by Mark Chandik | Jul 22, 2024

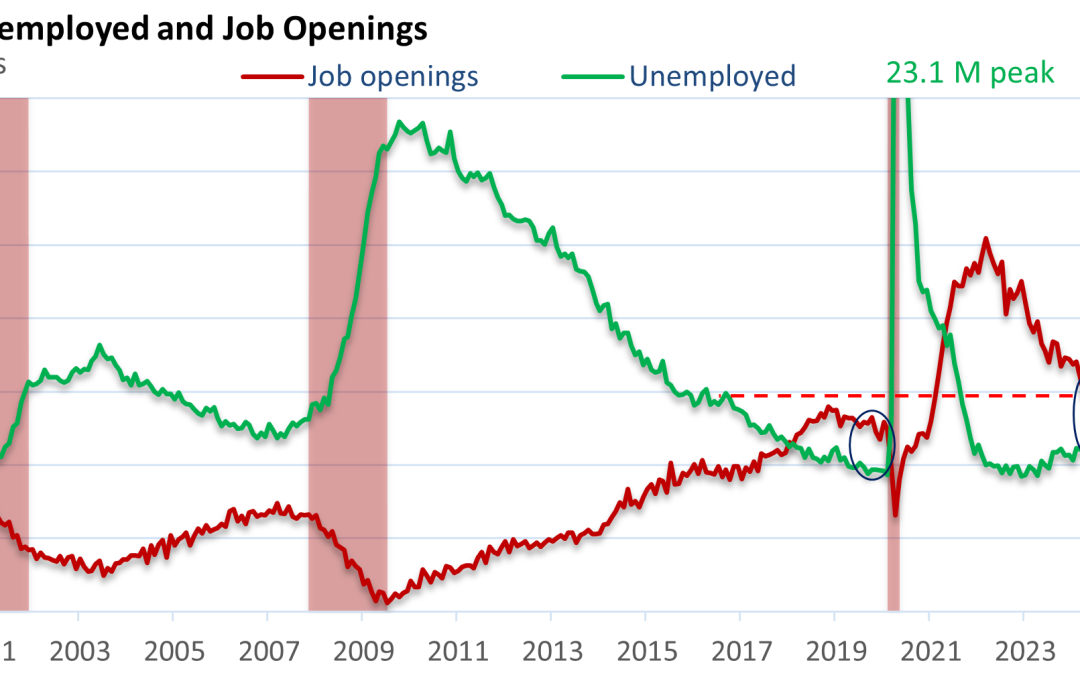

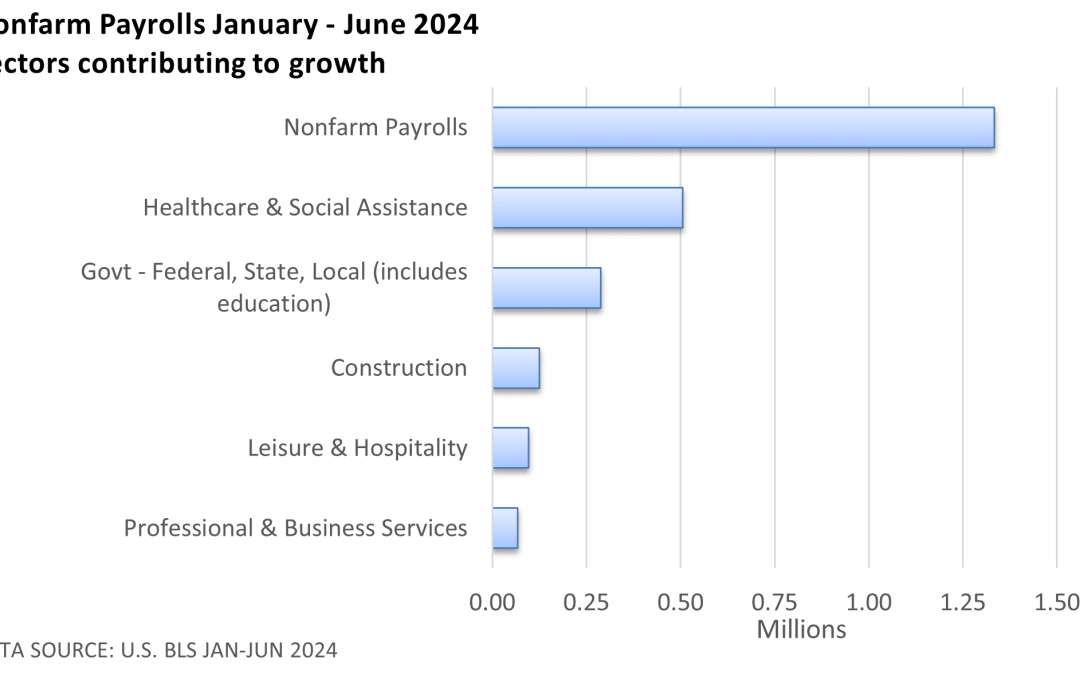

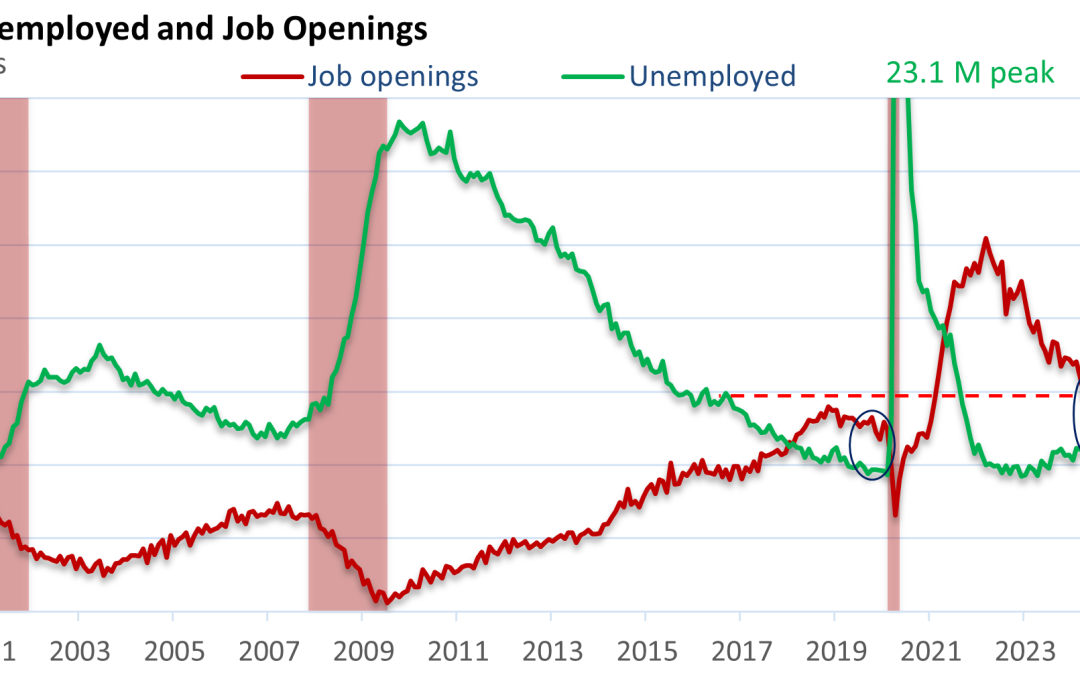

…And they all come to the same conclusion. What’s going on? The labor market is moving back into balance. No longer do we come across articles touting the Great Resignation. In 2021 and 2022, it was ‘advantage employee.’ Employees still have some leverage, but the...

