by Mark Chandik | Sep 29, 2025

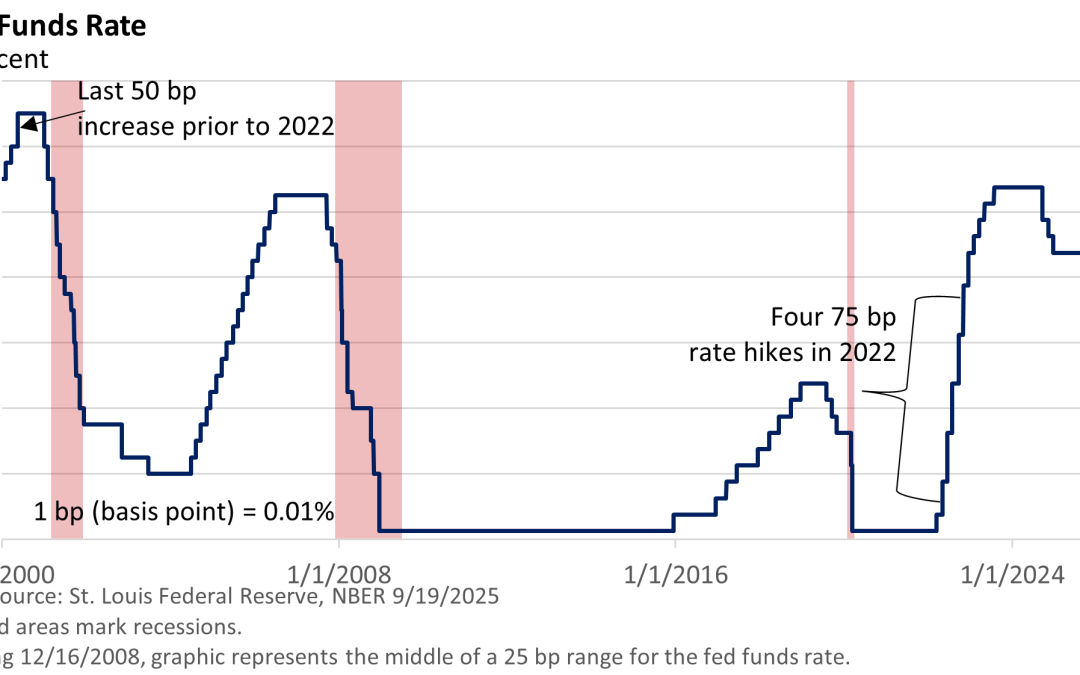

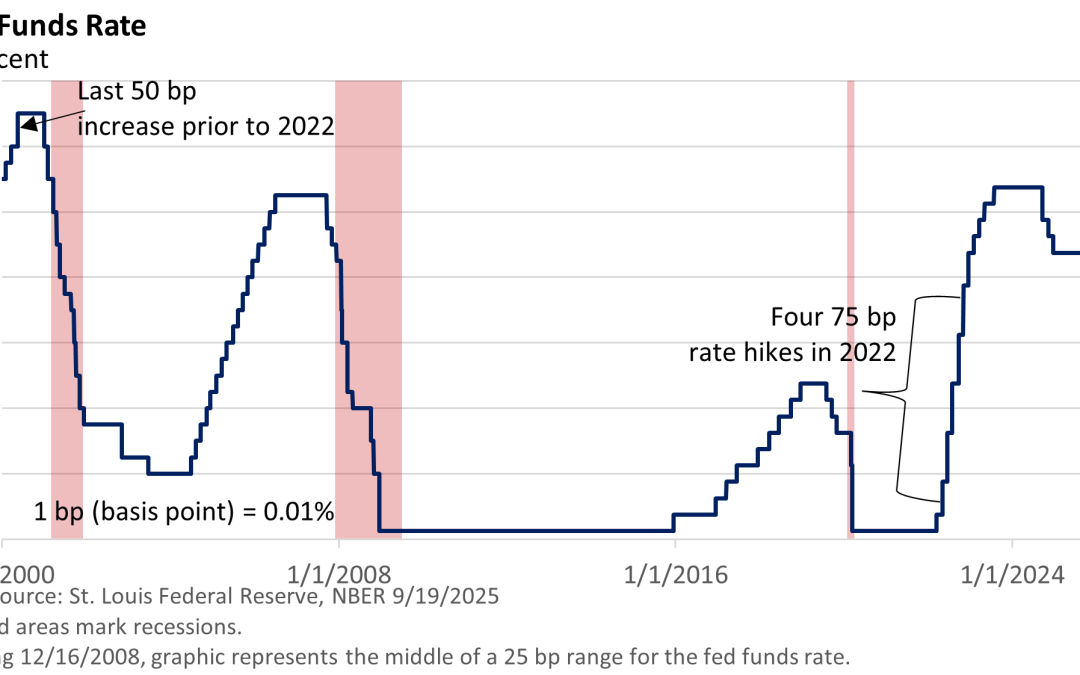

A couple of weeks ago, the Federal Reserve cut its key rate, the fed funds rate, by a quarter-percentage point to 4.00-4.25%. It’s the first rate cut since last December. So, is this one and done, or will there be a series of rate reductions? A speech delivered last...

by Mark Chandik | Sep 22, 2025

To virtually no one’s surprise, the Federal Reserve slashed the target on its key interest rate—the fed funds rate—at the conclusion of its meeting on Wednesday. The only question regarding the decision was whether the Fed would cut by a quarter point (25 basis points...

by Mark Chandik | Sep 15, 2025

The only thing that might have been standing in the way between the Federal Reserve and a rate cut this week was last Thursday’s release of the Consumer Price Index (CPI). While the inflation figures weren’t particularly soft, August’s data didn’t reflect a sharp rise...

