Weekly Market Commentary

The U.S. Bureau of Labor Statistics (BLS) reported that nonfarm payrolls rose a solid 206,000 in June, topping the consensus forecast offered by Bloomberg News of 190,000. However, first glances may not always leave the correct impression.

Private sector payrolls increased by a more modest 136,000, and nonfarm payrolls were revised downward by 111,000 in April and May.

Average job growth over the last three months moderated to its slowest pace since January 2021, according to U.S. BLS data. In addition, the unemployment rate rose to 4.1% in June, up from 4.0% in May.

Lopsided

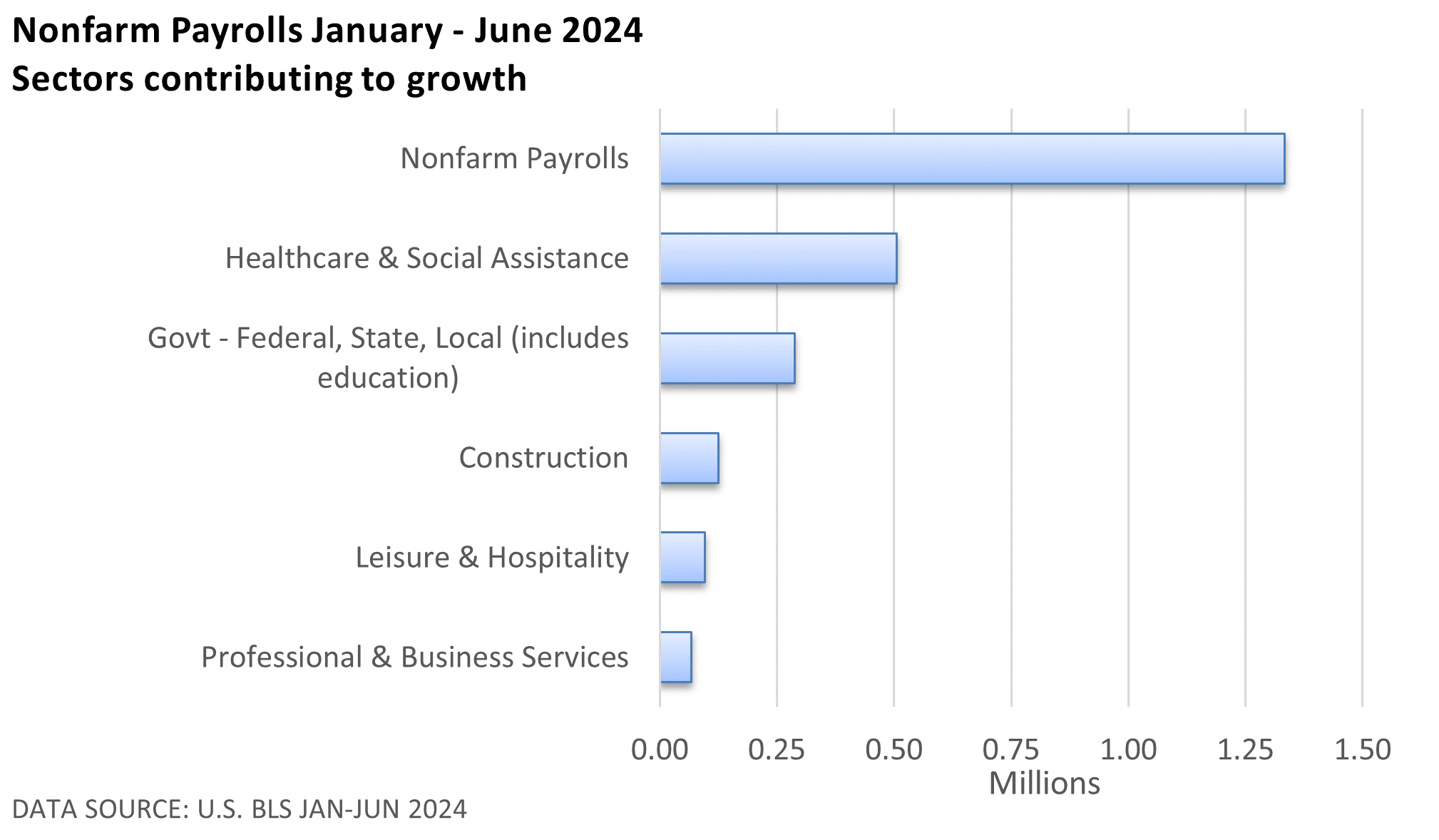

Growth in the job market has been driven by a couple of industries.

Nonfarm payrolls are up by 1.3 million this year. That’s impressive by any measure. But 505,000 came from just one sector—healthcare. Government jobs accounted for another 288,000, with almost two-thirds of those jobs created by local governments (U.S. BLS).

Nearly 60% of all net new jobs were generated by two sectors. They account for 29% of all jobs.

The category ‘professional and business services’ (exclusive of healthcare) added just 68,000 positions this year. Growth has also slowed for the once red-hot leisure and hospitality group.

Bottom Line

The report could shift the Fed’s perception of the balance of risks as unemployment has gradually risen and payroll growth has moderated.

The latest numbers also increase the probability that the Fed could implement its first rate cut in September.