by Mark Chandik | Oct 20, 2025

On October 12, 2022, the S&P 500 Index hit a cyclical low. In hindsight, that marked the end of the 2022 bear market. Fast forward three years, and the current bull market has now been running for three years. Let’s compare the current run to the six longest bull...

by Mark Chandik | Oct 20, 2025

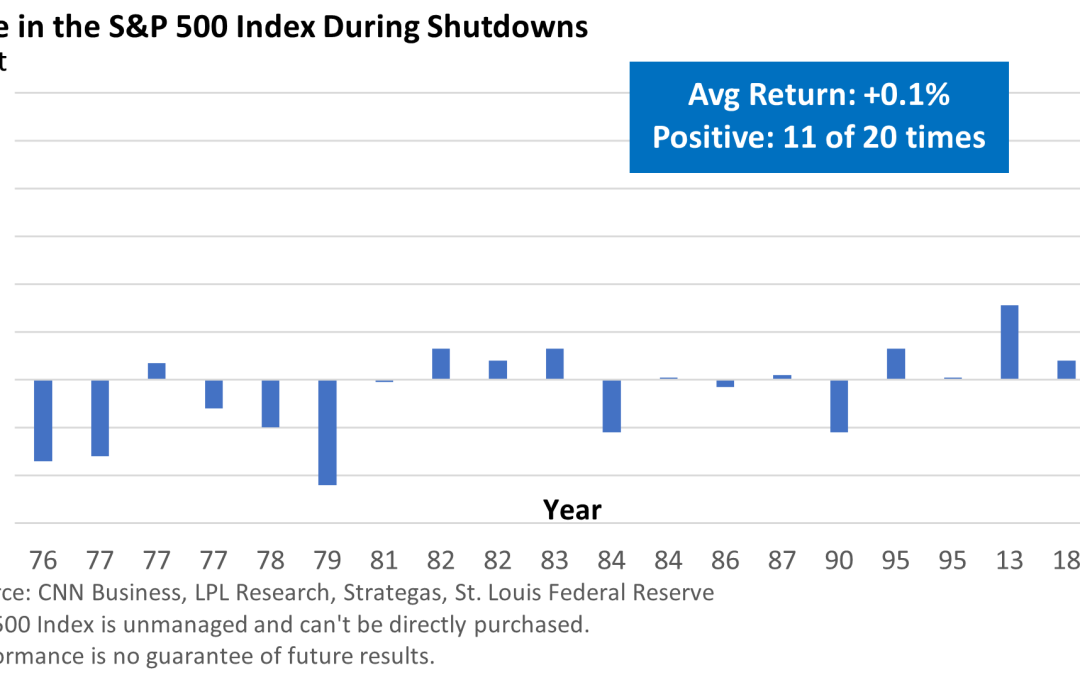

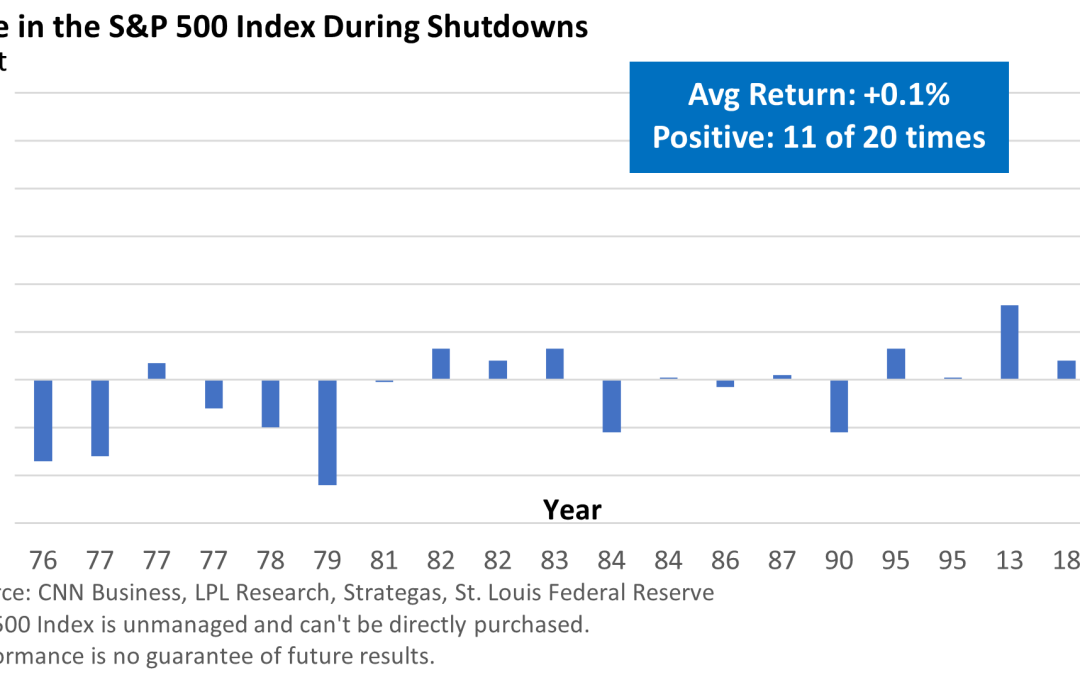

Historically, US government shutdowns have had minimal impact on the stock market. Let’s review the graphic below. Since 1976, government shutdowns of varying lengths have had little effect on stocks, as measured by the S&P 500 Index. The government closure began...