by Mark Chandik | Sep 8, 2025

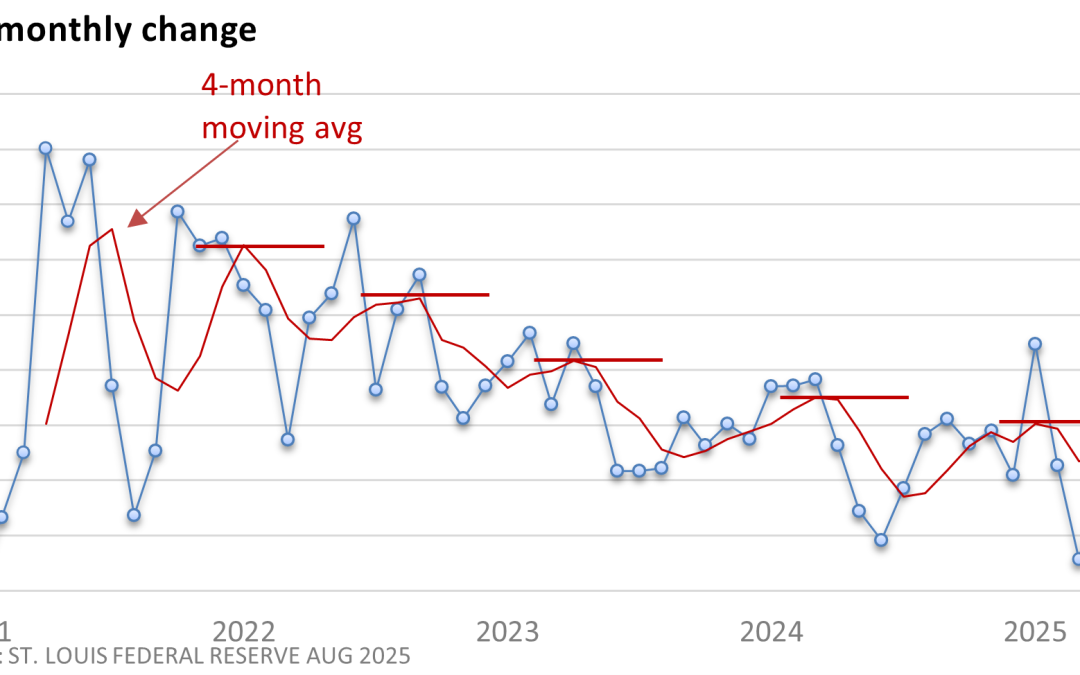

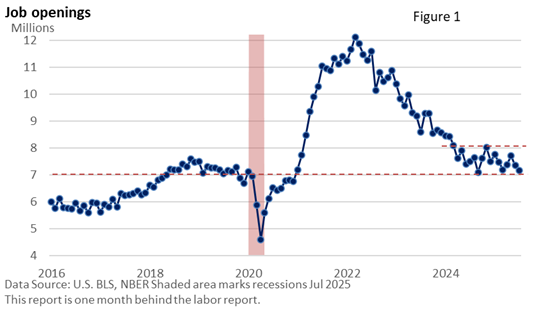

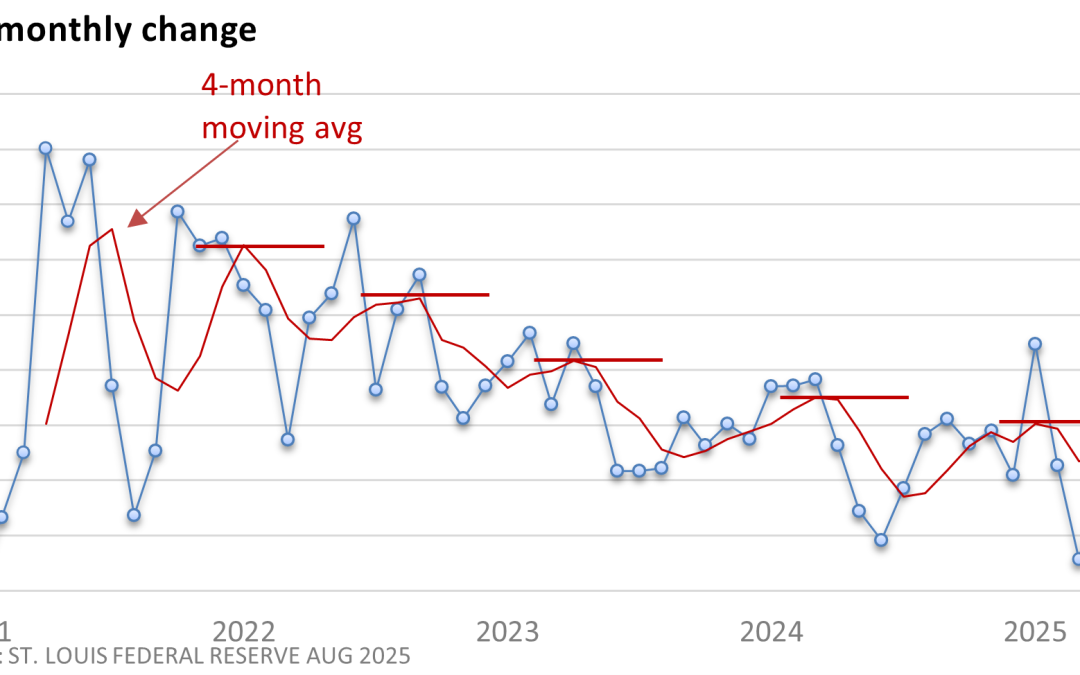

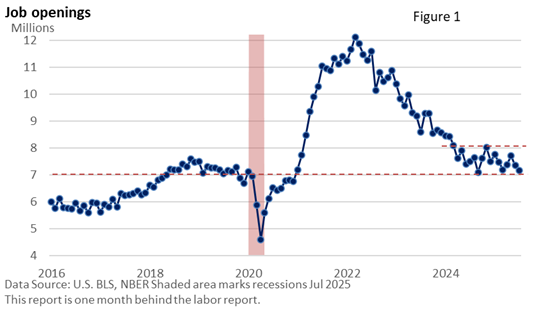

For starters, the title is a simplified five-word summary of the labor market. Recall that last week, we explored the low level of layoffs. This week, we shift the focus to hiring trends. But first, let’s take a closer look at the numbers from the latest jobs report....

