by Mark Chandik | Dec 2, 2024

Our discussions have included Fed policy, the economy, and the surge in inflation since the pandemic. Why? In large part, they are all a part of the stock market pricing equation. Yet, so are corporate profits, and profits for the largest U.S.-based companies are...

by Mark Chandik | Nov 25, 2024

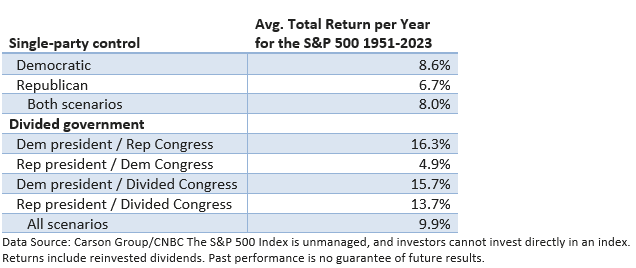

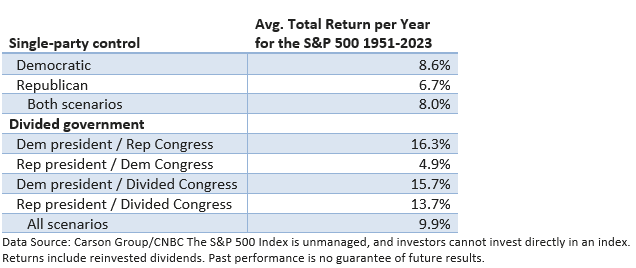

Tables and graphics such as the one below typically surface every four years. While they are interesting, they do not provide much insight, except for the idea that stocks tend to perform well regardless of who occupies the White House and Congress. As the table...