by Mark Chandik | Sep 29, 2025

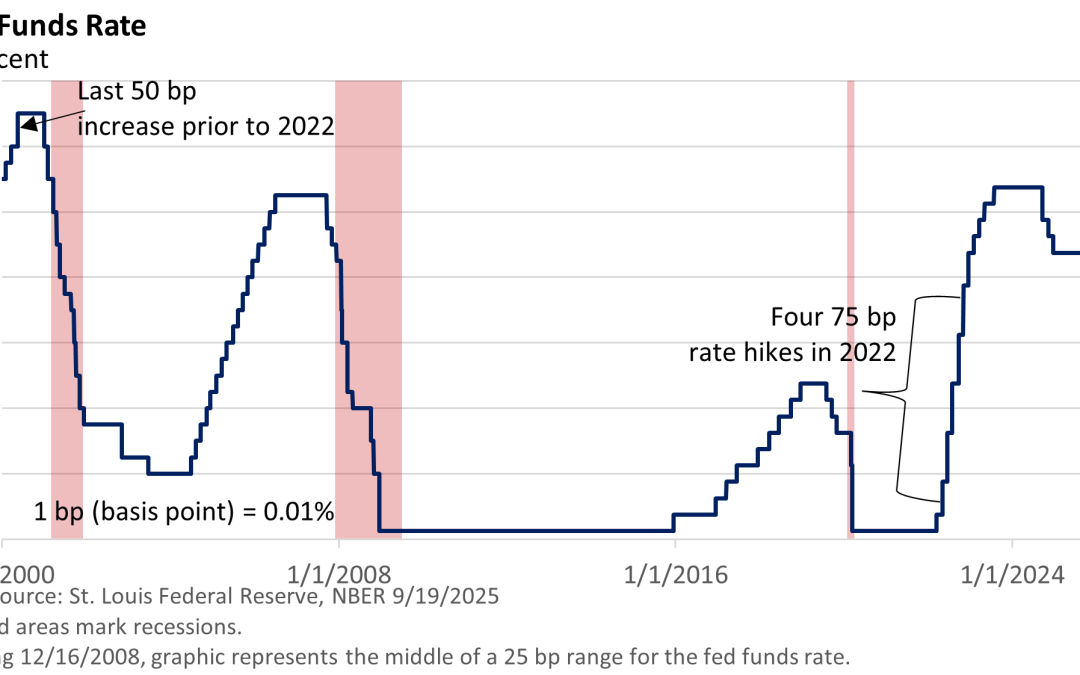

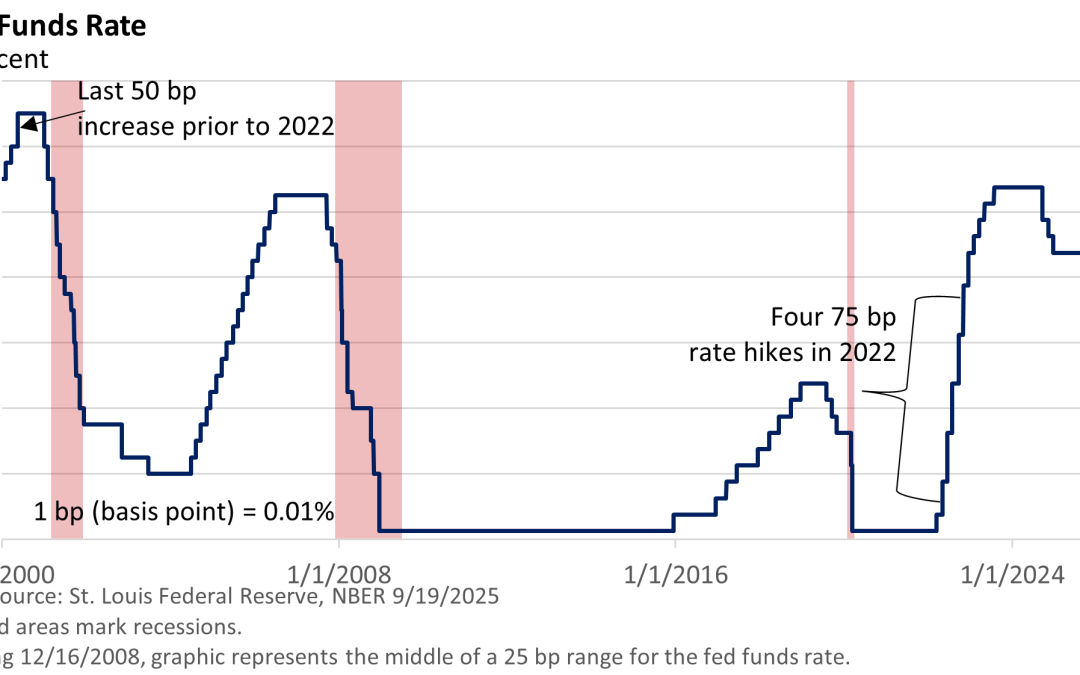

A couple of weeks ago, the Federal Reserve cut its key rate, the fed funds rate, by a quarter-percentage point to 4.00-4.25%. It’s the first rate cut since last December. So, is this one and done, or will there be a series of rate reductions? A speech delivered last...

by Mark Chandik | Sep 22, 2025

To virtually no one’s surprise, the Federal Reserve slashed the target on its key interest rate—the fed funds rate—at the conclusion of its meeting on Wednesday. The only question regarding the decision was whether the Fed would cut by a quarter point (25 basis points...