by Mark Chandik | Jul 15, 2024

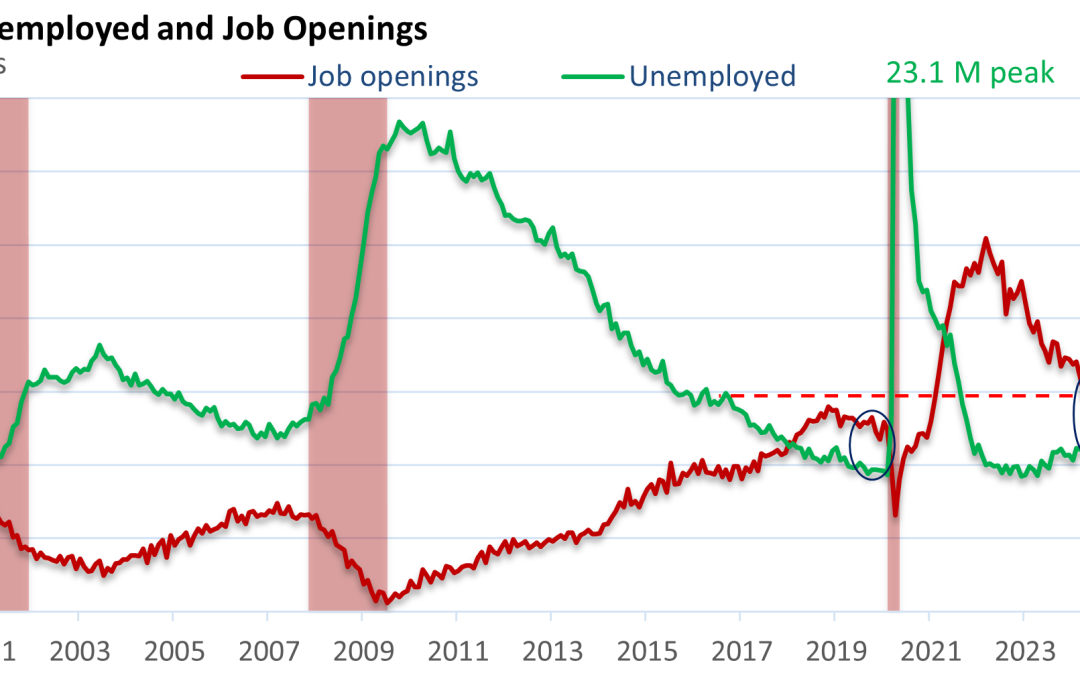

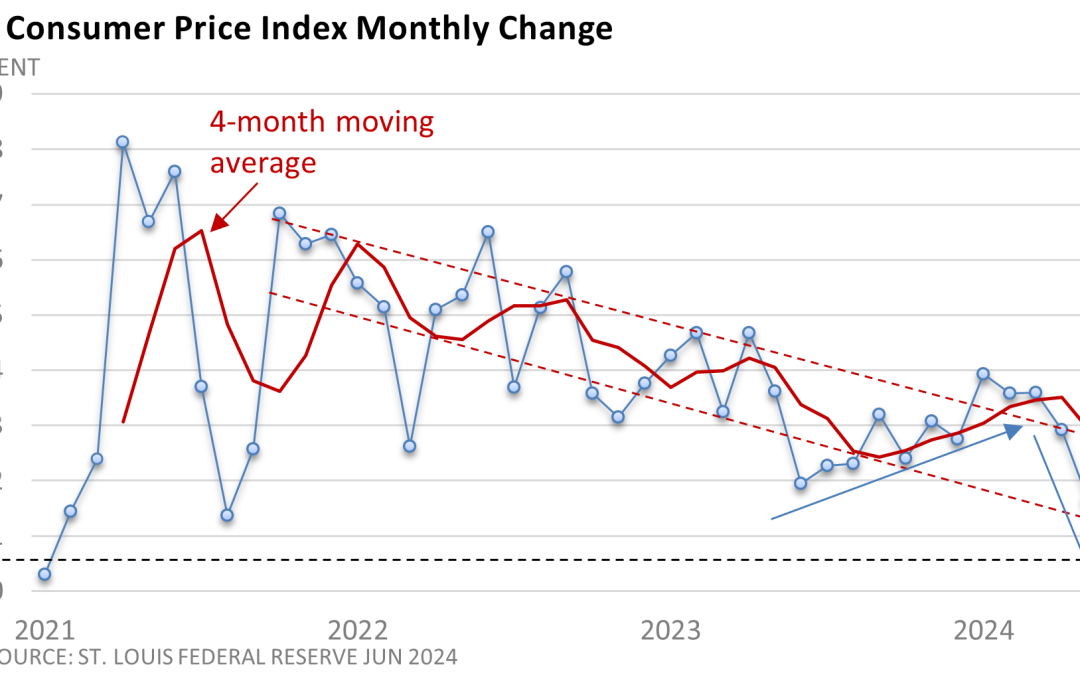

Weekly Market Commentary In 2021 and 2022, soaring inflation sparked the most aggressive series of rate hikes in decades. While prices remain high, the rate of those price increases has slowed, and the Federal Reserve may finally be seriously considering a reduction...

