Weekly Market Commentary

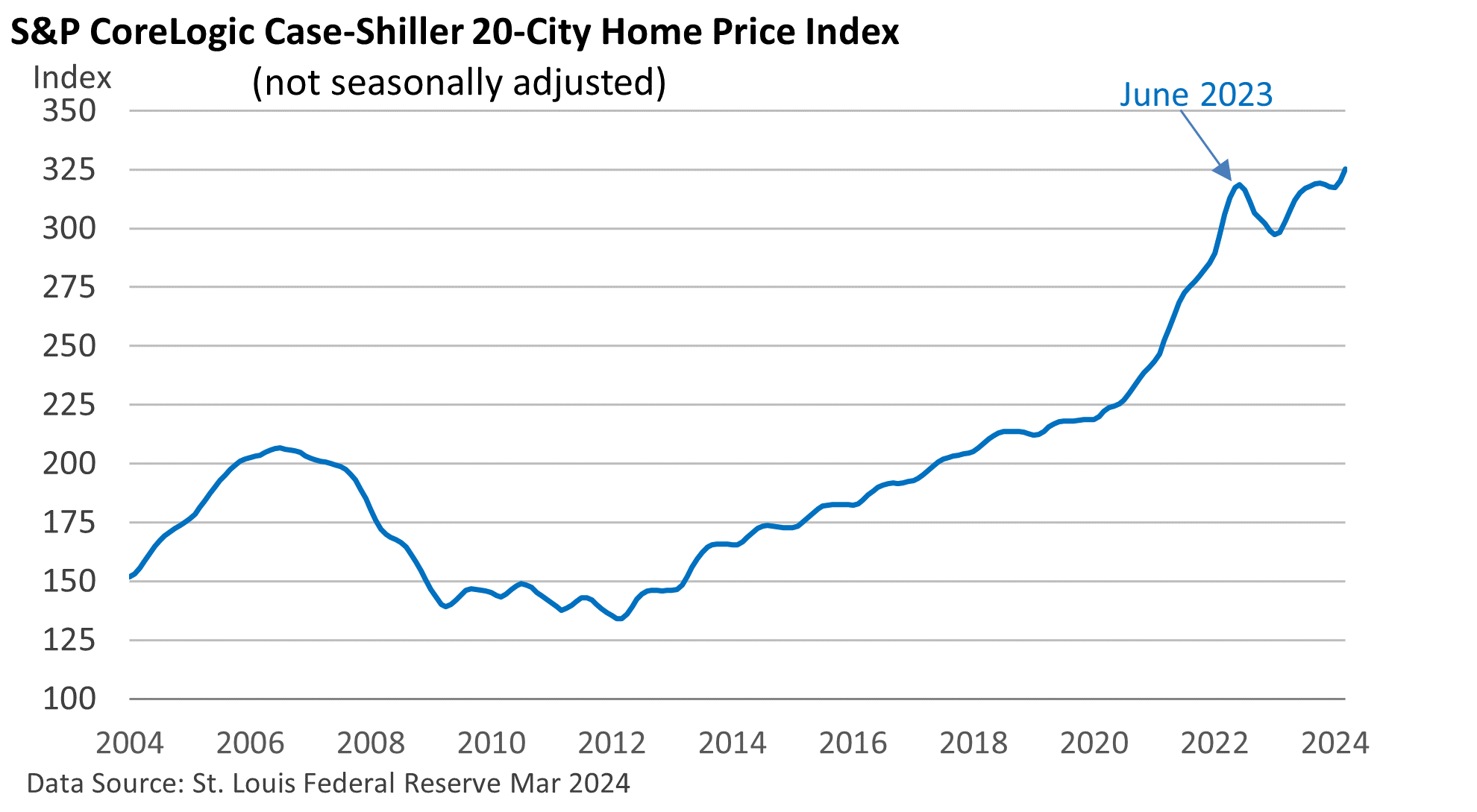

The price of a home hit a new record, according to the latest data on housing prices.