by Mark Chandik | Sep 2, 2025

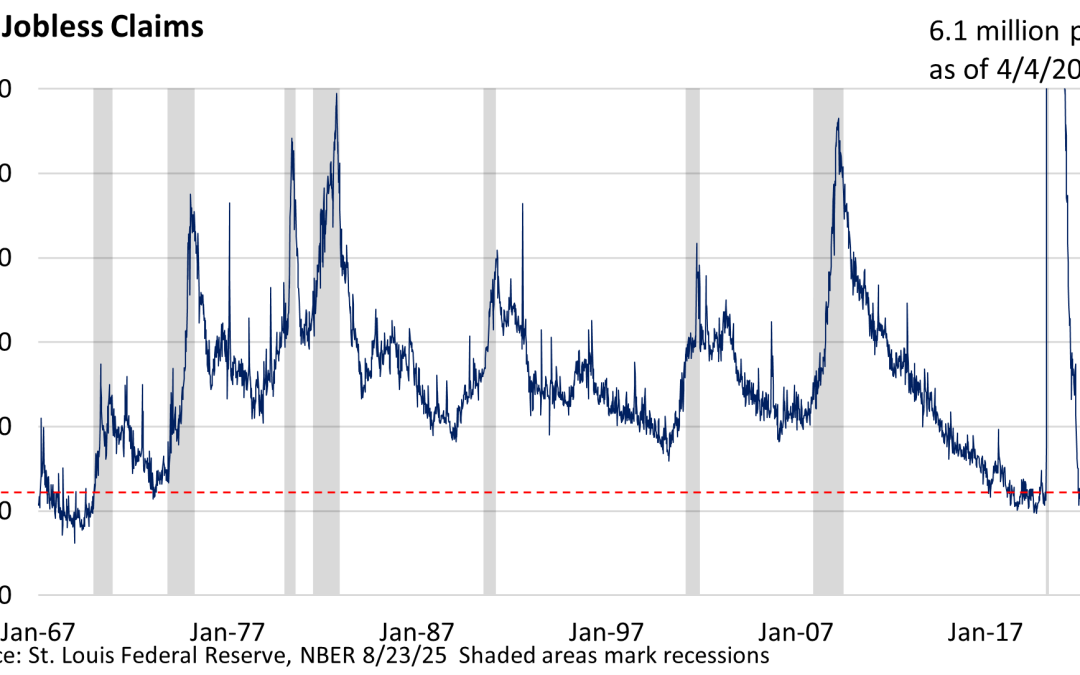

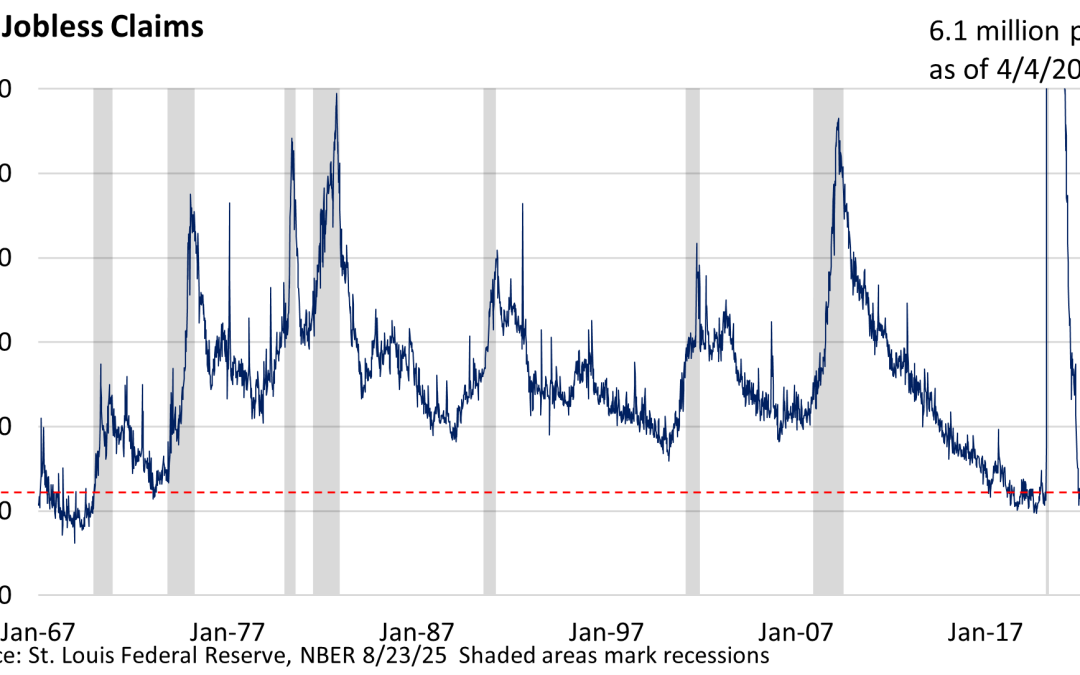

Initial claims for unemployment insurance measure the number of people filing for unemployment benefits for the first time. The data is released weekly, making it one of the most up-to-date indicators of labor market conditions. It is a key economic indicator because...