by Mark Chandik | Sep 15, 2025

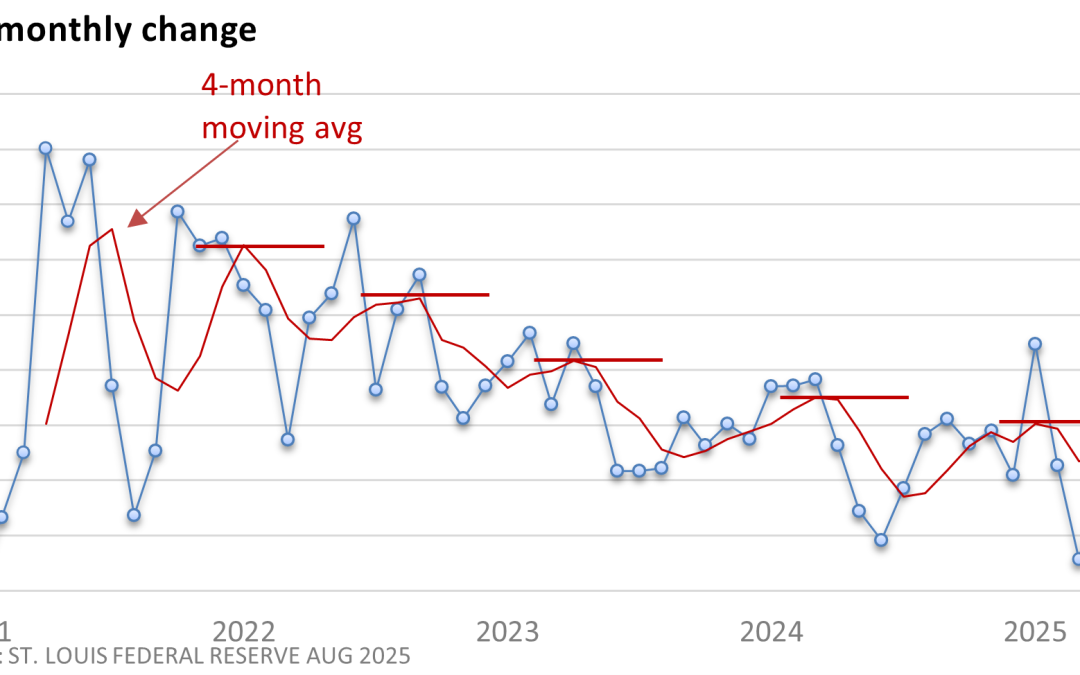

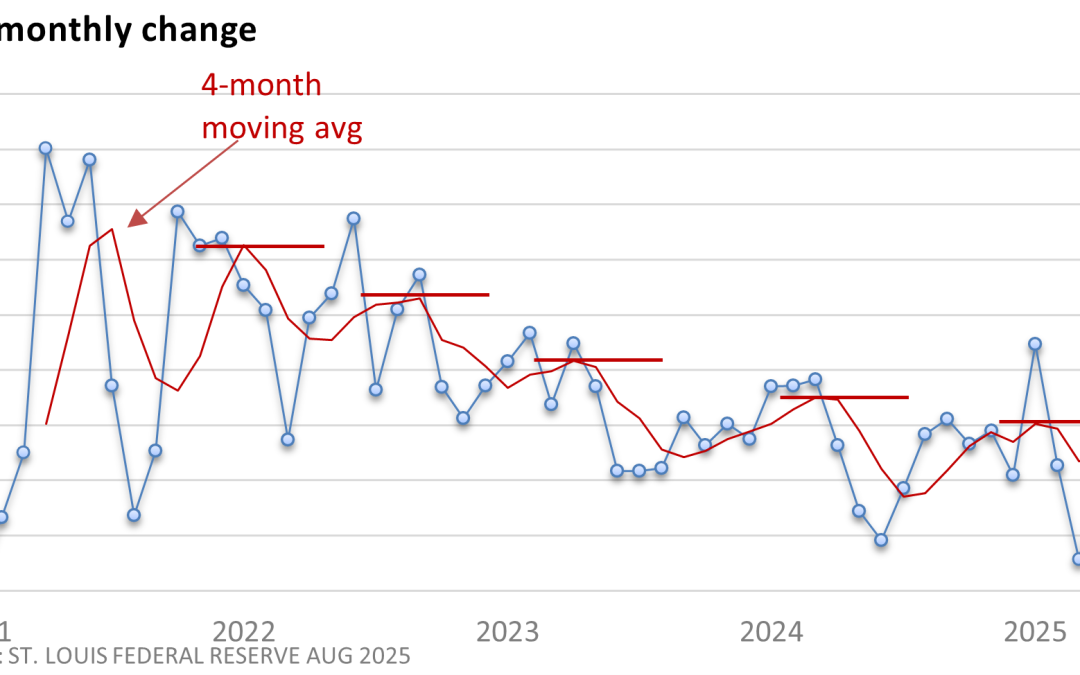

The only thing that might have been standing in the way between the Federal Reserve and a rate cut this week was last Thursday’s release of the Consumer Price Index (CPI). While the inflation figures weren’t particularly soft, August’s data didn’t reflect a sharp rise...

