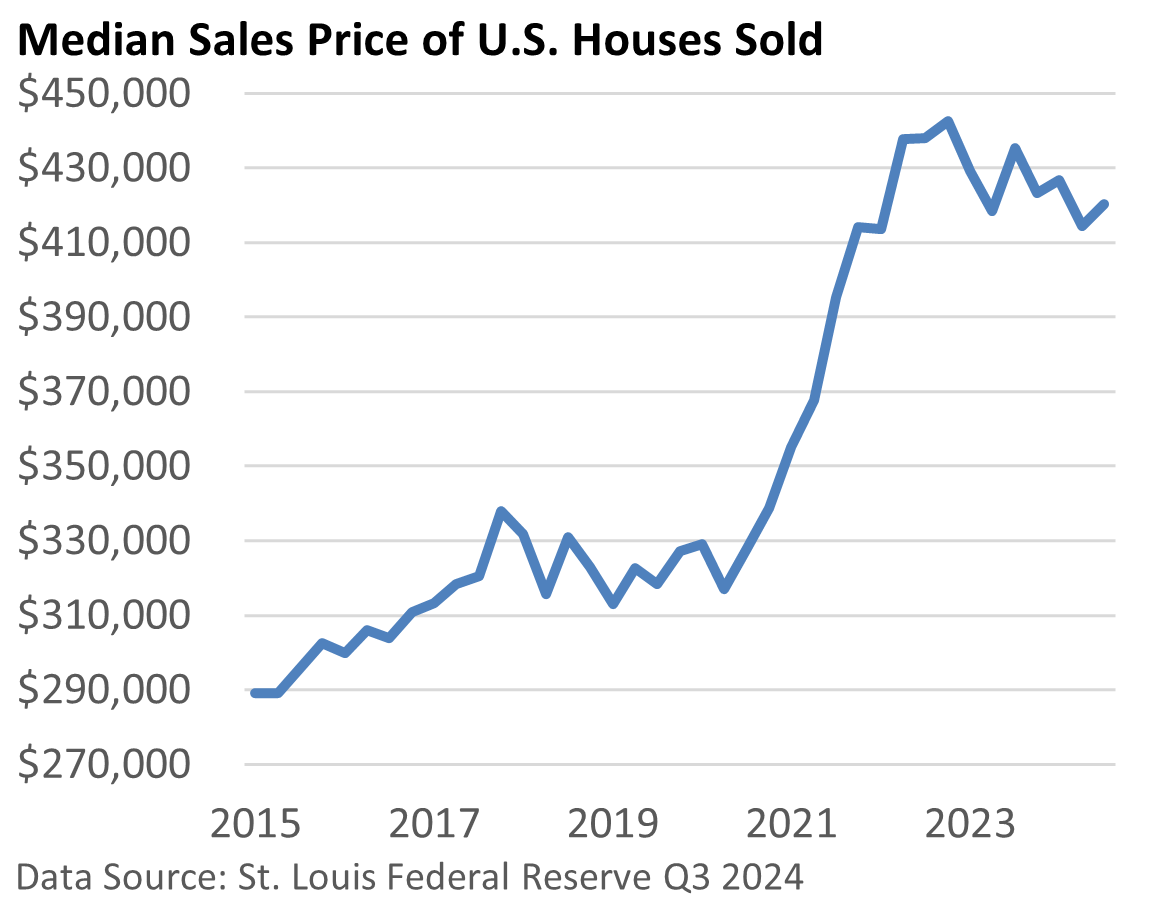

Contrary to conventional wisdom, home prices have remained high despite the substantial decline in sales.

The median price of a home sold in the third quarter of 2024 was $420,400, according to price data from the St. Louis Federal Reserve.

Despite the sharp decline in sales, Q3’s median price sold is down just 5% from the peak two years ago. It’s up sharply from the pre-pandemic price of $329,000 in Q1 2020.

According to the National Association of Realtors, it boils down to a scarcity of homes for sale.

In part, some homeowners who might like to sell are reluctant to give up a low mortgage rate obtained in 2020 or 2021, which restricts the number of homes for sale and props up prices.

Inventories of homes available will likely rise in the spring, but they are expected to remain historically low.

Over time, however, prospective buyers may become accustomed to higher rates, while current homeowners may recognize that they can no longer wait for lower mortgage rates as their life circumstances evolve.