by Mark Chandik | Jul 8, 2024

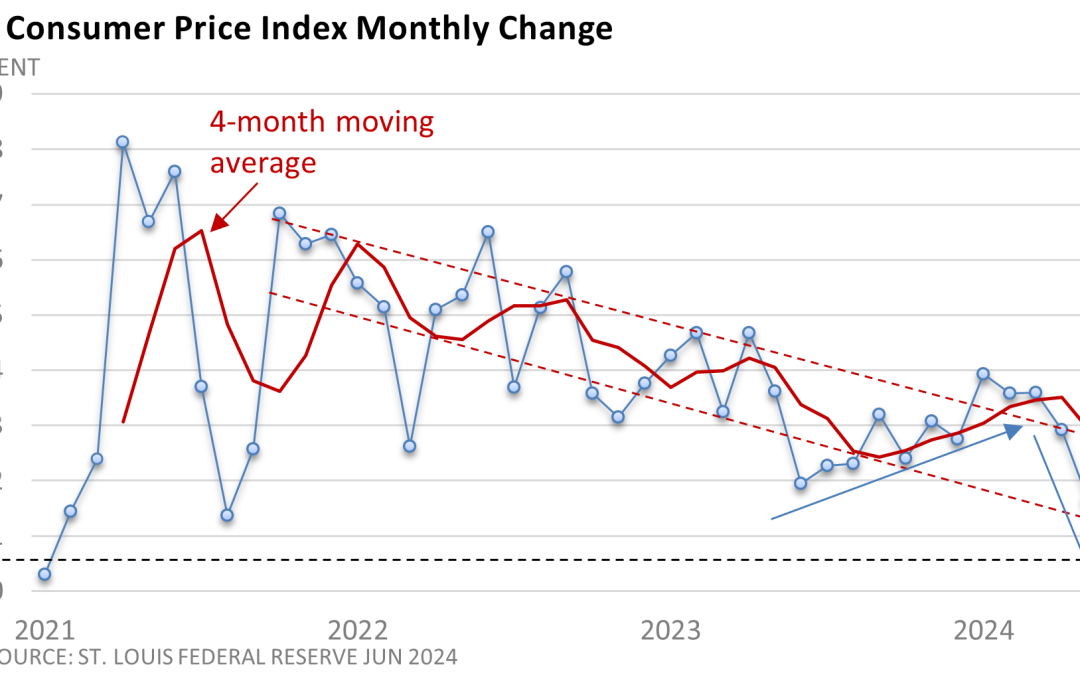

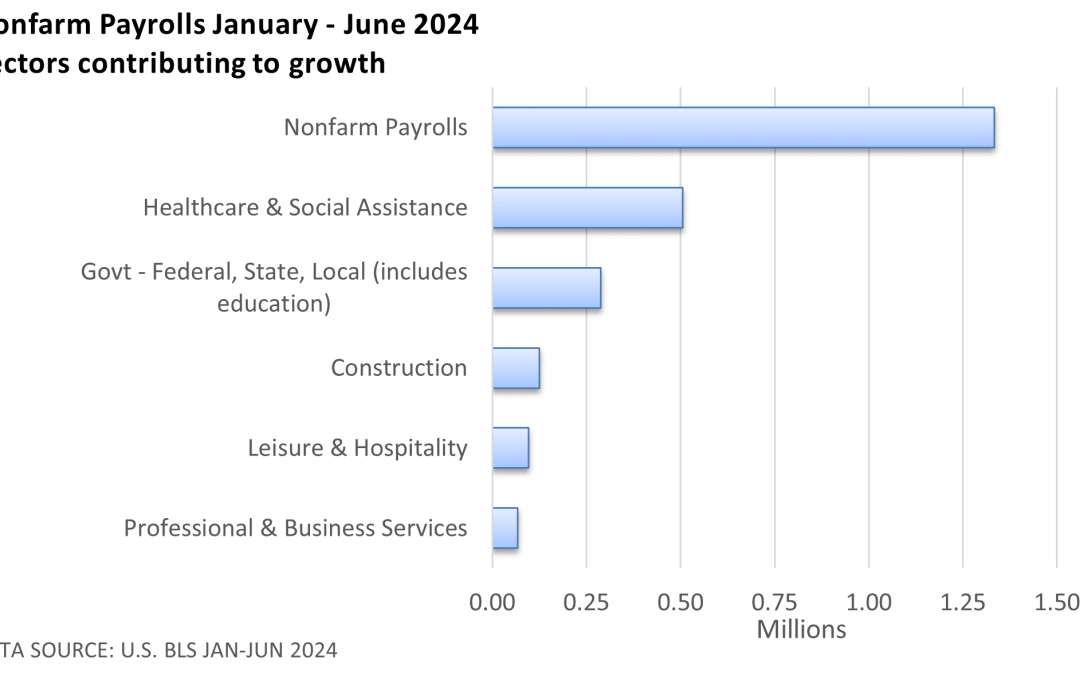

Weekly Market Commentary The U.S. Bureau of Labor Statistics (BLS) reported that nonfarm payrolls rose a solid 206,000 in June, topping the consensus forecast offered by Bloomberg News of 190,000. However, first glances may not always leave the correct impression....