by Mark Chandik | Nov 18, 2024

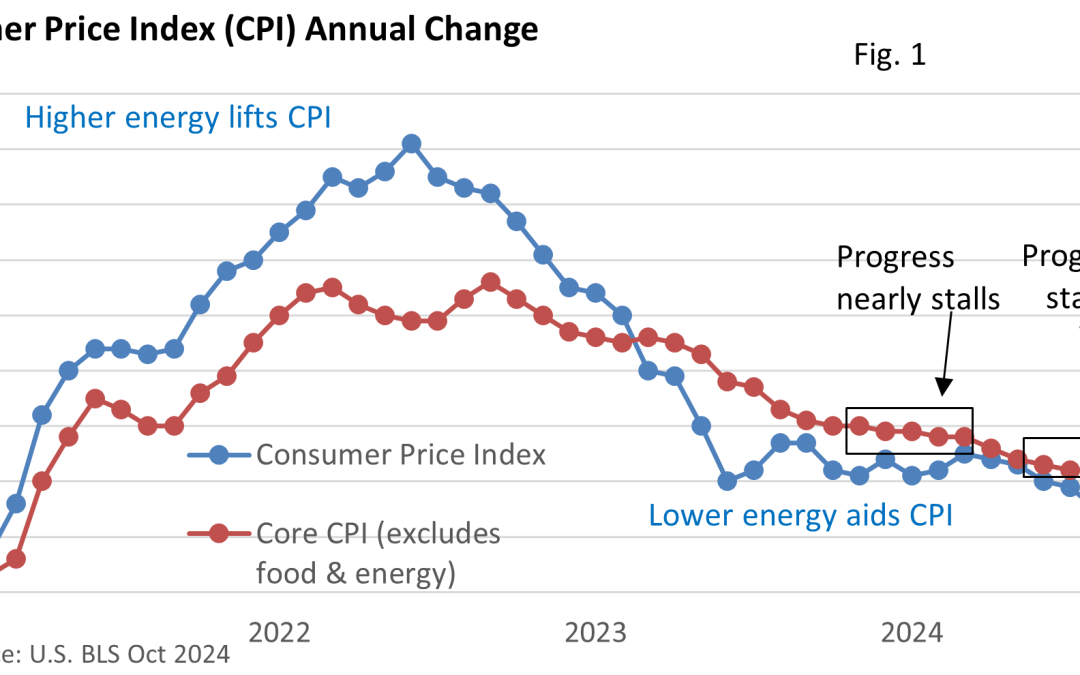

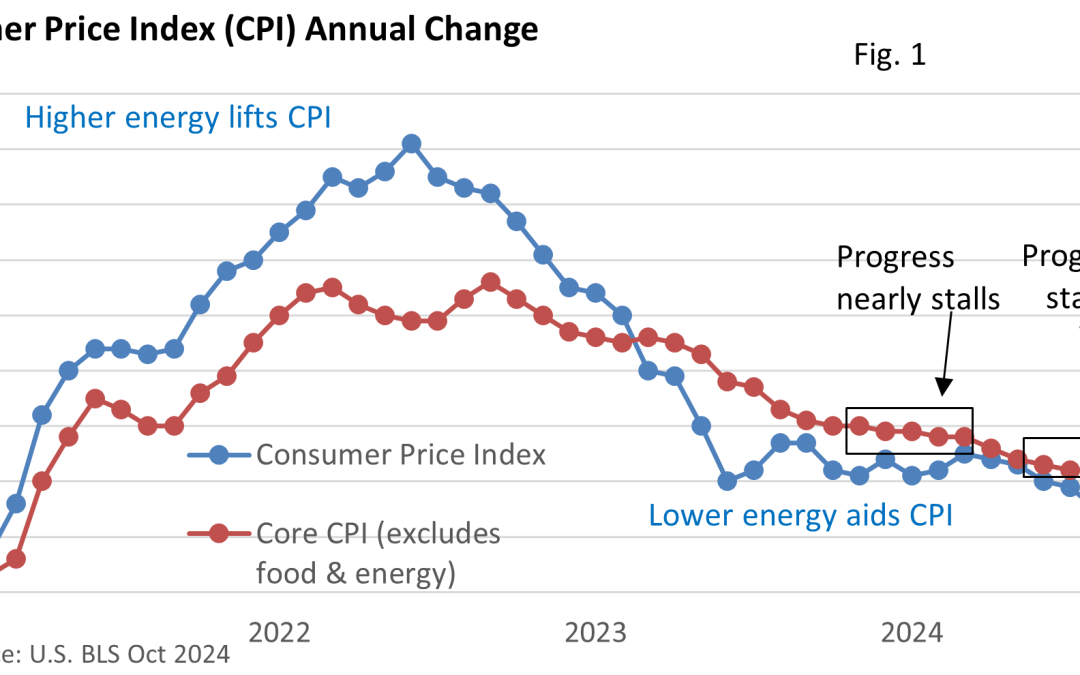

The Consumer Price Index (CPI) rose 0.2% in October, according to the U.S. Bureau of Labor Statistics. The core CPI, which excludes food and energy, rose 0.3% last month. The CPI is up 2.6% compared to one year ago, and the core CPI is up 3.3%. After reviewing the...

