by Mark Chandik | Nov 10, 2025

The government shutdown has been and will always be prominently featured in the 24-hour news cycle. Travelers are feeling it, furloughed federal employees wonder when they will receive their next paycheck, and even the housing market is affected as some buyers are...

by Mark Chandik | Nov 3, 2025

The Federal Reserve delivered a widely expected 25-basis-point rate cut (bp, 1 bp = 0.01%), but Fed Chief Jay Powell tempered market enthusiasm by signaling that a December cut is far from certain. It was the second rate reduction of 25 basis points in the current...

by Mark Chandik | Oct 27, 2025

Among various assets, one unexpected outperformer has been gold. Since the start of the year, the shiny metal has increased by over 50%, easily surpassing the major stock market indexes. The Dollar Index (DXY) is an index (or measure) of the value of the US dollar...

by Mark Chandik | Oct 20, 2025

On October 12, 2022, the S&P 500 Index hit a cyclical low. In hindsight, that marked the end of the 2022 bear market. Fast forward three years, and the current bull market has now been running for three years. Let’s compare the current run to the six longest bull...

by Mark Chandik | Oct 20, 2025

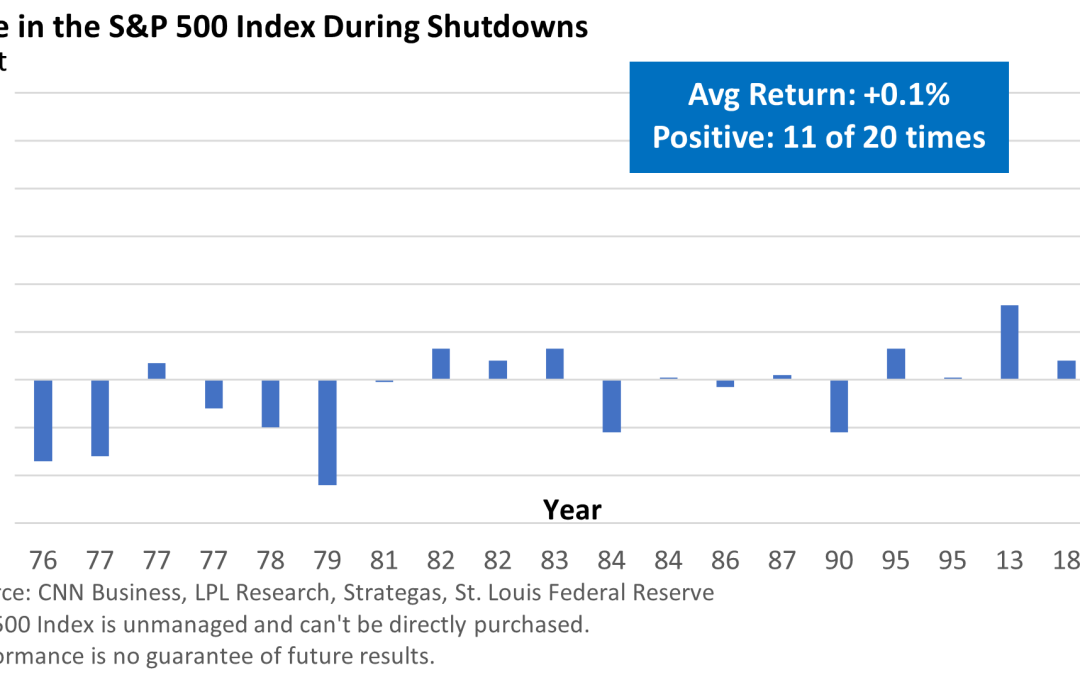

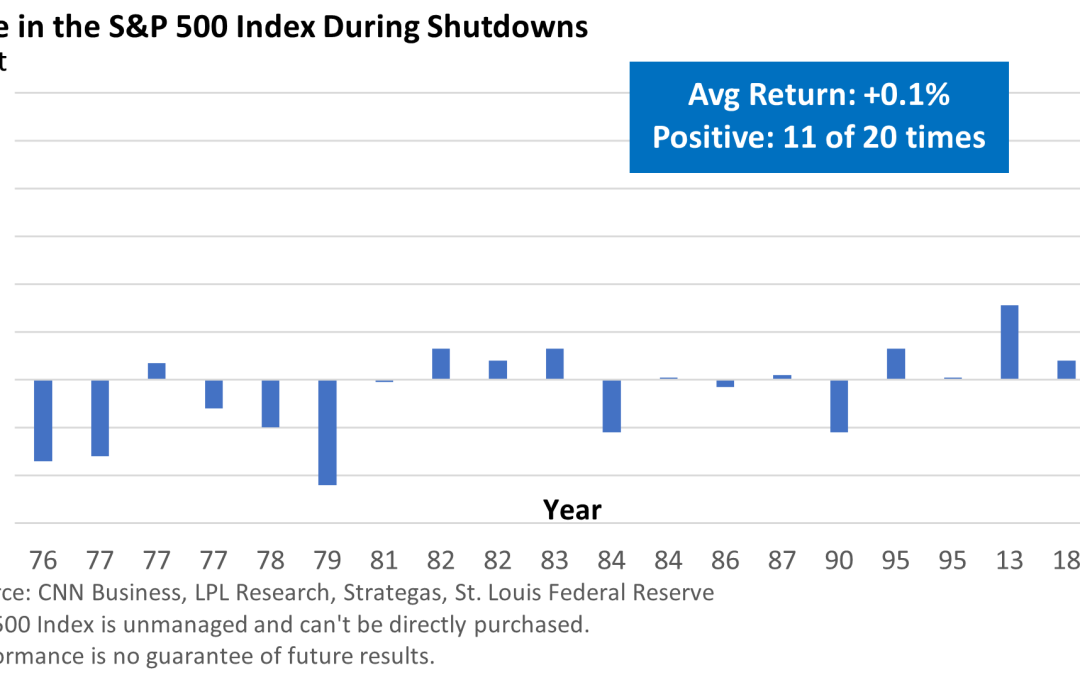

Historically, US government shutdowns have had minimal impact on the stock market. Let’s review the graphic below. Since 1976, government shutdowns of varying lengths have had little effect on stocks, as measured by the S&P 500 Index. The government closure began...