by Mark Chandik | Aug 12, 2024

Ask the average investor what inflation or unemployment is, and they can probably give you a good working definition. Ask them about the ‘carry trade,’ and you’ll likely get a blank stare. Even the term itself isn’t intuitive. But a sudden unwinding of the carry trade...

by Mark Chandik | Aug 5, 2024

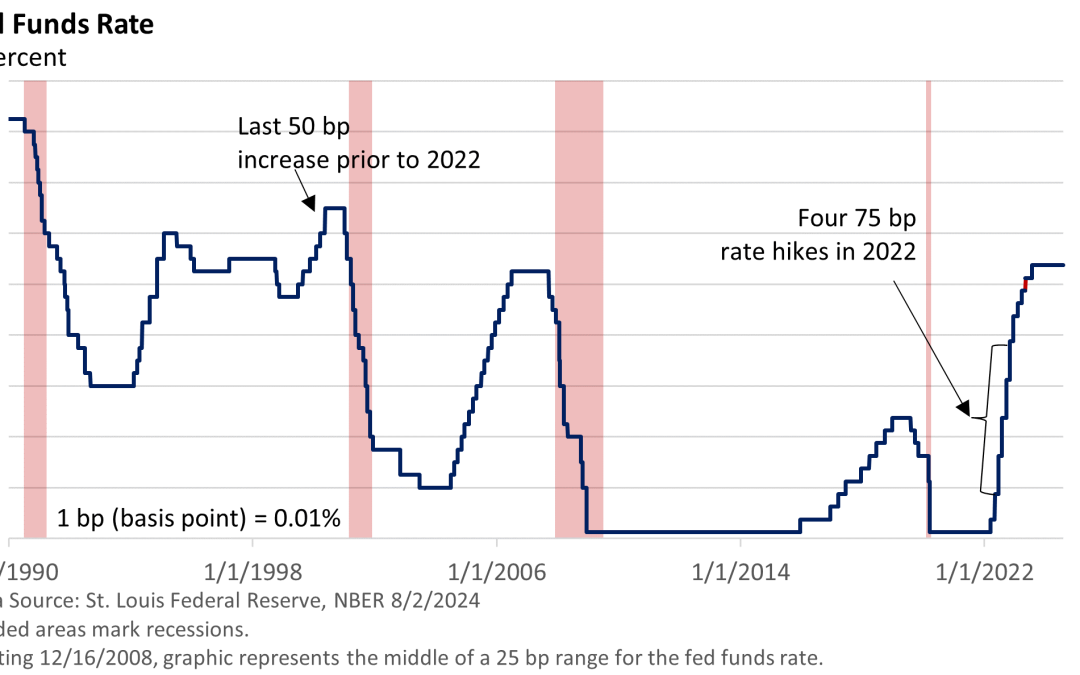

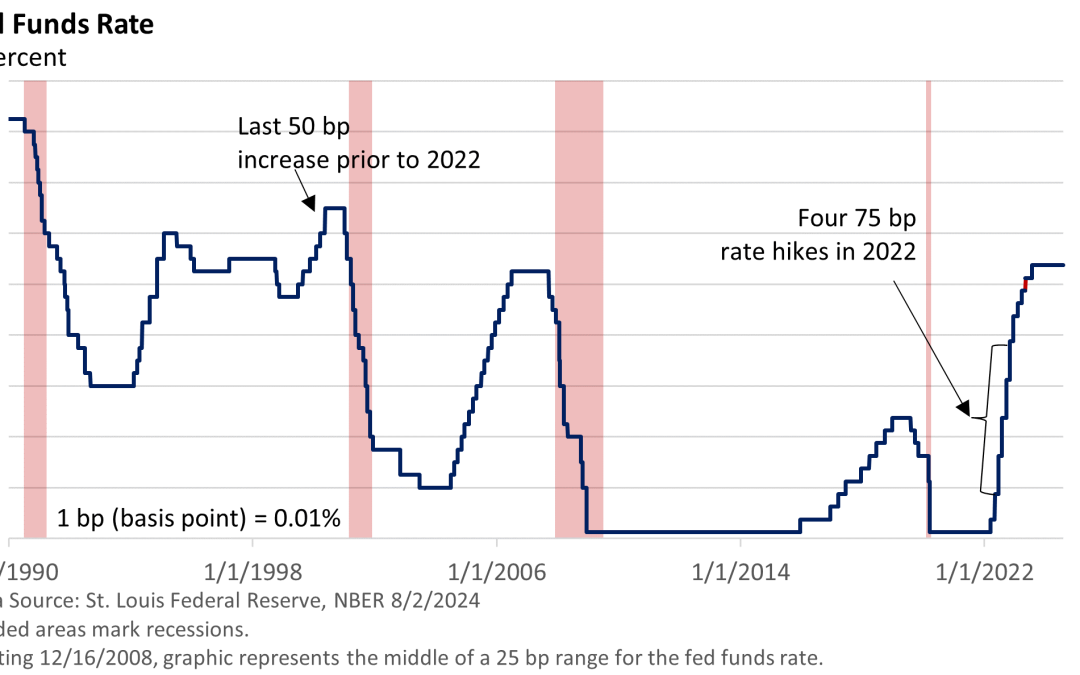

As expected, the Federal Reserve kept its key rate, the fed funds rate, unchanged at 5.25 – 5.50%. After holding the fed funds rate steady for a year, Fed Chief Jay Powell twice-mentioned that a September rate cut is on the table at his press conference. The Federal...

