Weekly Market Commentary

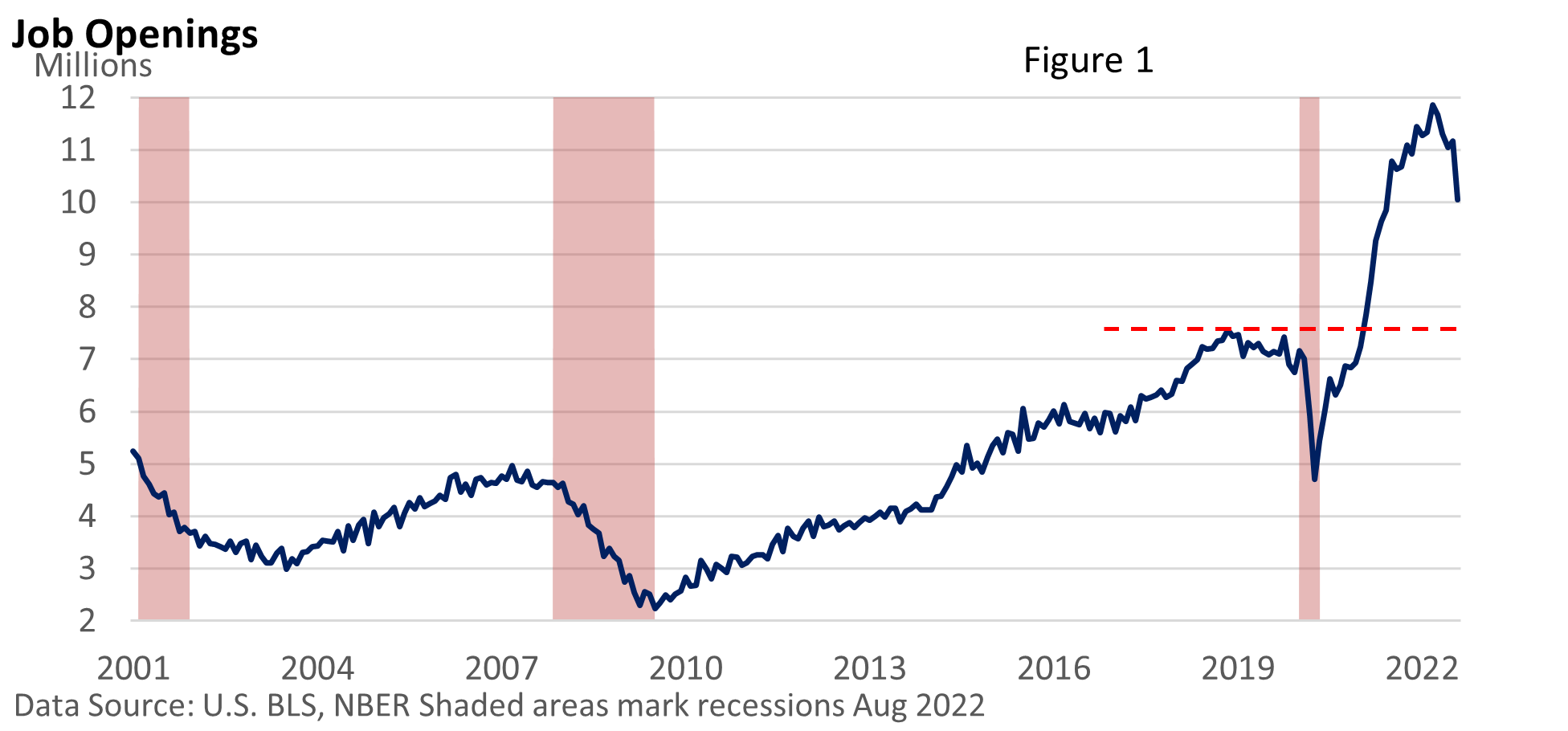

Last week, the U.S. Bureau of Labor Statistics (BLS) reported that job openings fell by 1.1 million in August to 10.1 million, the second steepest decline on record.

Job growth continues, however, as evidenced by a 263,000 increase in nonfarm payrolls in September (U.S. BLS).

Yet, openings remain quite elevated, as illustrated in Figure 1. It’s not that all workers have their pick of jobs, but many businesses have struggled to fill open positions. We see it in the never-ending stream of help wanted signs.

