Markets settled down in Japan, and the latest economic reports in the U.S. aren’t signaling that the economy is headed for an imminent recession.

These factors sparked a strong rally in U.S. stocks last week.

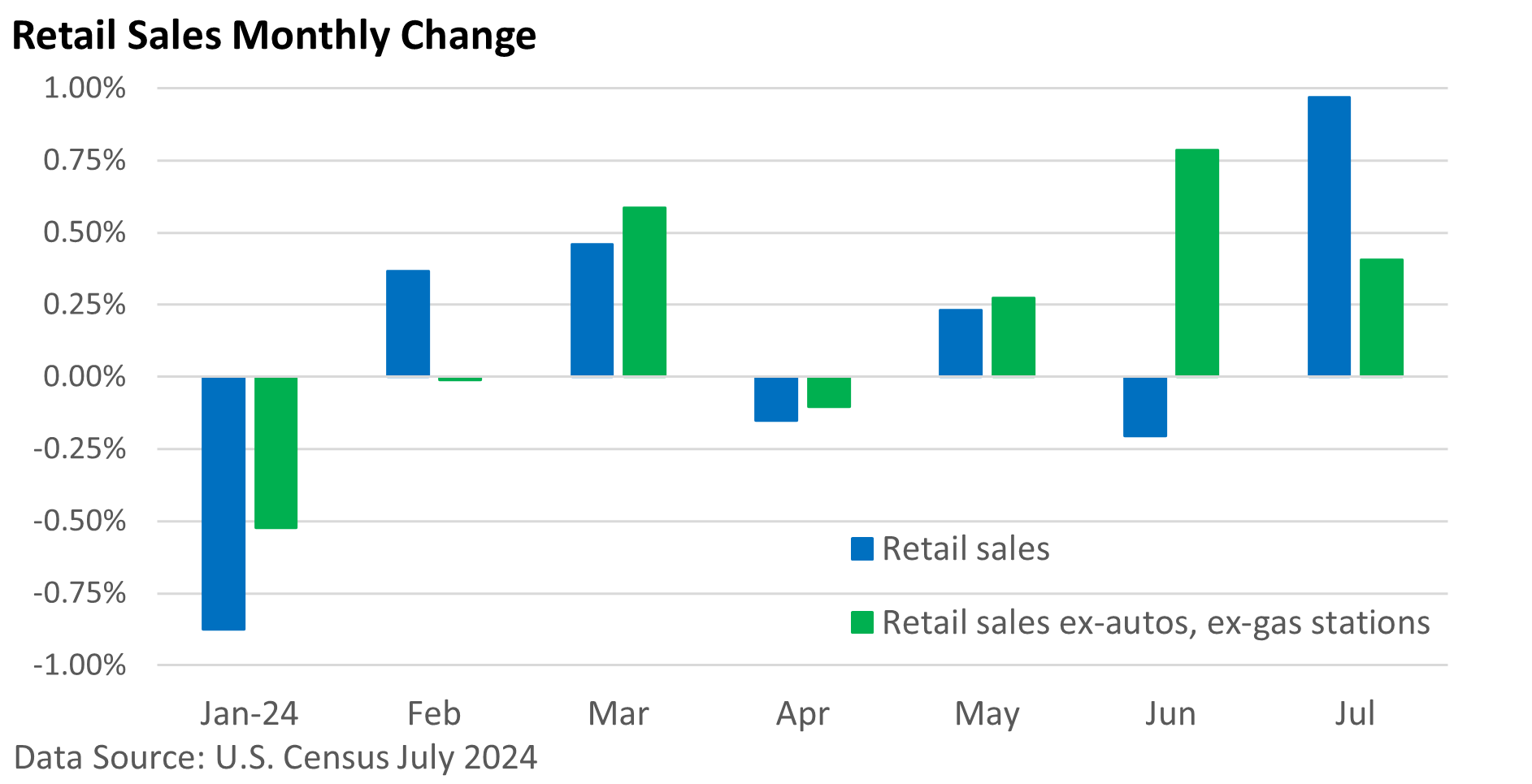

Led by a 3.6% rise in auto sales, the U.S. Census Bureau reported that retail sales jumped 1.0% in July.

The surge in car sales can be attributed to a rebound at dealerships that were held back in June by a

cyberattack that depressed sales. In June, auto sales slid 3.4%.

While July’s headline is overstating strength, the underlying current is flowing in the right direction.

The graphic below illustrates the monthly change in retail sales (blue bar), and the monthly change in retail sales excluding autos and gas stations (helps filter for changes in gas prices).

Ex-autos and ex-gas stations, the moving average over the last three months is the highest of the year.

Good cheer, however, is not being spread equally.

According to the Wall Street Journal, one large home improvement retailer warned last week that consumer weakness is affecting sales.

Yet the remark, “We have not seen any incremental fraying of consumer health,” came just two days later from the chief financial officer of the world’s largest retailer (Wall Street Journal).

The economy isn’t creating the massive number of jobs we saw a couple of years ago (nor was that sustainable).

And, as the Wall Street Journal pointed out last week, “Suddenly, hourly workers aren’t so hard to find.” But the economy is slowly grinding higher.