by Mark Chandik | Jul 29, 2024

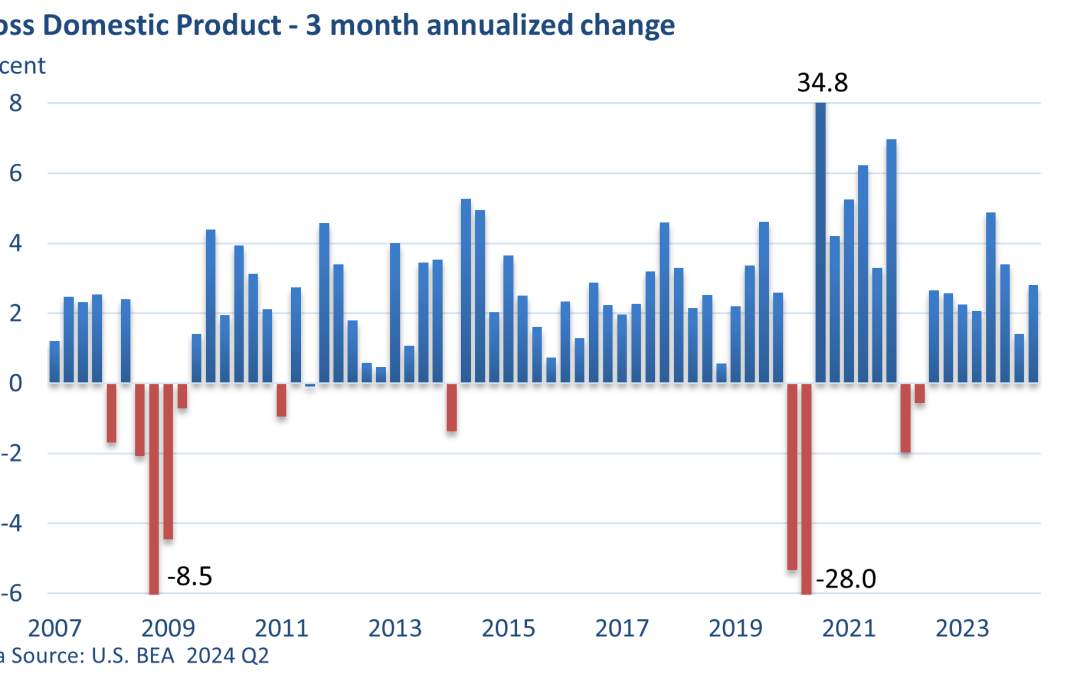

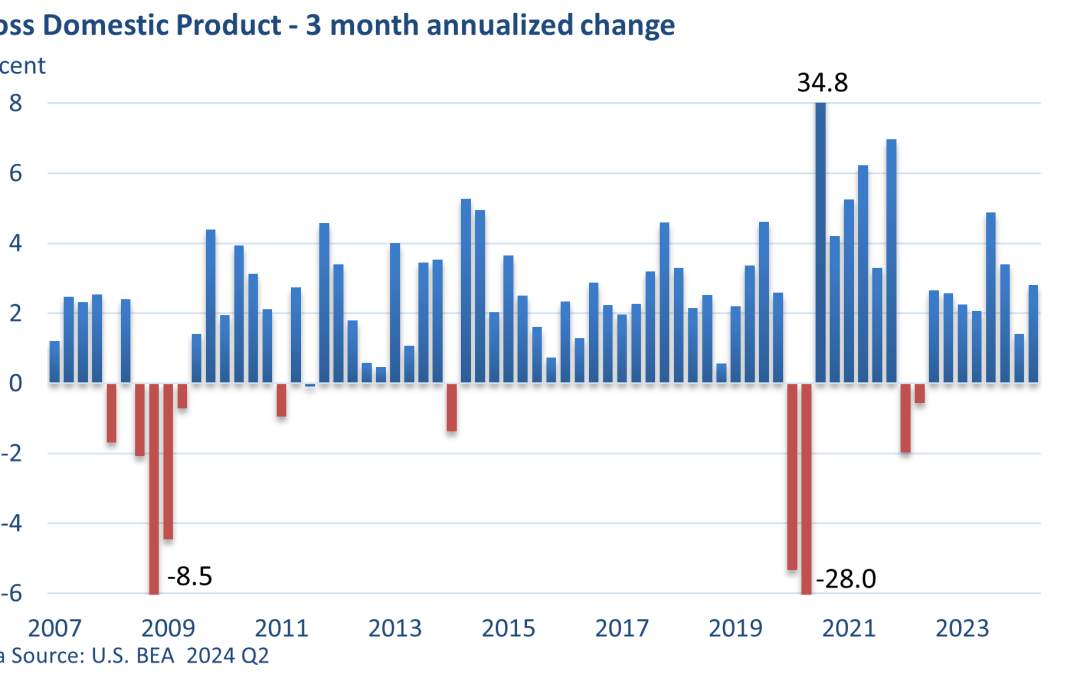

The U.S. Bureau of Economic Analysis reported that the Gross Domestic Product (GDP), the largest measure of goods and services, expanded at a brisk annualized pace of 2.8% in the second quarter. That’s up from 1.4% in the first quarter and well ahead of...

