Weekly Market Commentary

“The unfortunate cost of reducing inflation” could bring “some pain to households and businesses,” Fed Chief Jay Powell remarked in August. Pain is rarely distributed evenly. Some folks go unscathed, while others bear the brunt of the discomfort.

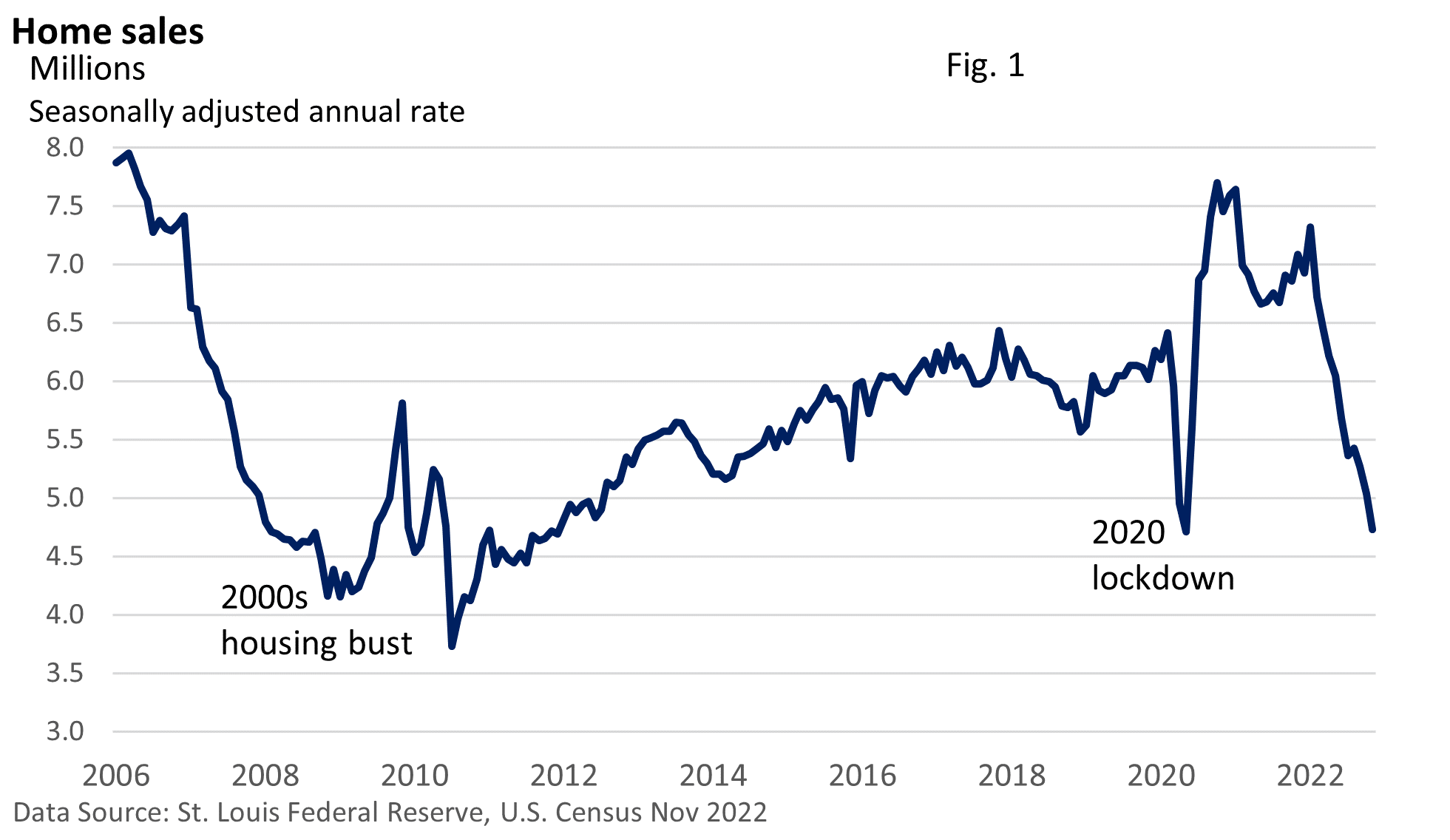

Look no further than housing. Sales are down an astounding 35% since January, according to data from the St. Louis Federal Reserve and the U.S. Census Bureau.

A year ago, many sellers simply placed a for sale sign in their front yard and sifted through multiple offers. Clearly, that’s no longer the case.

As Figure 1 illustrates, the decline in sales has been unusually swift. Look no further than the substantial run-up in prices last year followed by a surge in mortgage rates this year.

For buyers, it has been a double whammy.

The 30-year fixed mortgage rate peaked in early November at an average of 7.08%, a 20-year high and more than double the 3.11% as of December 30, 2021, according to Freddie Mac’s weekly survey.

As of December 22, the benchmark 30-year rate dipped to 6.22%. According to a leading real estate trade group, that has pushed down the average monthly payment by almost $200.

Despite the sharp decline in sales, the number of homes for sale remains contrained, which has helped cushion the dip in prices.

Distressed sales remain subdued, in part due to a low unemployment rate and much more realistic lending standards, which were absent in the 2000s.