Weekly Market Commentary

There have been no flareups since the bank failures in early March, and the crisis continues to simmer on the back burner. But anxieties haven’t completely subsided.

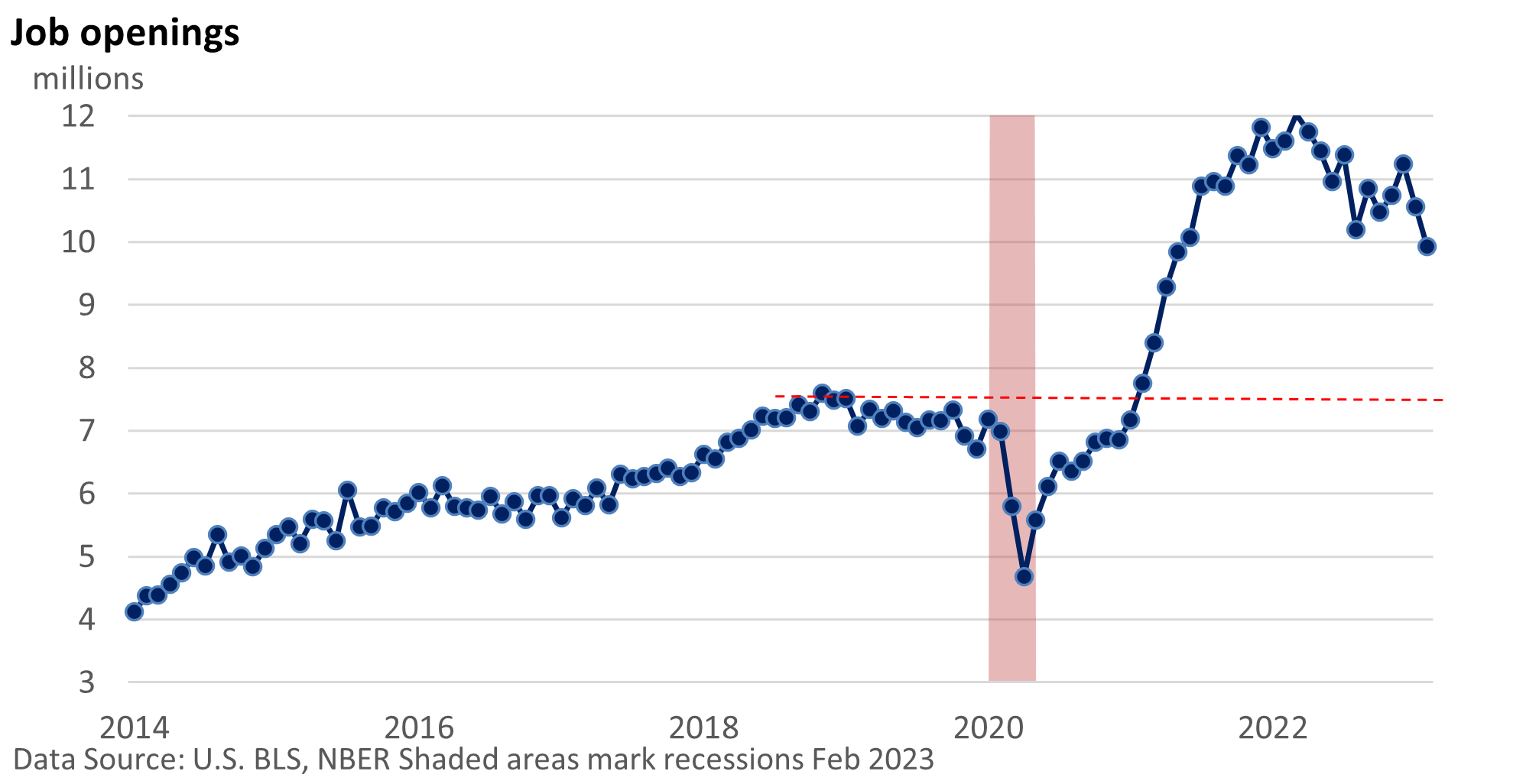

Last week the U.S. Bureau of Labor Statistics reported that job openings fell 632,000 in February to 9.93 million. That’s on top of a downwardly revised 670,000 in January.

Openings remain historically high, though they have been moving lower. This is Fed-friendly because the Fed wants to slow inflation by bringing the demand for labor back in line with the supply of labor.

However, its tools are blunt and can’t be targeted toward specific industries.

While there are plenty of companies begging for workers, there is a mismatch in skills. Openings remain very high for restaurants and other lower-paying service jobs, while tech and other large firms are being much more selective.

Deciphering the data

The recent revisions in job openings also highlight the problems we sometimes see with the data. Distortions in spending created by the pandemic aren’t yet fully understood or incorporated into models.

Data are seasonally adjusted so we can compare weekly, monthly, and quarterly reports as if they are apple-to-apple comparisons.

For example, spending typically jumps in November and December and falls sharply in January. That’s before the data are adjusted for seasonal variations.

However, the pandemic forced a shift in patterns. Holiday spending has spilled into October. That means actual spending doesn’t go up as much in December as it did in the past. So, spending in December fell last year after seasonal adjustments.

Continuing, actual spending doesn’t fall as much in January. Coupled with milder weather in much of the country, spending with seasonal adjustments surged in January per Census data.

What does it mean? As we entered 2023, the economy wasn’t as robust as some of the earlier reports suggested, and recent data are signaling a slowdown, including the labor market.