by Mark Chandik | Nov 11, 2024

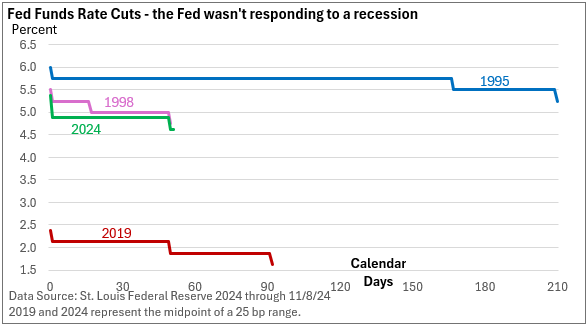

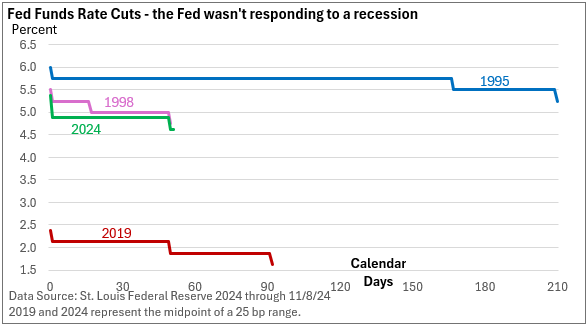

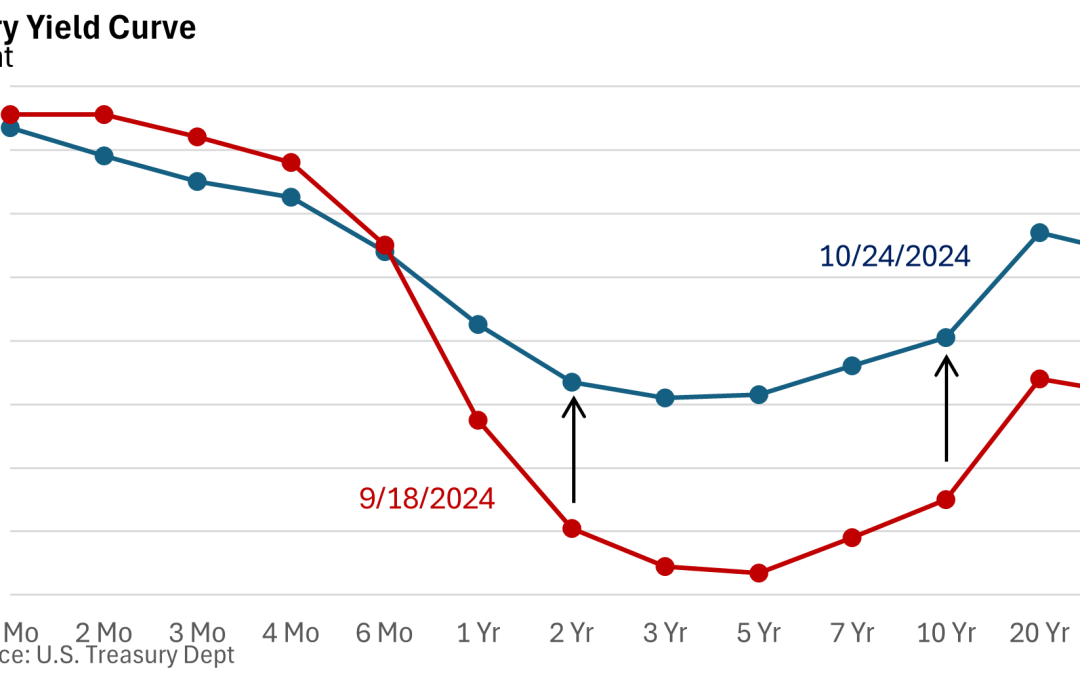

More about the asterisk in a moment, but first, let’s touch on the meat and potatoes of last week’s Federal Reserve meeting. It came as no surprise that the Fed reduced its key rate, the fed funds rate, by 25 basis points (bp, 1 bp = 0.01%) to a range of 4.50—4.75%....