by Mark Chandik | Jul 1, 2024

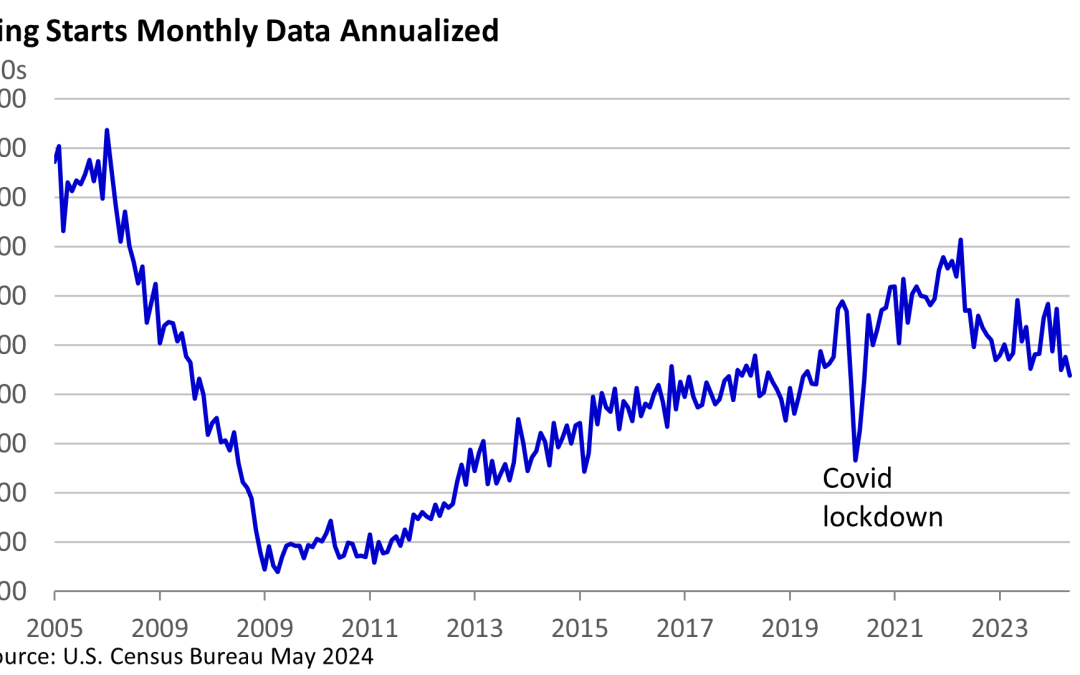

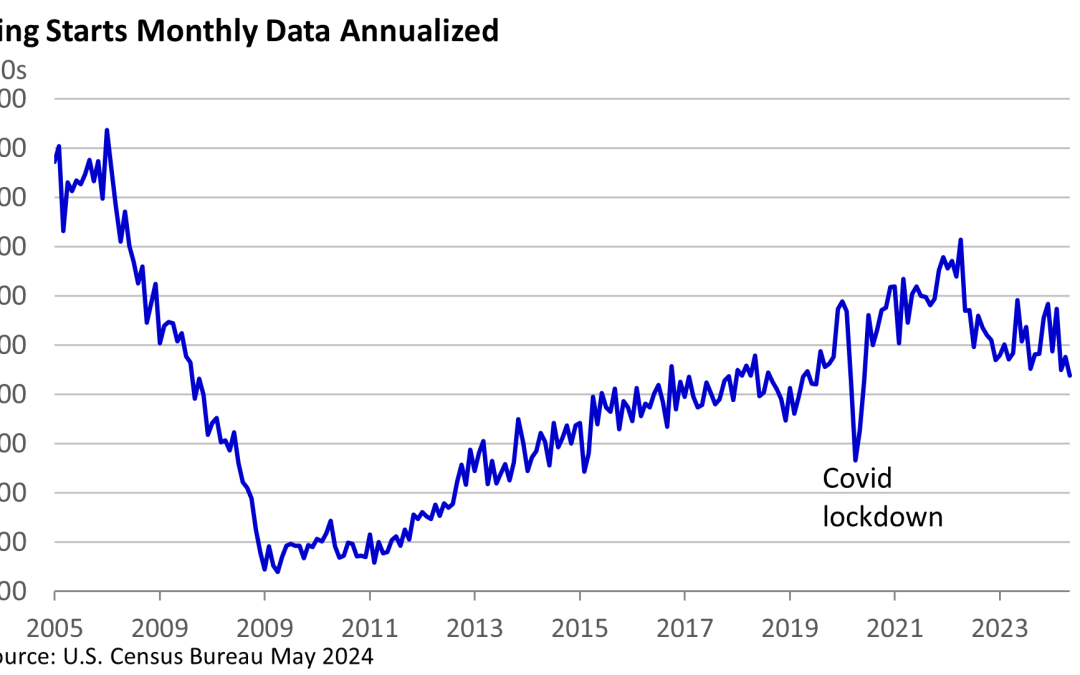

Weekly Market Commentary What happens when mortgage rates tumble below 3% and then spike above 7%? Unintended consequences are bound to play out. In hindsight, they aren’t difficult to spot. You’re a winner if you have no intention of moving and were lucky enough to...

