by Mark Chandik | Sep 9, 2024

Market pullbacks are to be expected. They are incorporated into the financial plan. But like an unexpected traffic jam, they are exceedingly difficult to predict. Early August was one such event. The turbulence began at the end of July in the wake of seemingly minor...

by Mark Chandik | Sep 3, 2024

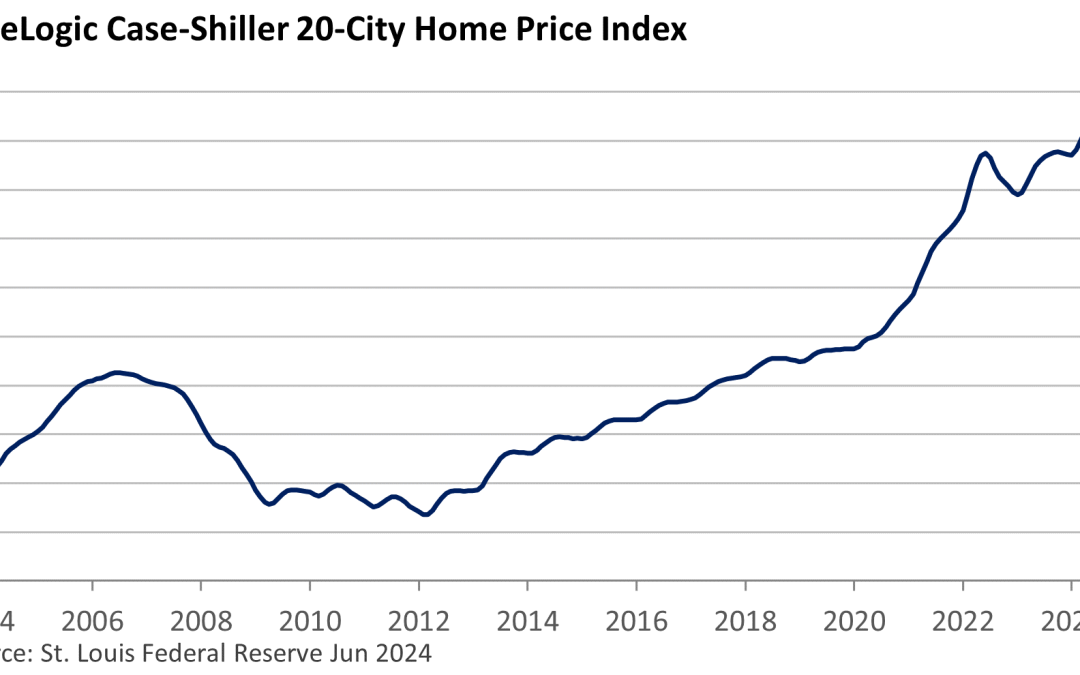

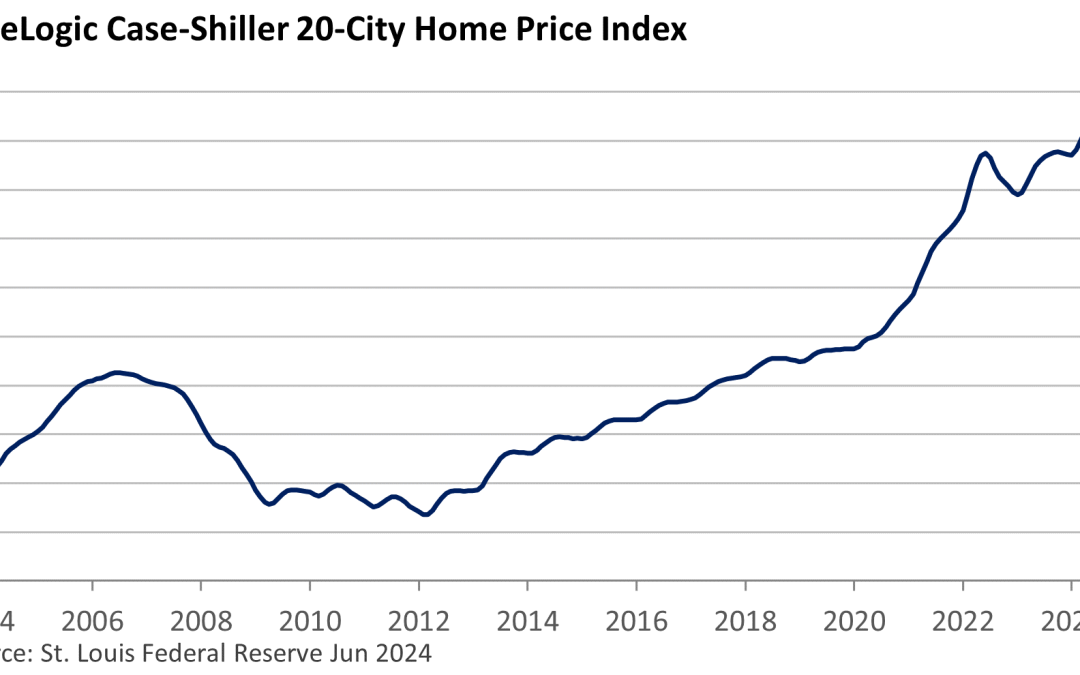

Overbuilding, speculation, and easy access to credit encouraged a housing boom and a bust in the 2000s. Sales cratered later in the decade, and along with it, prices tumbled. Today, housing sales have plummeted once again. According to the National Association of...

