The US Census categorizes it as ‘food services and drinking places.’ That can best be described as restaurants and bars.

When the economy is riding high, most people feel optimistic and are more inclined to make discretionary purchases—non-essential items or services. This would include eating out.

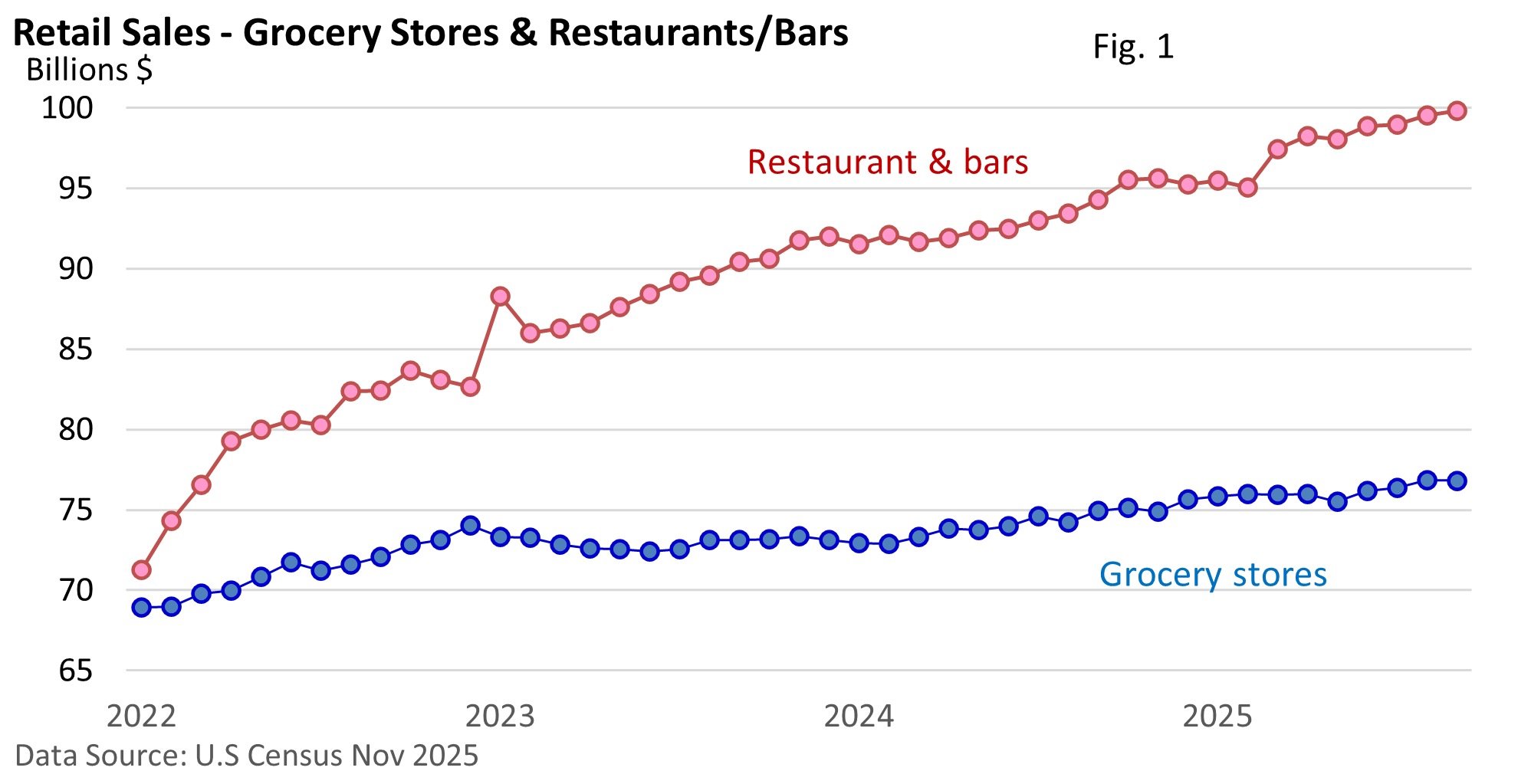

As highlighted in Figure 1, eating out has far outpaced grocery purchases over the last four years. Notably, the upbeat pace has continued in recent months, suggesting an expanding economy.