by Mark Chandik | Jul 22, 2024

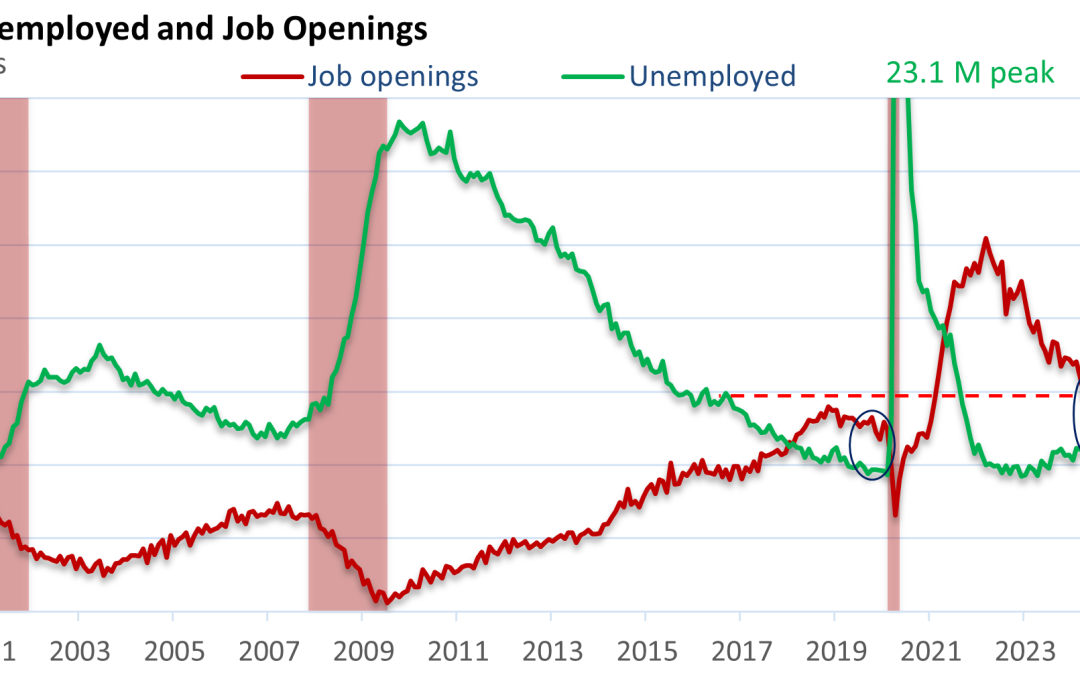

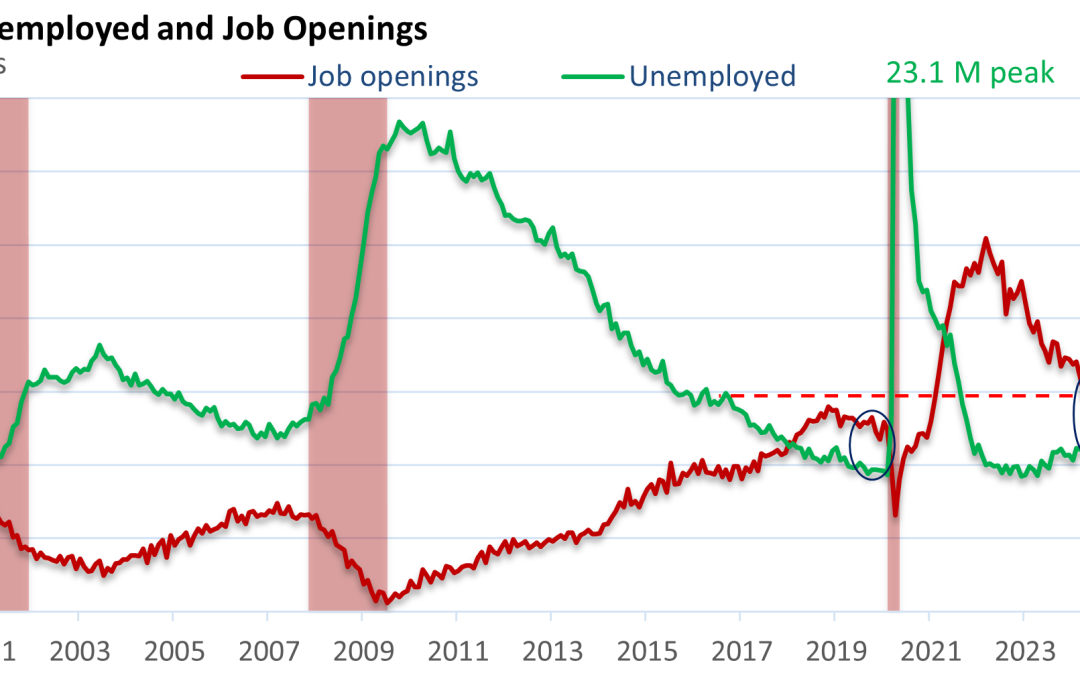

…And they all come to the same conclusion. What’s going on? The labor market is moving back into balance. No longer do we come across articles touting the Great Resignation. In 2021 and 2022, it was ‘advantage employee.’ Employees still have some leverage, but the...