by Mark Chandik | Aug 26, 2024

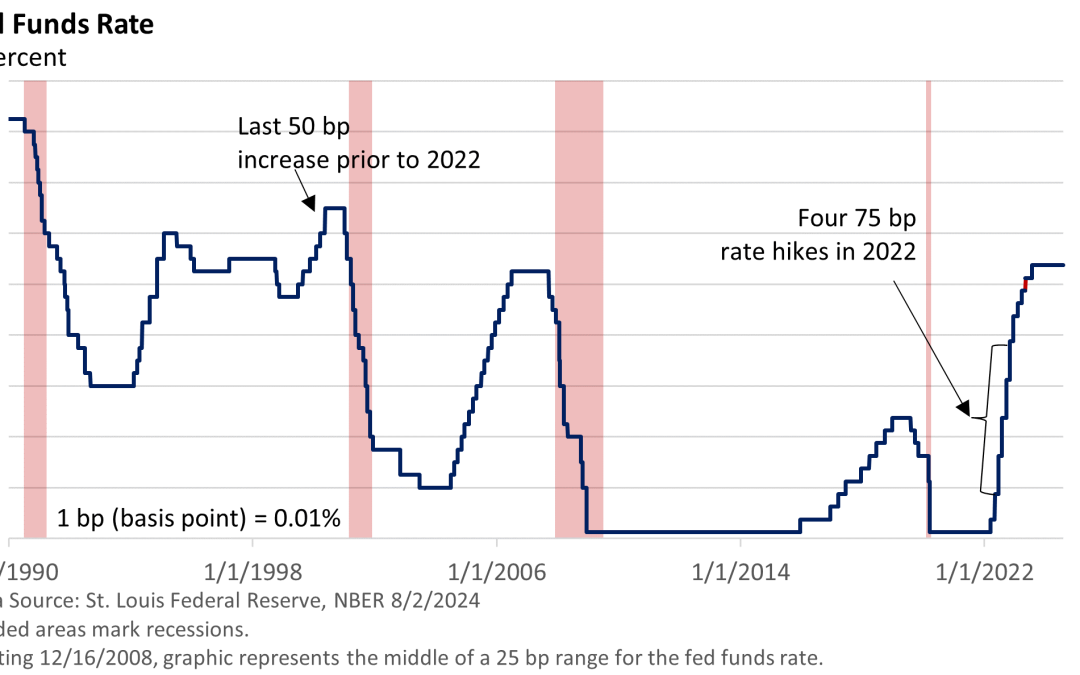

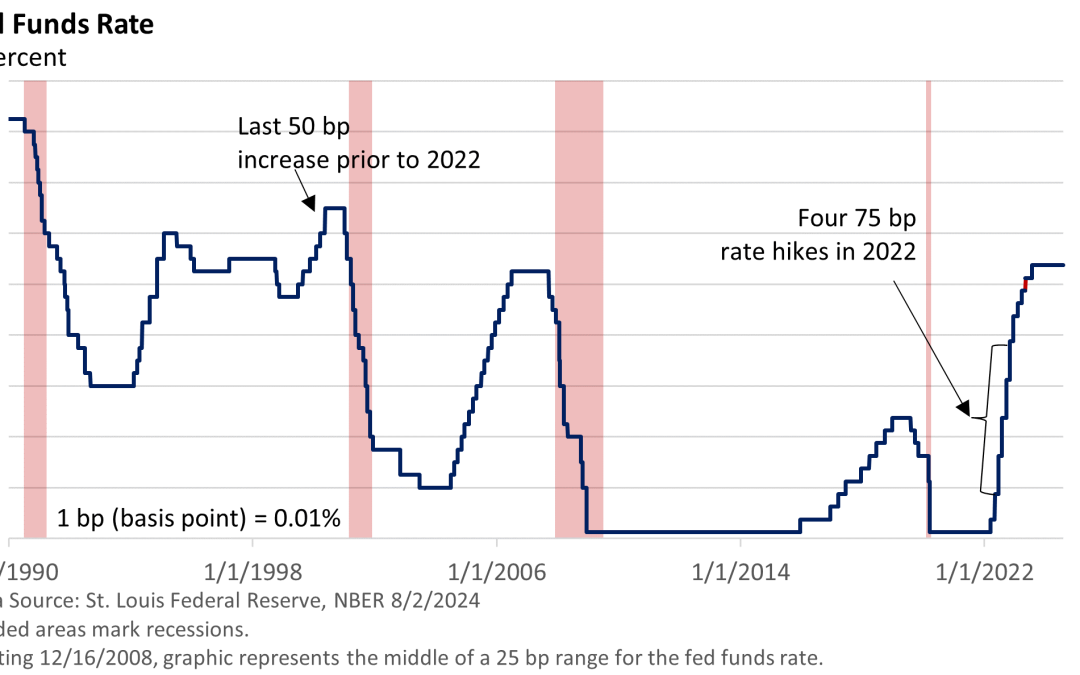

Fed Chief Powell’s much-anticipated speech against the picturesque backdrop of the Grand Tetons in Jackson Hole, WY, virtually assures that the Fed will reduce interest rates next month. In a short 16-minute speech, Powell said the magic words. “The time has come for...