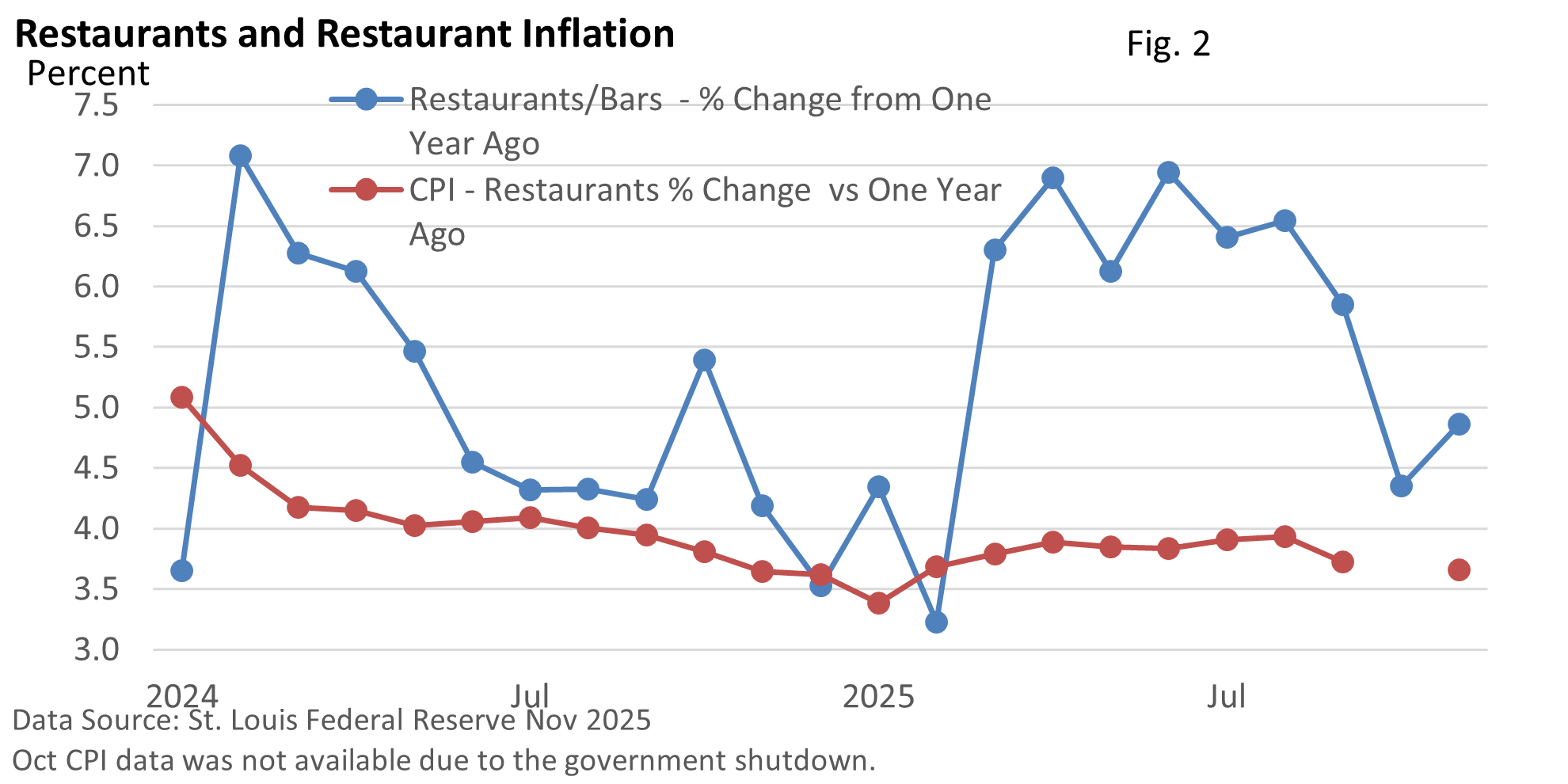

Figure 2 attempts to adjust for inflation by comparing the annual change in sales at restaurants with the annual change in the CPI for eating out. Given that adjustment, sales are outpacing inflation in all but two months.

That’s not the case.

As with any anecdotal measures of economic activity, it must be paired with broader economic reports. Today, most economic data is signaling an expanding economy.