Weekly Market Commentary

The Federal Reserve surprised virtually no one when Fed officials unanimously voted to keep the fed funds rate unchanged at 5.25 – 5.50% on Wednesday.

While it is the second time the Fed has punted on a rate hike this year (the last time was June), official Federal Reserve Economic Projections (released quarterly and updated last week) still suggest we may get one more increase this year, possibly in early November or in December.

The Fed also upgraded its assessment of the economy, noting in its press release that the economy is expanding at a “solid pace,” up from “moderate” in July.

Fed Chief Jerome Powell mentioned the Fed’s 2 percent annual inflation goal eight times in his opening statement that preceded the Q&A at the press conference.

So, if inflation is still well above the 2 percent target, AND Powell emphasized that the Fed is fully committed to getting inflation back to 2 percent, AND economic growth has recently accelerated, why did the Fed forgo a rate increase?

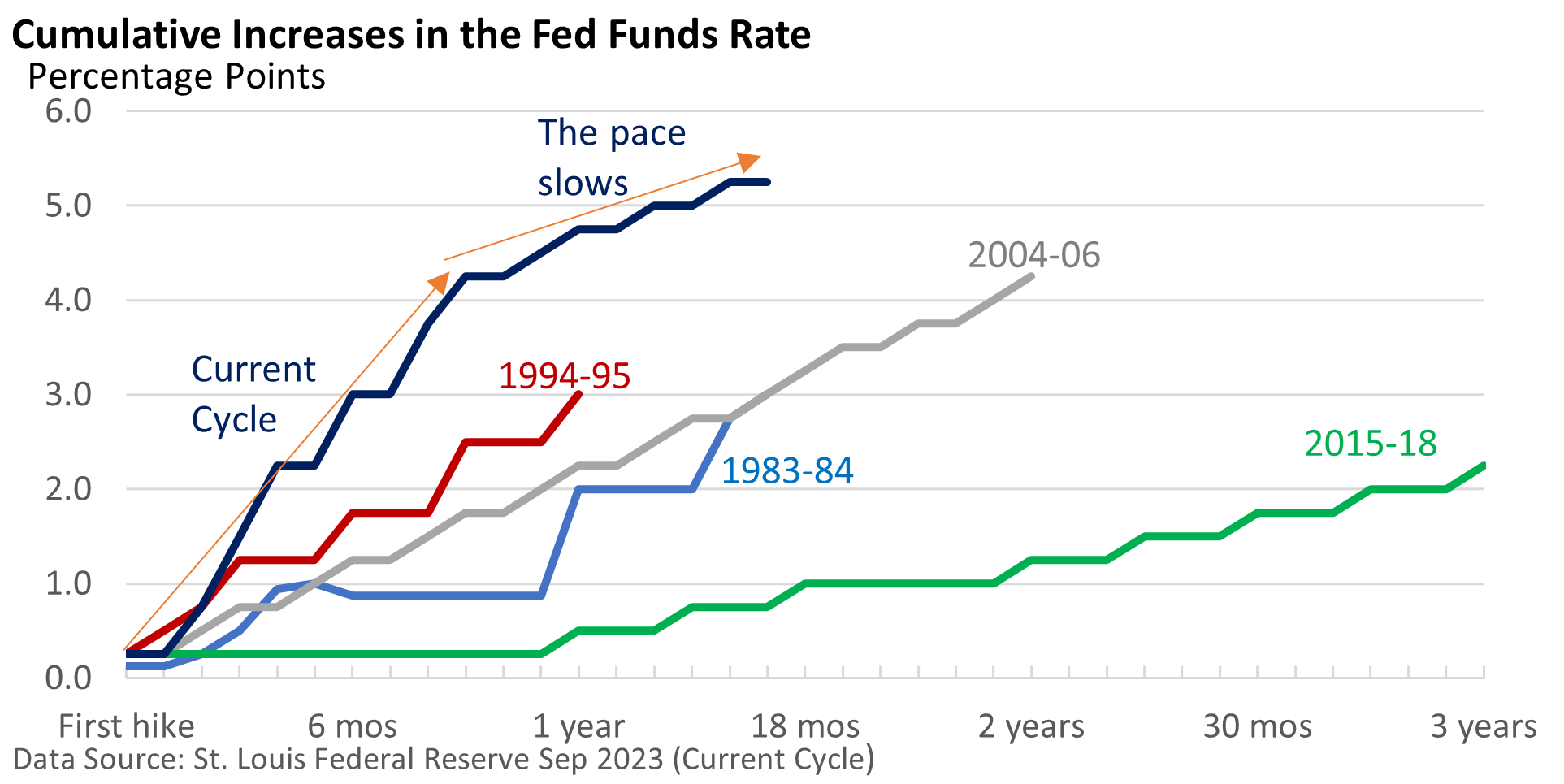

Since the start of the current cycle of rate hikes, they quickly covered a lot of ground. And there is a concern that too many increases might needlessly tip the economy into a recession.

Though the Fed always denies that politics plays a role in formulating policy, cynics might suggest that next year’s election is also creating a more cautious mood among policymakers.

As the graphic illustrates, this is the most aggressive series of rate hikes in over 40 years. Why aren’t we already in a recession, as many forecasters had projected early in the year?

Maybe rates haven’t been high enough for long enough. Or consumers and businesses were in a much stronger position than was fully understood. Or maybe there are other factors in play.

When asked about ever-changing Fed economic forecasts, Powell was blunt. “Forecasting is very difficult. Forecasters are a humble lot with much to be humble about.”

The Fed reminded the public that it still expects one more rate increase this year, and it reduced the projected size of rate cuts in 2024 from a full percentage point to a half-percentage point.

Bottom line: investors have continually underestimated the Fed’s commitment to maintaining higher interest rates. It’s why “higher for longer” is now a part of the vocabulary for investors.