by Mark Chandik | Aug 19, 2024

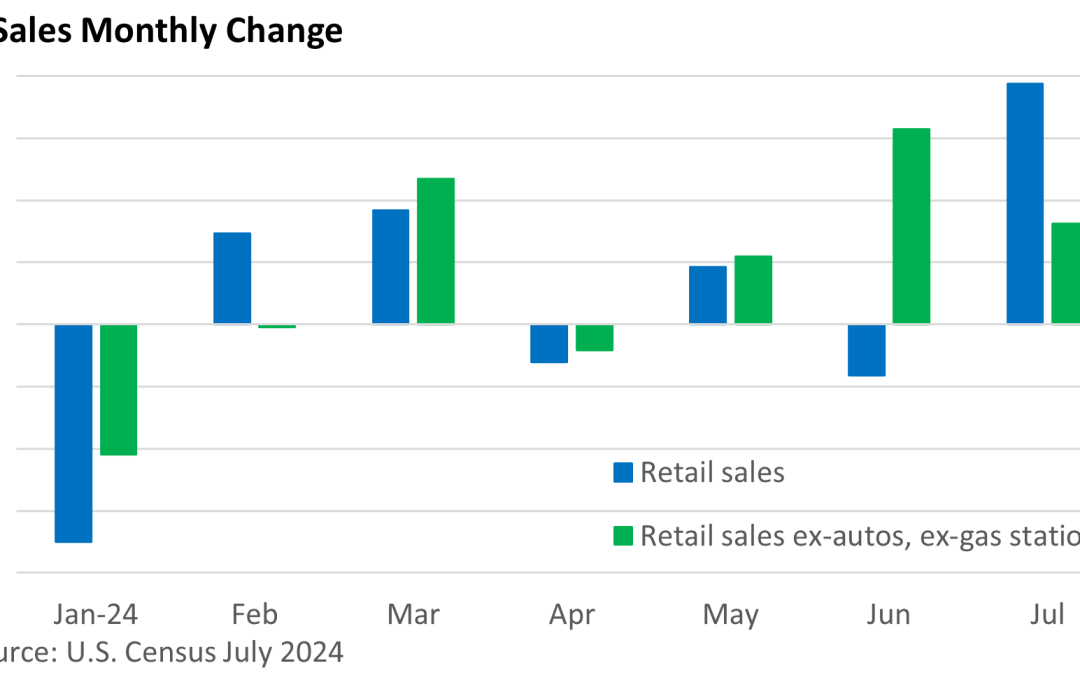

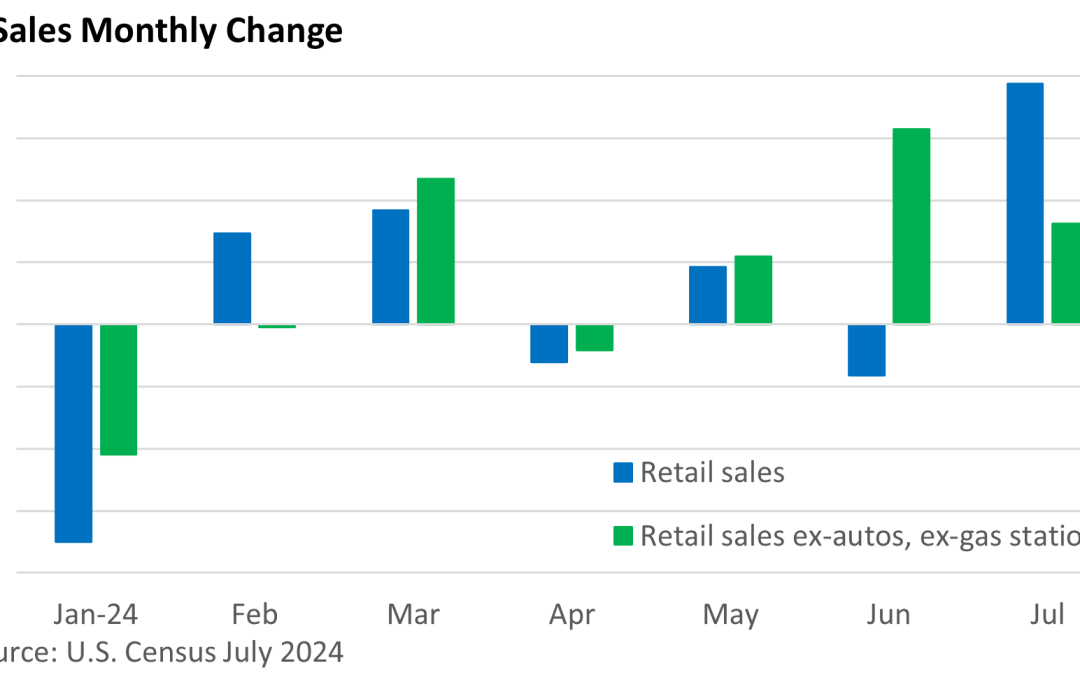

Markets settled down in Japan, and the latest economic reports in the U.S. aren’t signaling that the economy is headed for an imminent recession. These factors sparked a strong rally in U.S. stocks last week. Led by a 3.6% rise in auto sales, the U.S. Census Bureau...

