by Mark Chandik | Jan 2, 2024

Weekly Market Commentary A December 29th Wall Street Journal title summed the year up: What Did Wall Street Get Right About Markets This Year? Not Much. Back up to December 2022, when Moody’s Chief Economist Mark Zandi captured the most prevalent view at the time....

by Mark Chandik | Dec 28, 2023

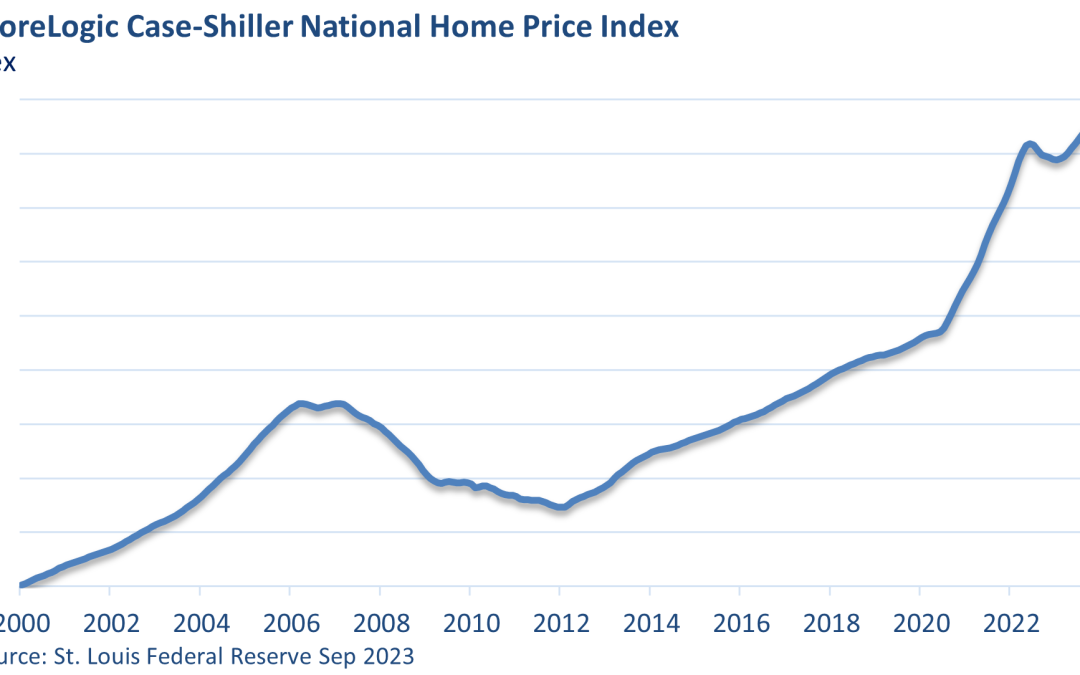

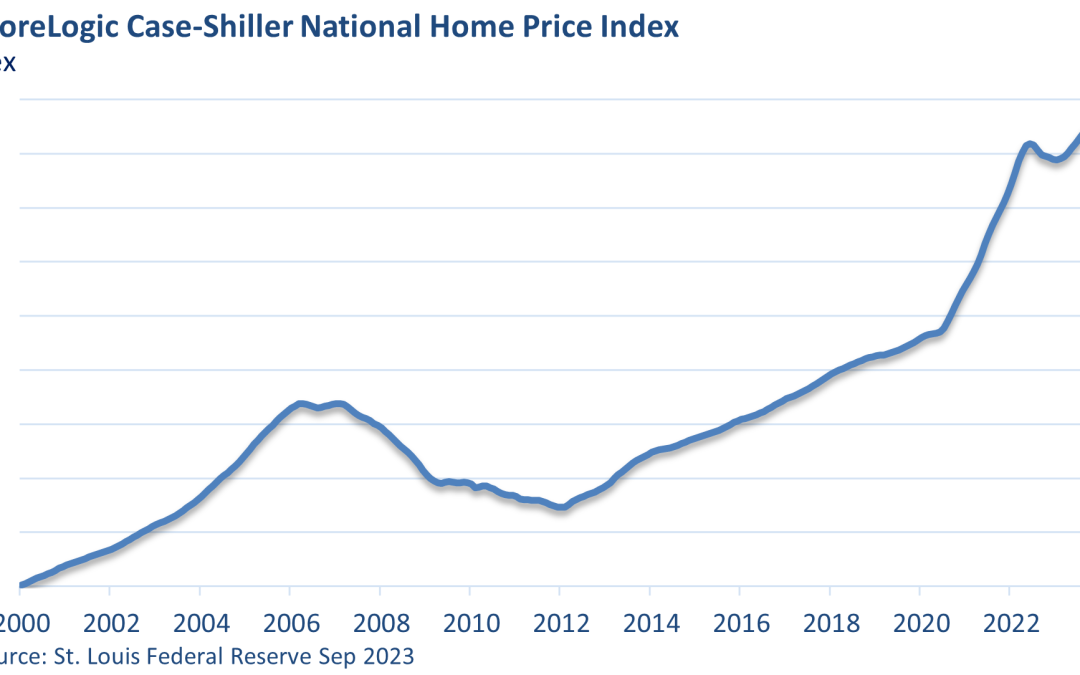

Weekly Market Commentary Mortgage rates have soared, and home sales are down sharply. Conventional wisdom would suggest that prices should be down. But housing prices have defied expectations, rising to record heights and locking first-time buyers out of the market....

by Mark Chandik | Dec 28, 2023

As our company transitions from www.fdpwm.com to www.prosperity-pwm.com, we want to ensure seamless communication with our valued clients. Whitelisting our new domain is crucial to prevent important messages from being lost in spam folders. What is Whitelisting?...