For workers, fewer opportunities could eventually create challenges. For investors, who have been battered by steep rate hikes, a slowdown would be welcome news, as the Federal Reserve is trying to slow the economy and rein in inflation.

As Figure 1 highlights, an expanding economy increases openings as businesses hunt for workers. Declines are typically associated with a weak economy or a recession.

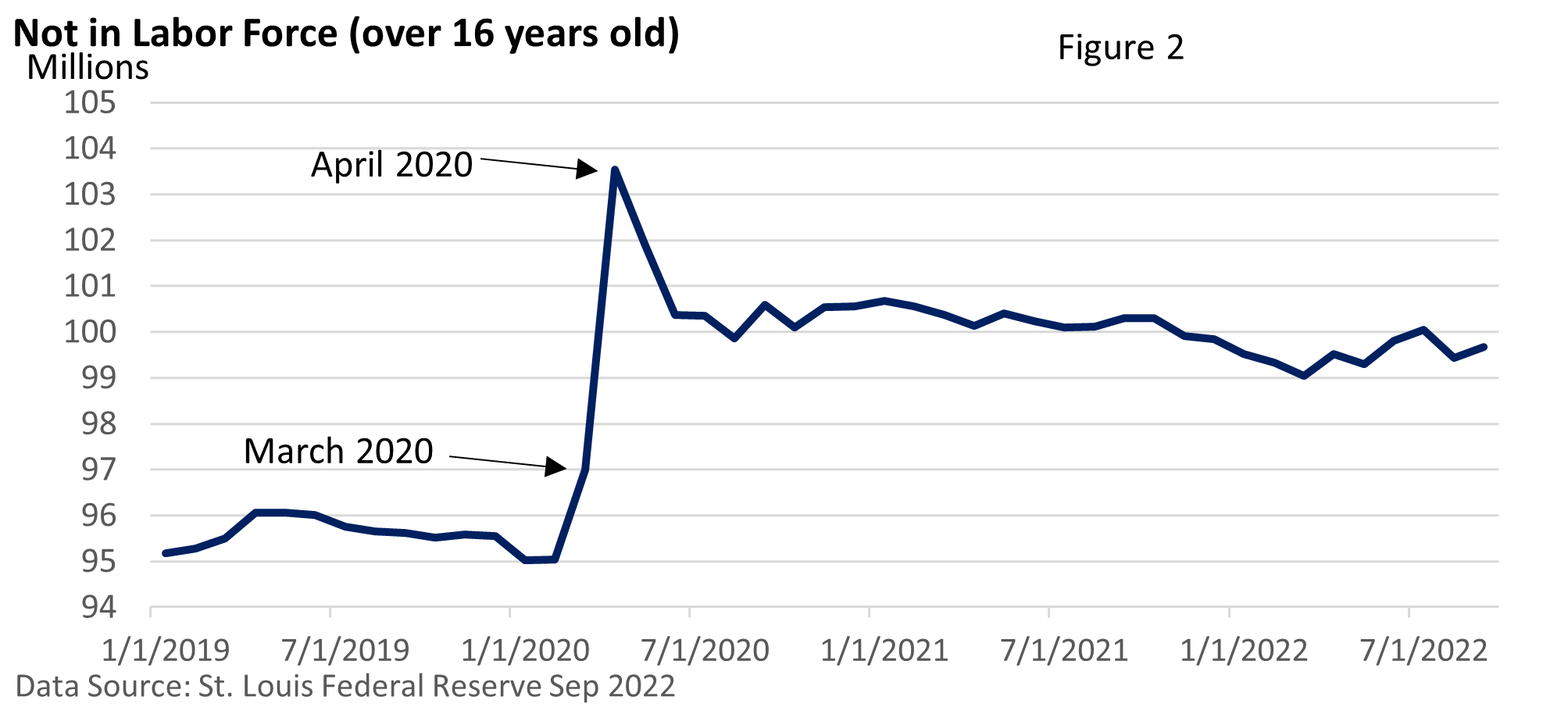

Figure 2 helps explain why so many job openings exist.

Many have tried to explain why some folks have stayed at home vs. pre-pandemic. But pinpointing the precise reason or reasons have been elusive. It is playing a role in today’s labor shortage, it puts pressure on wages, and it is has helped contribute to inflation.