by Mark Chandik | Sep 8, 2025

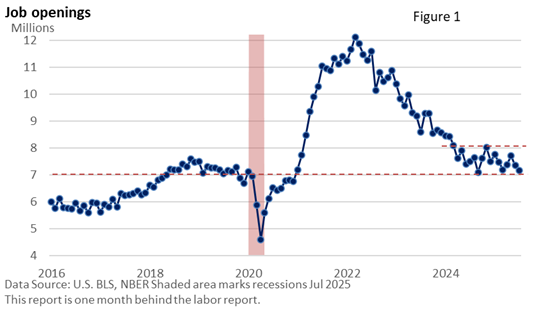

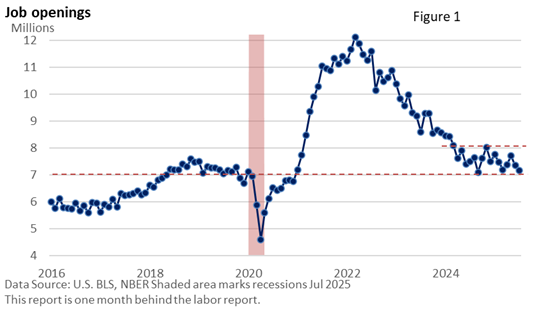

For starters, the title is a simplified five-word summary of the labor market. Recall that last week, we explored the low level of layoffs. This week, we shift the focus to hiring trends. But first, let’s take a closer look at the numbers from the latest jobs report....