Weekly Market Commentary

In 2021 and 2022, soaring inflation sparked the most aggressive series of rate hikes in decades. While prices remain high, the rate of those price increases has slowed, and the Federal Reserve may finally be seriously considering a reduction in interest rates.

On Thursday, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index fell 0.1% in June. It’s the first monthly decline since early 2020.

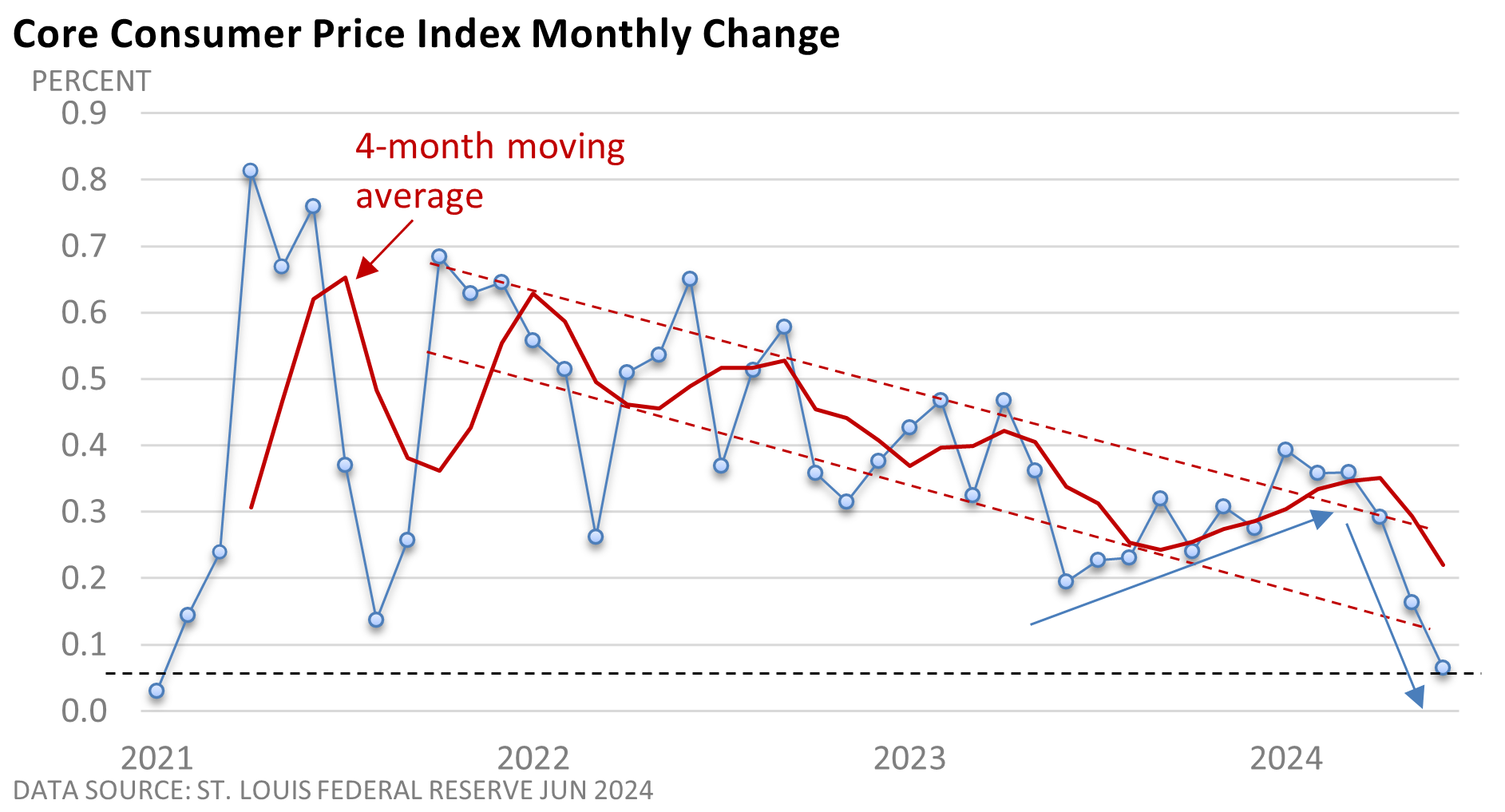

The core CPI, which excludes food and energy, rose just 0.1%. Today, however, progress is measured in inches and millimeters. Rounding out the increase to the second decimal point, core inflation was up just 0.06% in June—the smallest increase since January 2021.

Exclusive of declines in early 2020, when the economy was shutting down and demand for goods and services was drying up, June’s rise was the smallest since January 2017.

What’s behind the recent good news? Consumer goods outside of food and energy have fallen 12 of the last 13 months. Services, which had been sticky, slowed dramatically in May and June.

Going forward, additional progress is far from guaranteed. As the graphic above illustrates, the path to a lower rate of inflation has been uneven. Consequently, we should not dismiss the possibility that we might encounter some monthly data points that disrupt the longer-term trend.

But after a rough start early in the year, recent numbers are encouraging.

Meanwhile, last week, Fed Chief Powell took a more dovish stance on rates.

Overall, the job is not done on inflation, but the Fed is becoming more mindful of the softer labor market. As he remarked in testimony last week on Capitol Hill, “We just need to see more good inflation data, that’s all (before the Fed can reduce rates).”

His comments and Thursday’s tame CPI reading helped the Dow close at 40,000.90, less than 3 points from its previous closing high set on May 17 (MarketWatch).