by Mark Chandik | Jul 15, 2024

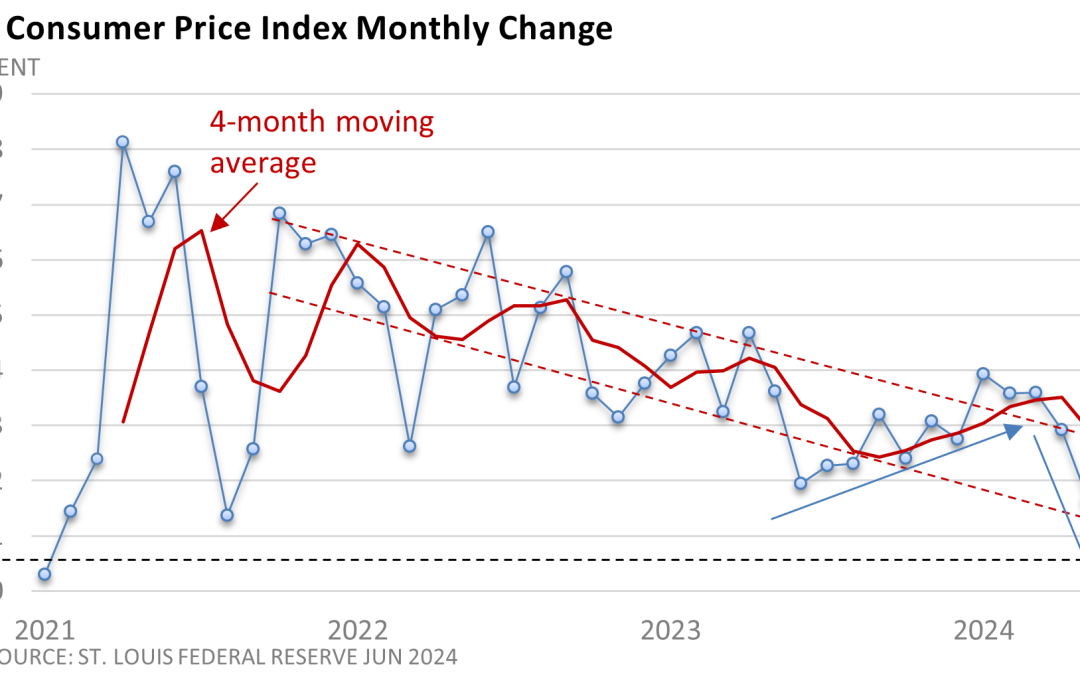

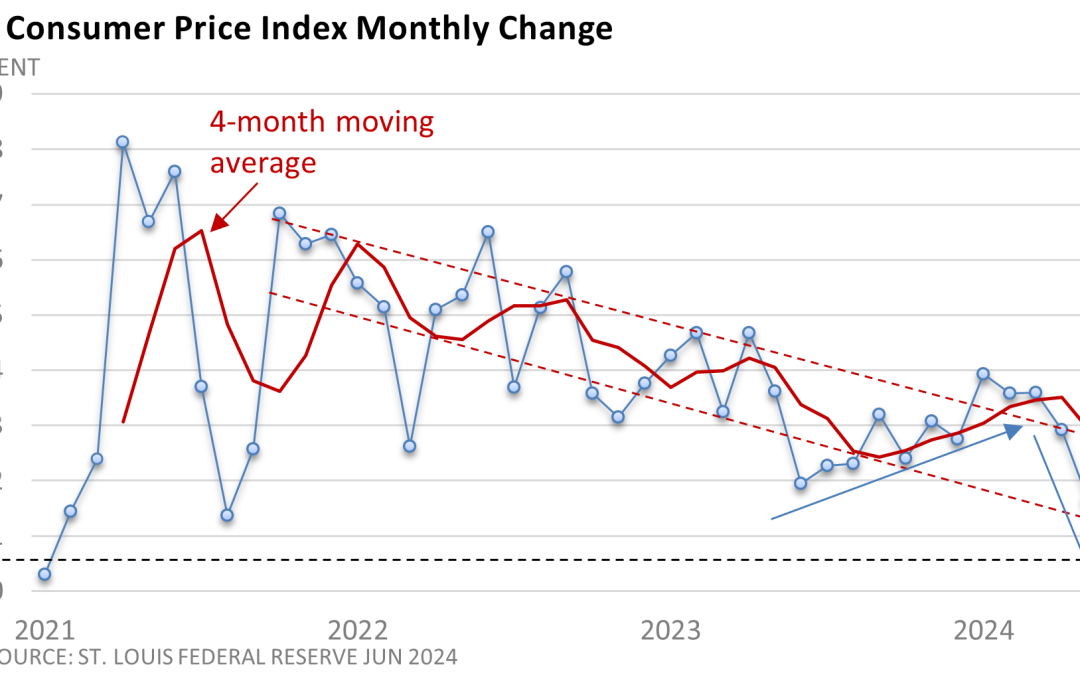

Weekly Market Commentary In 2021 and 2022, soaring inflation sparked the most aggressive series of rate hikes in decades. While prices remain high, the rate of those price increases has slowed, and the Federal Reserve may finally be seriously considering a reduction...