More about the asterisk in a moment, but first, let’s touch on the meat and potatoes of last week’s Federal Reserve meeting.

It came as no surprise that the Fed reduced its key rate, the fed funds rate, by 25 basis points (bp, 1 bp = 0.01%) to a range of 4.50—4.75%. That follows the Fed’s 50 bp rate cut in September.

At his press conference, Fed Chief Jay Powell did not commit to another reduction in interest rates at the December meeting, but he strongly signaled that the general path is lower.

But if economic growth is strong, why cut interest rates? “It’s actually remarkable how well the U.S. economy has been performing,” Powell said.

Despite a generally positive economic outlook, the Fed believes interest rates are too high, discouraging consumer and business borrowing. In turn, this could slow economic activity too much and increase the unemployment rate.

Recalibration

Powell responded that the Fed is recalibrating policy. He used the words ‘recalibrate,’ ‘recalibration,’ or ‘recalibrating’ five times at his press conference.

In other words, he wants to gradually reduce the fed funds rate to a less restrictive level. However, does the Fed risk stoking economic embers? If so, the Fed could give back some of the hard-won gains on inflation. Notably, the price level hasn’t fallen, but the rate of increases has slowed.

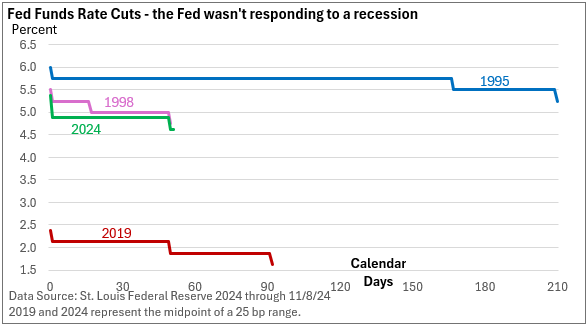

How low might interest rates go? Let’s look at rate cuts over the last 30 years when a recession didn’t set in.

During the four rate-cut cycles when the economy avoided a recession, the Fed lowered the fed funds rate three times. Each non-recessionary cycle of rate cuts totaled 75 basis points.

The Fed has already reduced rates by 75 basis points, indicating that additional cuts are likely. In order to find a sharper series of non-recessionary rate cuts, one must look back to the 1980s.

*Drama at a drama-free press conference

About that asterisk, a reporter asked Chair Powell, “Some of the president-elect’s advisors have suggested that you should resign. If he asked you to leave, would you go?

Powell didn’t flinch. He simply said, “No,” and took the next question.

The chairman of the Federal Reserve serves a four-year term. He was appointed by President Trump in 2018. President Biden re-appointed him in 2022. His four-year term ends in February 2026.

President elect-Trump has not threatened to fire Powell. A president can only fire a Fed chair “for cause.” Most legal scholars believe this doesn’t mean a president can fire a Fed chair simply because he/she disagrees with the Fed chair. There must be something more.

That leads us to last week’s election and subsequent stock market rally. As citizens and voters, our choices go well beyond the narrow lens of investors.

Let me explain.

Investors focus on the market through a very narrow lens. Investors don’t care if a president is Republican, Democrat, liberal, or conservative. Investors simply view the market through the very narrow lens of the economic fundamentals.

Historically, on average, stocks have performed well under both political parties (CNBC).

Investors expect that Trump will be business-friendly, pro-deregulation, and staff a justice department that will be more inclined to approve mergers rather than challenge them in court.

Investors believe the 21% corporate tax rate is safe. Moreover, markets are relieved that the outcome was quickly settled and didn’t drag out.

In 2017, stocks performed quite well in a pro-business, tax-cutting environment. In 2018, Trump turned his attention to trade and tariffs, which generated uncertainty among investors. How he may ultimately levy tariffs is unknown. Tariffs may support domestic manufacturing while also potentially lifting prices.

Last week, business-friendly, pro-deregulation sentiment fueled gains, lifting the Dow, S&P 500, and Nasdaq to new highs.