by Mark Chandik | Dec 18, 2023

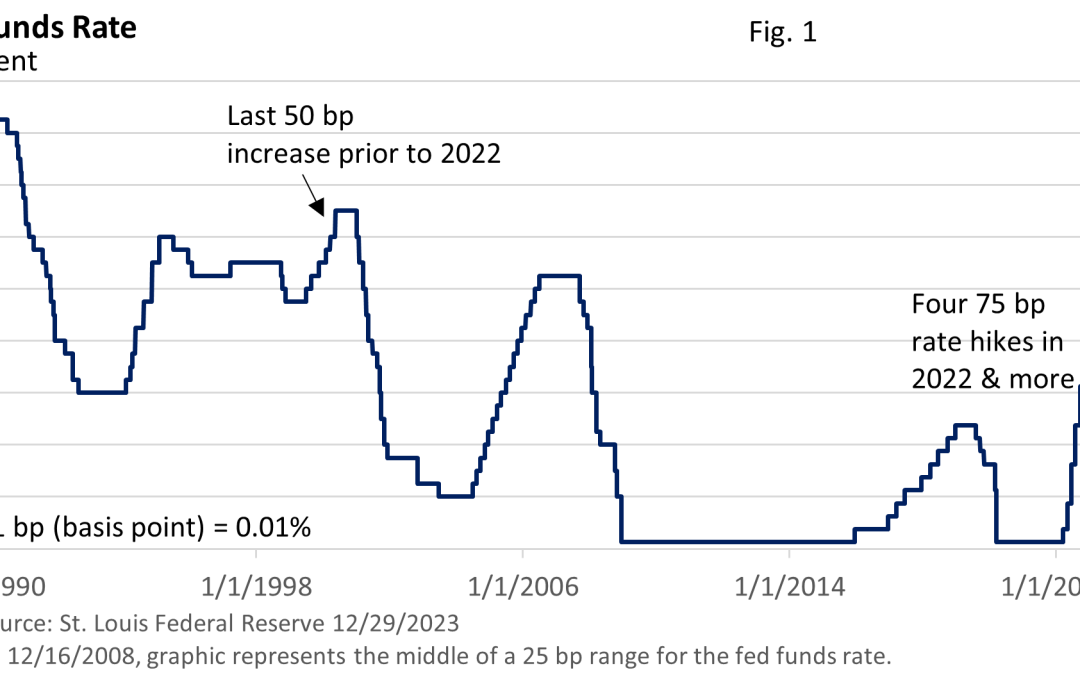

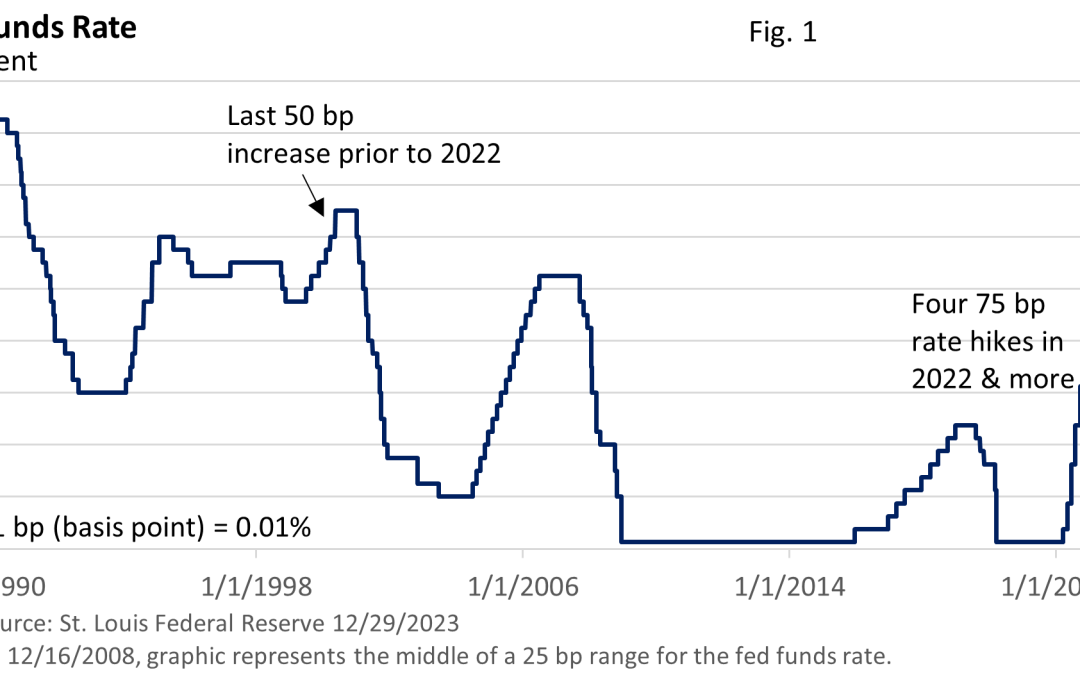

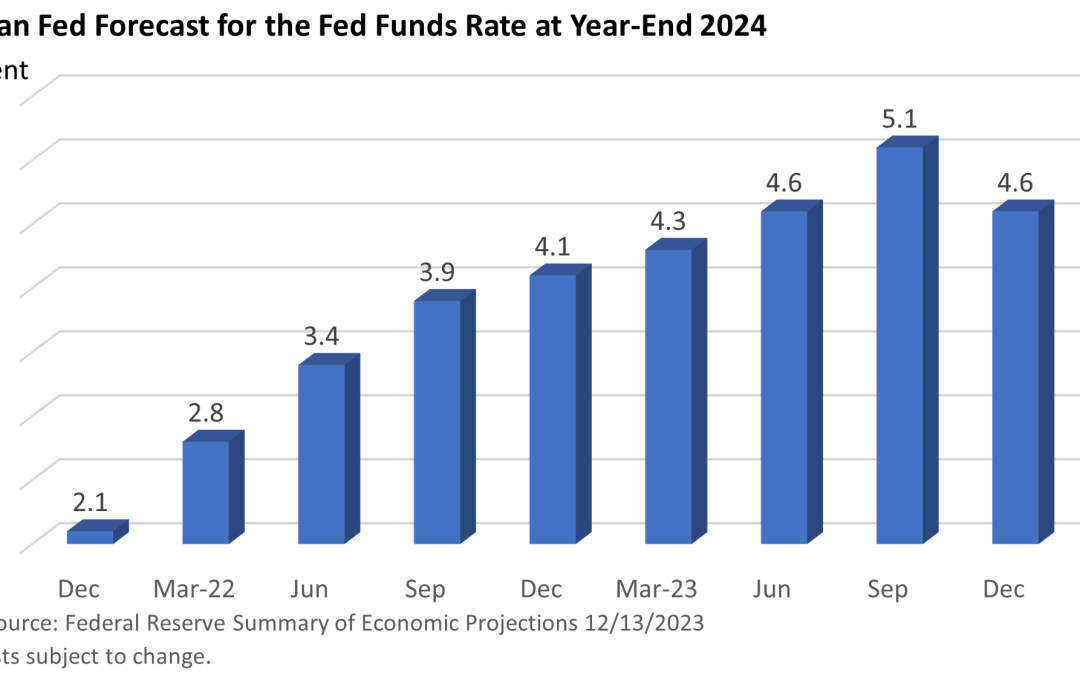

