Weekly Market Commentary

Gross Domestic Product (GDP) is defined by Investopedia as “the total market value of all the finished goods and services… in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.”

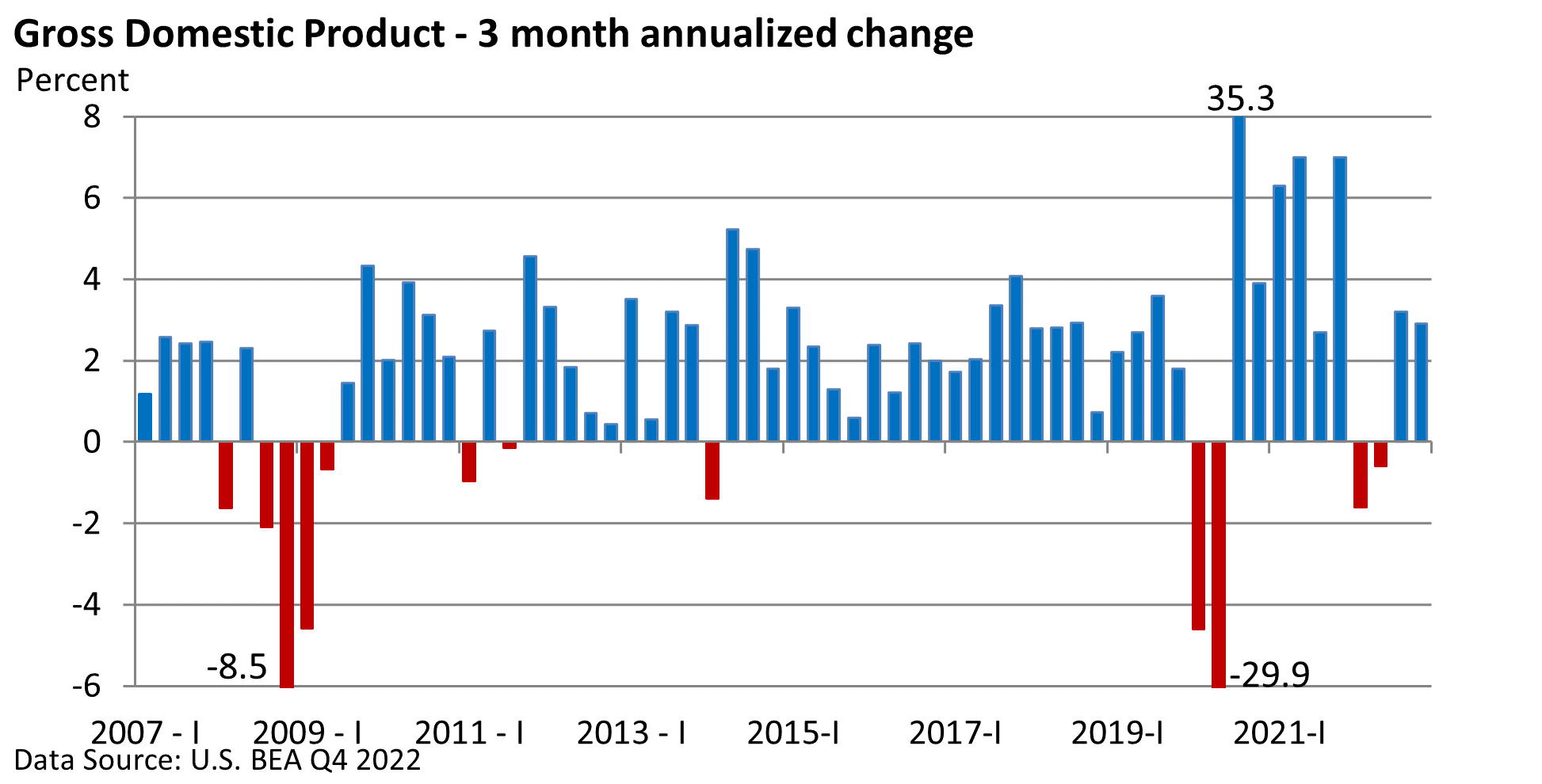

It is a very broad measure of economic activity, but it is also a look in the rearview mirror. In this case, GDP covers activity from October—December. We are about to enter February.

In Q4, GDP expanded at a respectable 2.9% annualized rate, according to the U.S. Bureau of Economic Analysis (BEA). It was down slightly from Q3’s 3.2% growth rate.

The good news: the economy continued to expand. But a quick peak under the hood reveals a more problematic scenario.

About half the increase came from a rapid rise in inventories, i.e., unsold goods (a rise or fall in inventories aids or detracts from GDP). Roughly 25% came from a big jump in government spending (a rise or fall in government spending is part of the GDP calculation).

What was positive? Consumer spending was a large part of GDP’s rise.

Uncertainty is the word of the day. According to a broad report released by the Federal Reserve, manufacturing has weakened over the last three months, and leading economic indicators continue to paint a bleak picture, according to the Conference Board.

However, the labor market remains tight, at least in most sectors. Notably, first-time claims for unemployment insurance from recently laid-off workers are near a cyclical low (Dept of Labor).

While recent reports are signaling weak growth in the first quarter, most investors do not believe a recession has begun.

So, investors are in a wait-and-see mode.

The Fed appears set to slow its rapid pace of rate increases. A closely watched gauge from the CME Group is suggesting a 25 bp rise in the fed funds rate this week (1 bp = 0.01%). That has supported equities, as it has been an upbeat start to 2023.