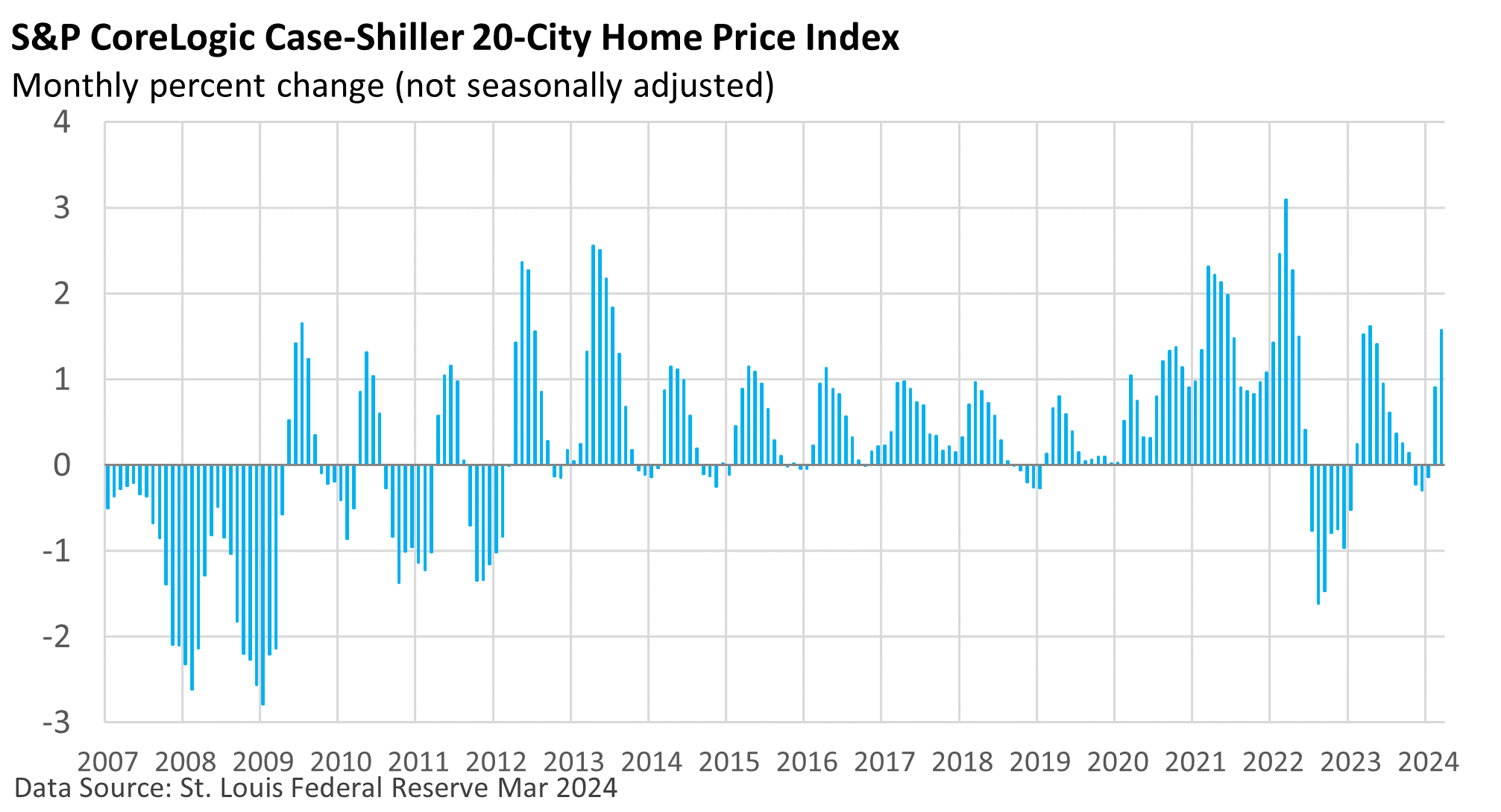

The S&P CoreLogic Case-Shiller 20-City Home Price Index, which measures monthly housing prices in 20 major metropolitan areas, rose 1.6% on a nonseasonally adjusted basis in March.

Notably, there is a distinct seasonal pattern. Price increases tend to be strongest in the spring and early summer and mildest late in the year and early in the new year.

Why is that? Buyers typically hibernate in late fall as they prepare for the holidays. They are out in full force in spring and summer.

We’ve been hearing plenty of chatter about high mortgage rates and lower sales compared with conditions two years ago.

Sales are down 35% from the early 2022 peak, per the National Association of Realtors, which reports on existing home sales (January 2022 through April 2024).

But viewed through the prism of prices, the market has been remarkably resilient in the face of falling sales, as prices have been underpinned by the scarcity of homes for sale.

What’s keeping potential sellers on the sidelines? Many locked in low rates of 3% or less in 2021 and 2022. If they were to sell, they’d be trading in their rock-bottom rate for around 7%.

Freddie Mac’s weekly survey pegged the 30-year fixed rate at 7.03% as of May 30.

However, that may not last forever, as any number of circumstances (or simply the desire to trade one living situation for another) could eventually push potential sellers off the fence.

The situation remains exceedingly difficult for first-time buyers as they grapple with high prices and higher mortgage rates. While all localities are not experiencing rising prices, on average, home prices are at a record high.