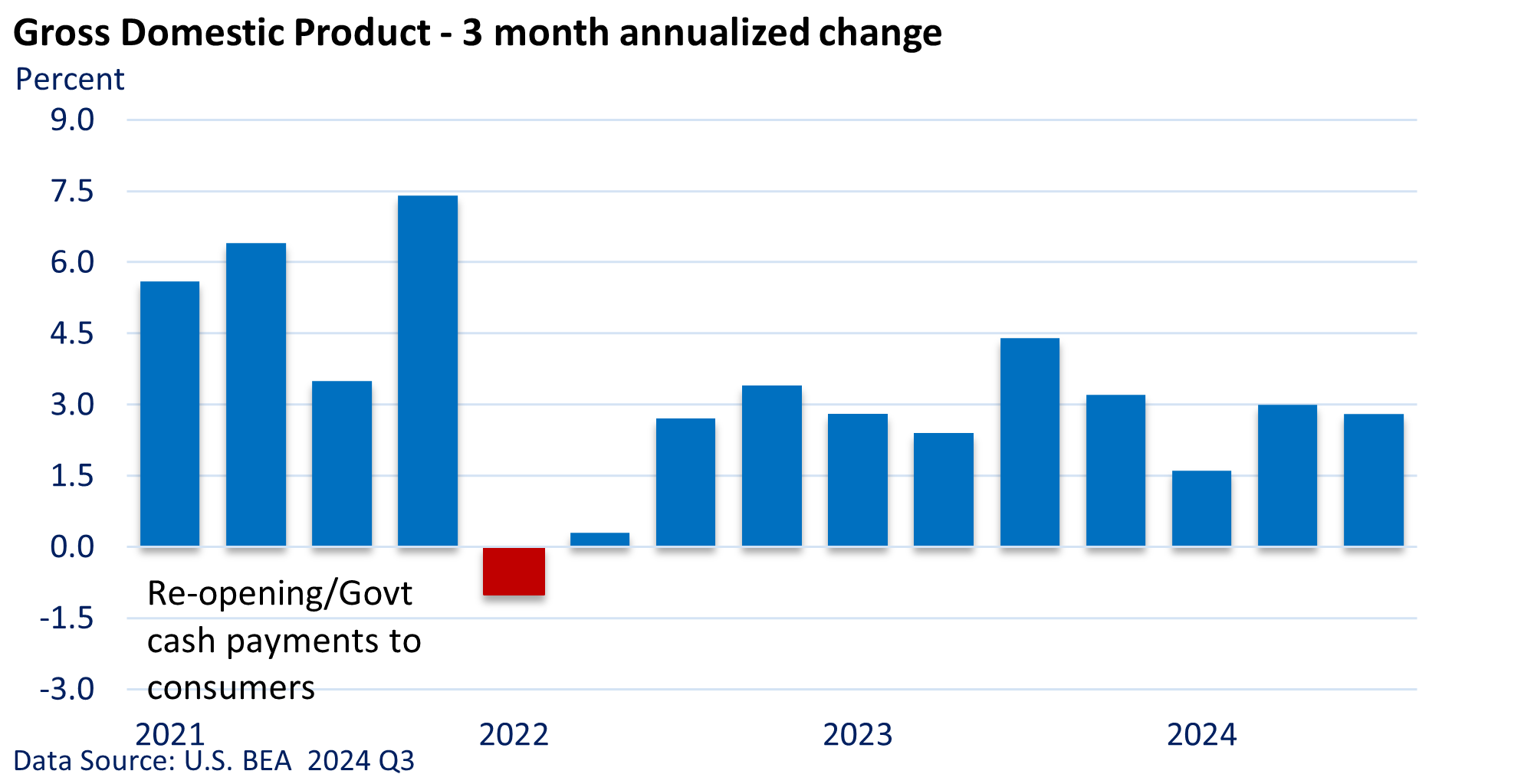

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2.

The broadest measure of U.S. economic activity matched the final report from the Atlanta Fed’s GDPNow model and came in slightly below economists’ projections of 3.1% (Wall Street Journal). GDP continues to expand at a strong pace despite the high cost of borrowing cash.

Notably, consumer spending, which accounts for nearly 70% of GDP, powered growth last quarter, contributing 2.5 percentage points to GDP. Led by defense spending, overall government outlays for goods and services supported economic activity. AI also generated big gains in business spending.

We’d expect an economy that’s powering ahead would generate abundant job growth. However, recent employment numbers suggest otherwise.

On Friday, the U.S. Bureau of Labor Statistics (BLS) reported that nonfarm payrolls rose just 12,000 in October. While the headline comes as a surprise, especially in light of September’s initially reported 254,000 increase (revised to 223,000), October’s numbers were noisy. Let me explain.

Manufacturing jobs fell by 46,000, “reflecting a decline of 44,000… that was largely due to strike activity (Boeing [BA $155] and the related supply chain), the U.S. BLS said.

The hurricanes, which slammed into the southeastern U.S. in late September and October, also muddied the data, but the U.S. BLS said it could not quantify the impact of the storms.

Further, the U.S. BLS said the “collection rate for October was well below average.” In other words, the report has too many holes to provide an accurate picture of October.

If anything, downward revisions to August and September were a bit discouraging. Yet, over a longer period, we’d expect economic growth to translate into stronger employment growth.

On an encouraging note, the Dept. of Labor reported on Thursday that first-time claims for unemployment benefits hit a five-month low as of October 26. Perhaps the government may have some wrinkles to iron out in its monthly labor report.