by Mark Chandik | Nov 4, 2024

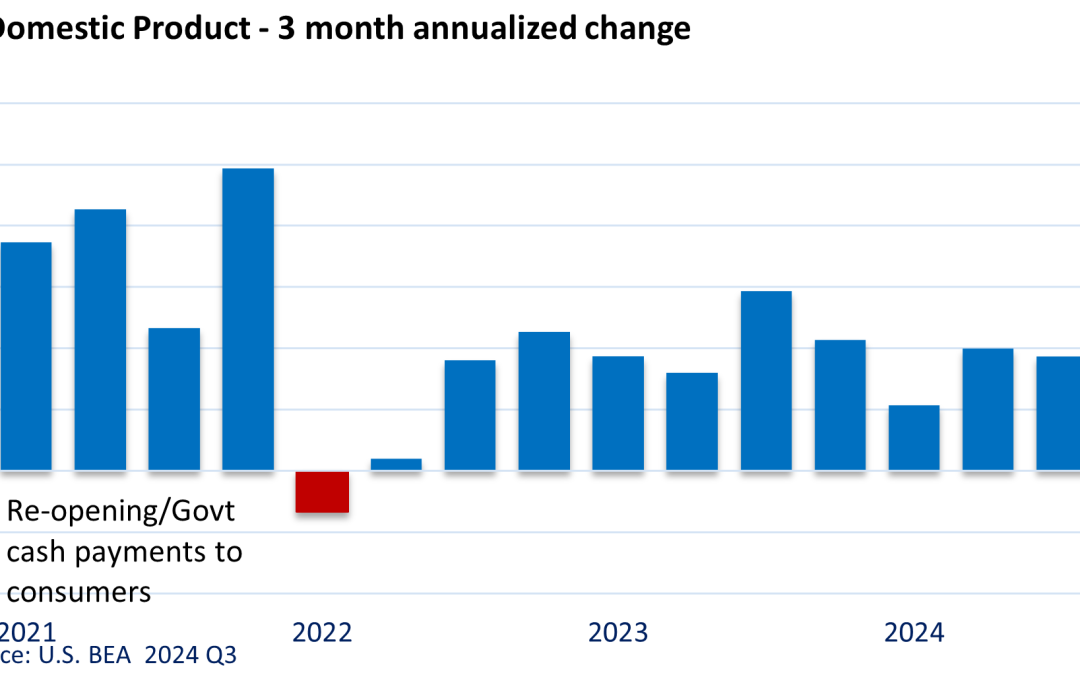

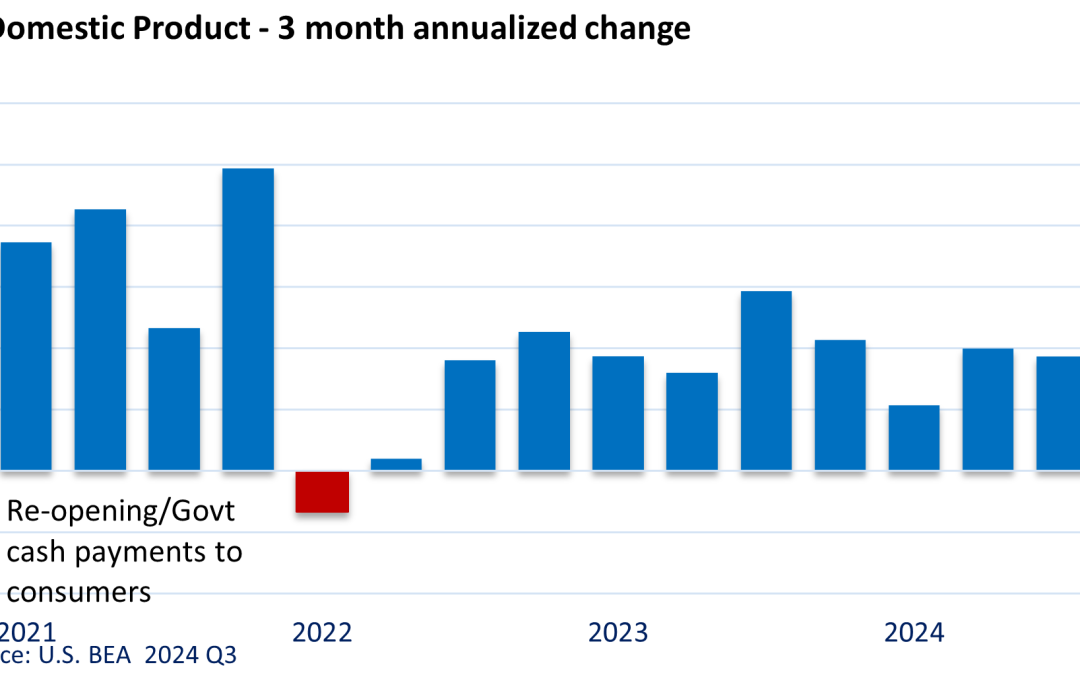

The U.S. Bureau of Economic Analysis (BEA) reported that Gross Domestic Product (GDP) expanded at an annual pace of 2.8% in Q3, which was down from 3.0% in Q2. The broadest measure of U.S. economic activity matched the final report from the Atlanta Fed’s GDPNow model...

by Mark Chandik | Oct 28, 2024

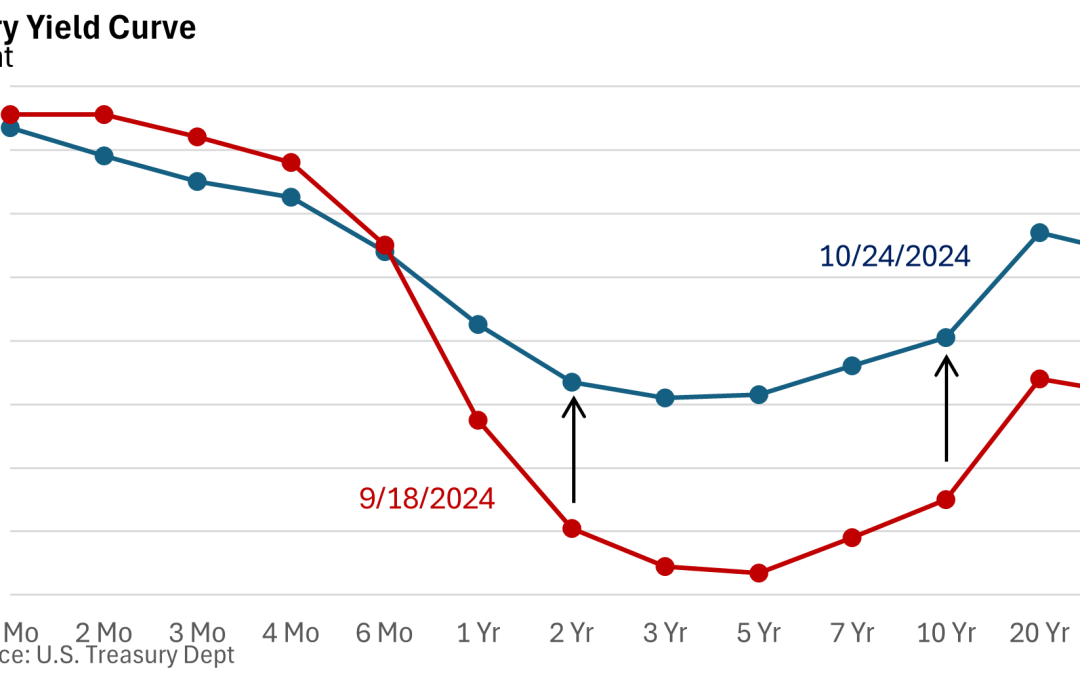

Last month, the Federal Reserve reduced its key interest rate, and the consensus suggested (and still suggests) that the Fed will cut rates two more times before the year ends. A closely watched tool from the CME Group is pricing in a quarter-point rate cut at the...