by Mark Chandik | Aug 12, 2024

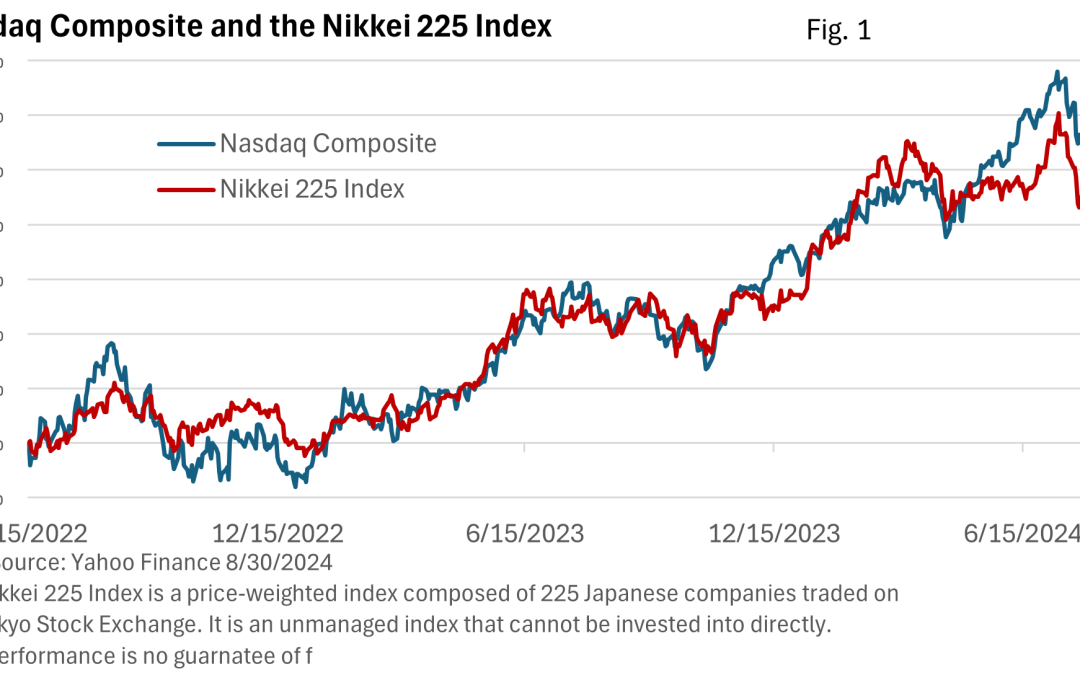

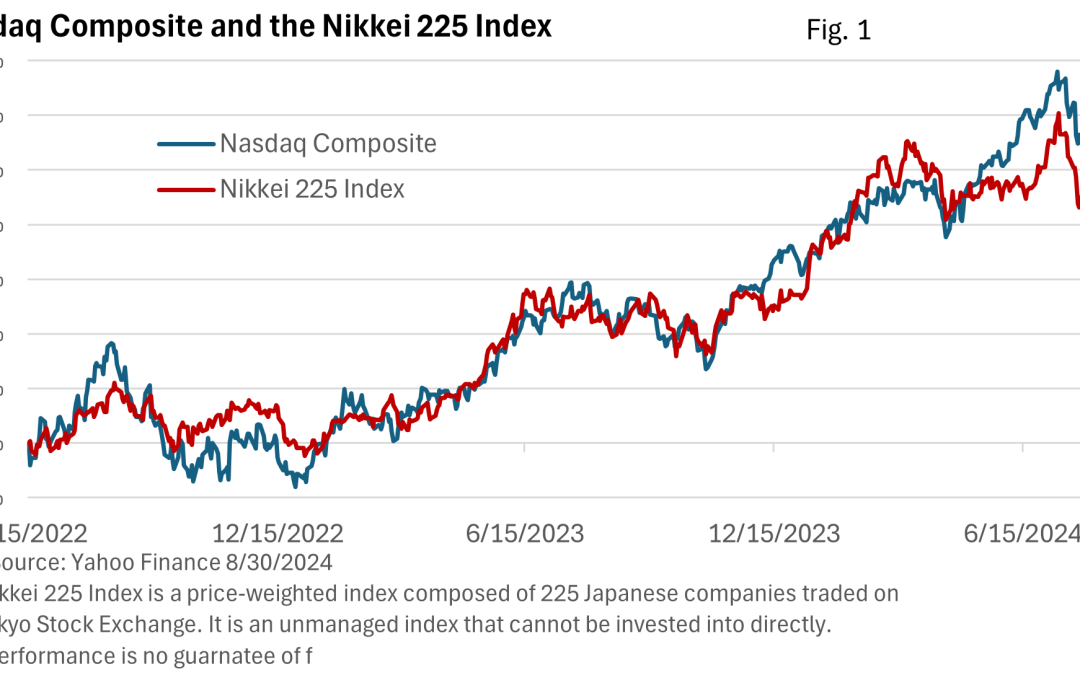

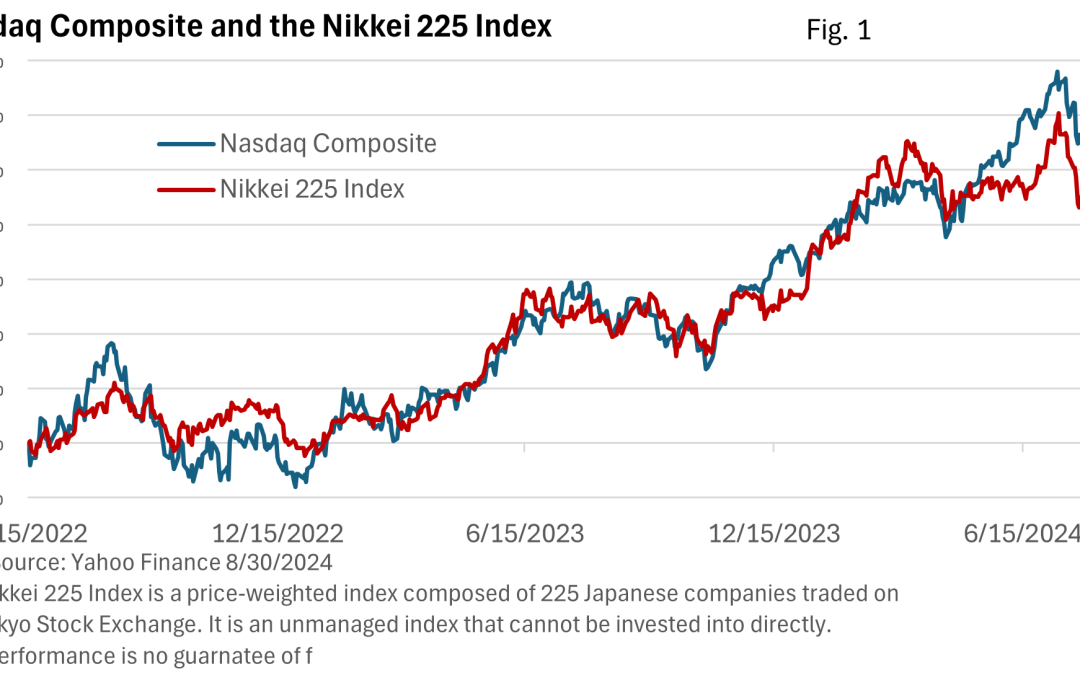

Ask the average investor what inflation or unemployment is, and they can probably give you a good working definition. Ask them about the ‘carry trade,’ and you’ll likely get a blank stare. Even the term itself isn’t intuitive. But a sudden unwinding of the carry trade...

by Mark Chandik | Aug 5, 2024

As expected, the Federal Reserve kept its key rate, the fed funds rate, unchanged at 5.25 – 5.50%. After holding the fed funds rate steady for a year, Fed Chief Jay Powell twice-mentioned that a September rate cut is on the table at his press conference. The Federal...