by Mark Chandik | Jun 25, 2024

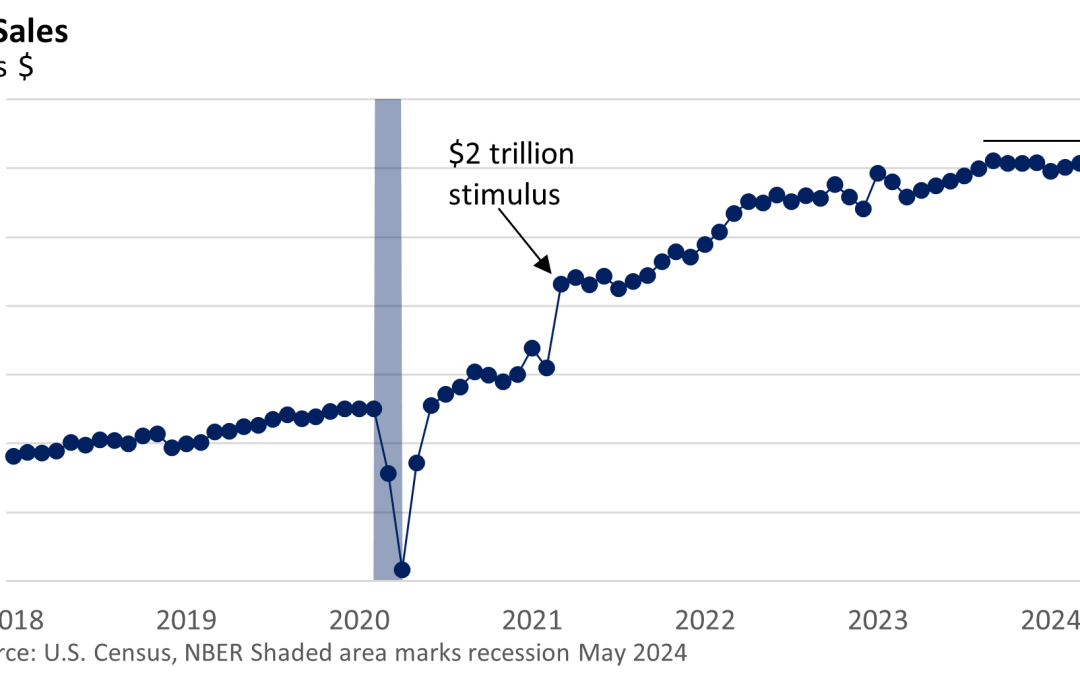

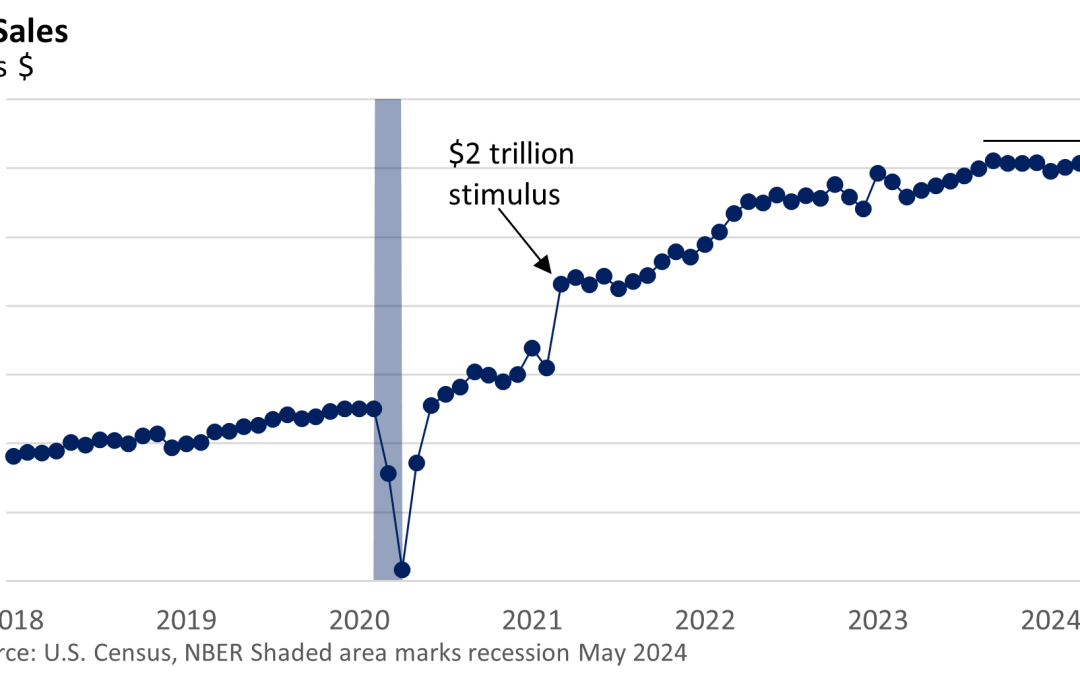

Weekly Market Commentary Much has been made of the remarkable resilience of the American economy. Forecasters who confidently called for a recession in 2023 got it wrong. So far this year, the economy is generating new jobs, and the U.S. economy has yet to falter....

by Mark Chandik | Jun 17, 2024

Weekly Market Commentary As expected, the Federal Reserve announced last Wednesday that it held its key rate, the fed funds rate, unchanged at 5.25 – 5.50%. The Fed left the door open to a cut in rates later in the year if inflation makes meaningful progress toward...