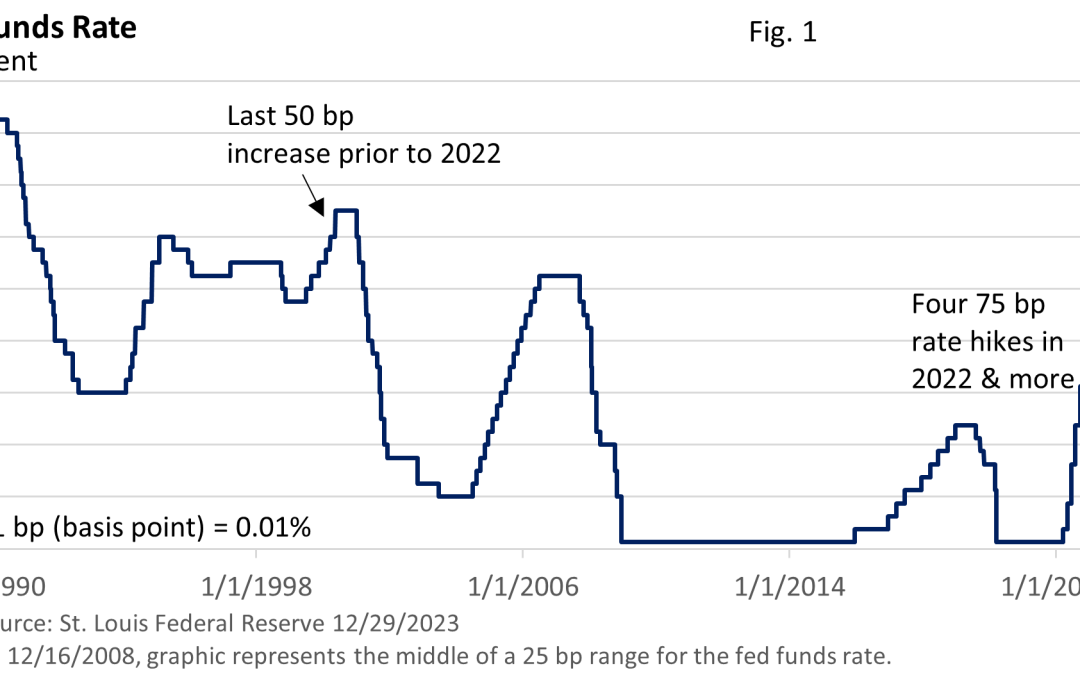

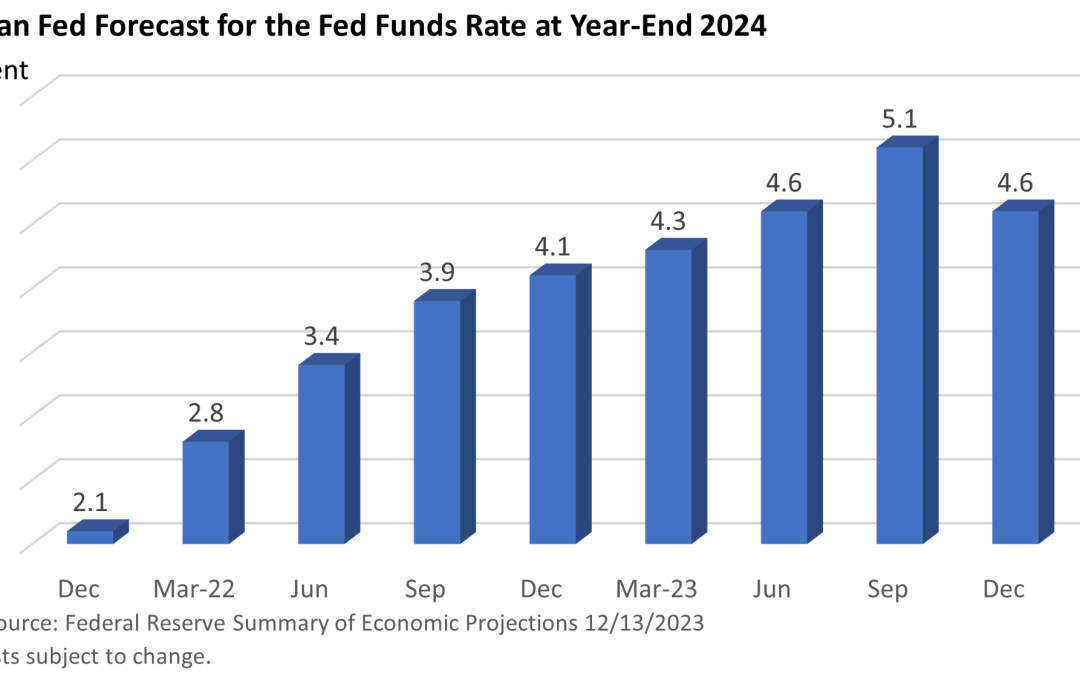

Weekly Market Commentary The meeting held by the Federal Reserve last week was the most consequential gathering of central bankers this year. The Fed held the fed funds rate at 5.25 – 5.50% as expected, but in so many words, the Fed pivoted on its rate stance. No...

by Mark Chandik | Dec 11, 2023

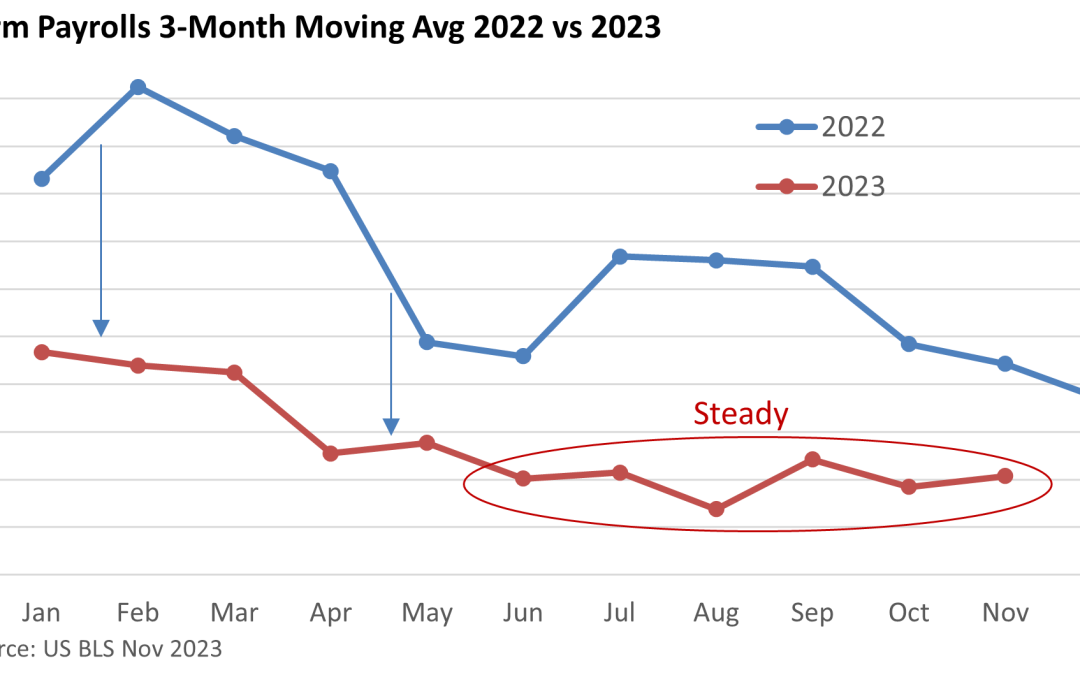

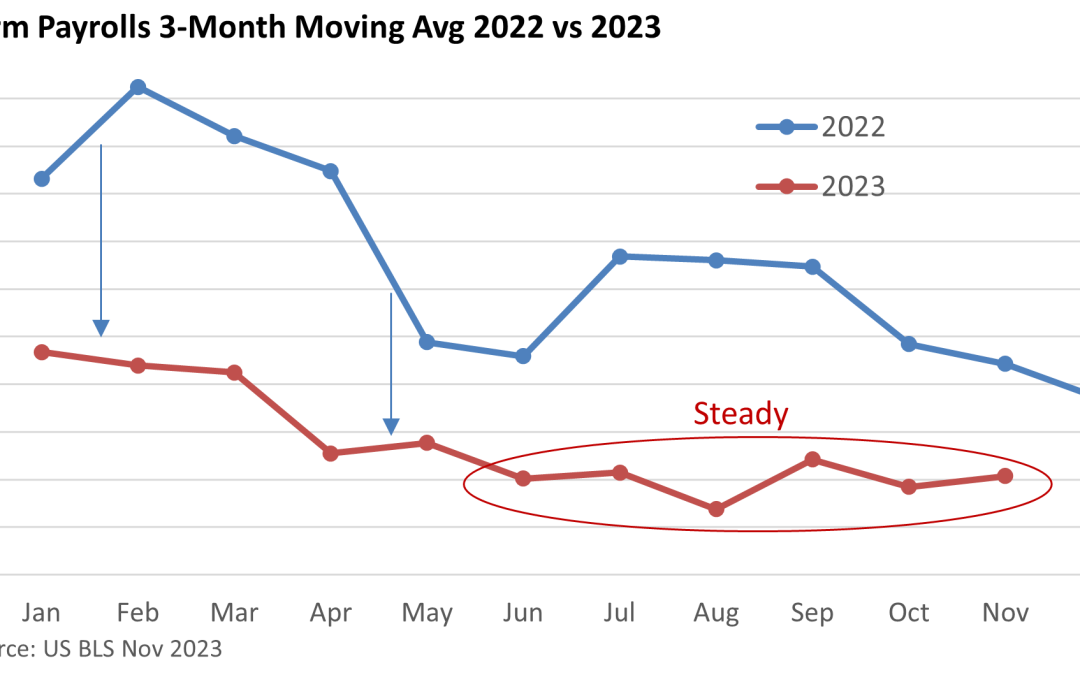

Weekly Market Commentary The latest jobs report did little to alter the economic outlook. Instead, it was a steady-as-she-goes report. Nonfarm payrolls grew by 199,000 in November, according to the U.S. Bureau of Labor Statistics (BLS). It was nearly in line with the...