Weekly Market Commentary

Investors celebrated an ‘in line with expectations’ CPI that suggested the rate of inflation isn’t accelerating. It’s a small win, but it was enough to send the three major market indexes, the Dow, the Nasdaq, and the S&P 500 to new highs.

Last Wednesday, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) rose 0.3% in April. The core CPI, which minuses out food and energy, also rose 0.3%. Both matched analyst expectations, according to the Wall Street Journal.

The core CPI slowed from 3.8% annually in March to 3.6% in April, the slowest pace since early 2021. The headline CPI eased to 3.4% annually from 3.5%.

So, why would stocks rally on a report that didn’t surprise anyone? Well, there were concerns that we’d see another hot CPI, something greater than 0.3% for the core rate.

That didn’t happen; call it a relief rally.

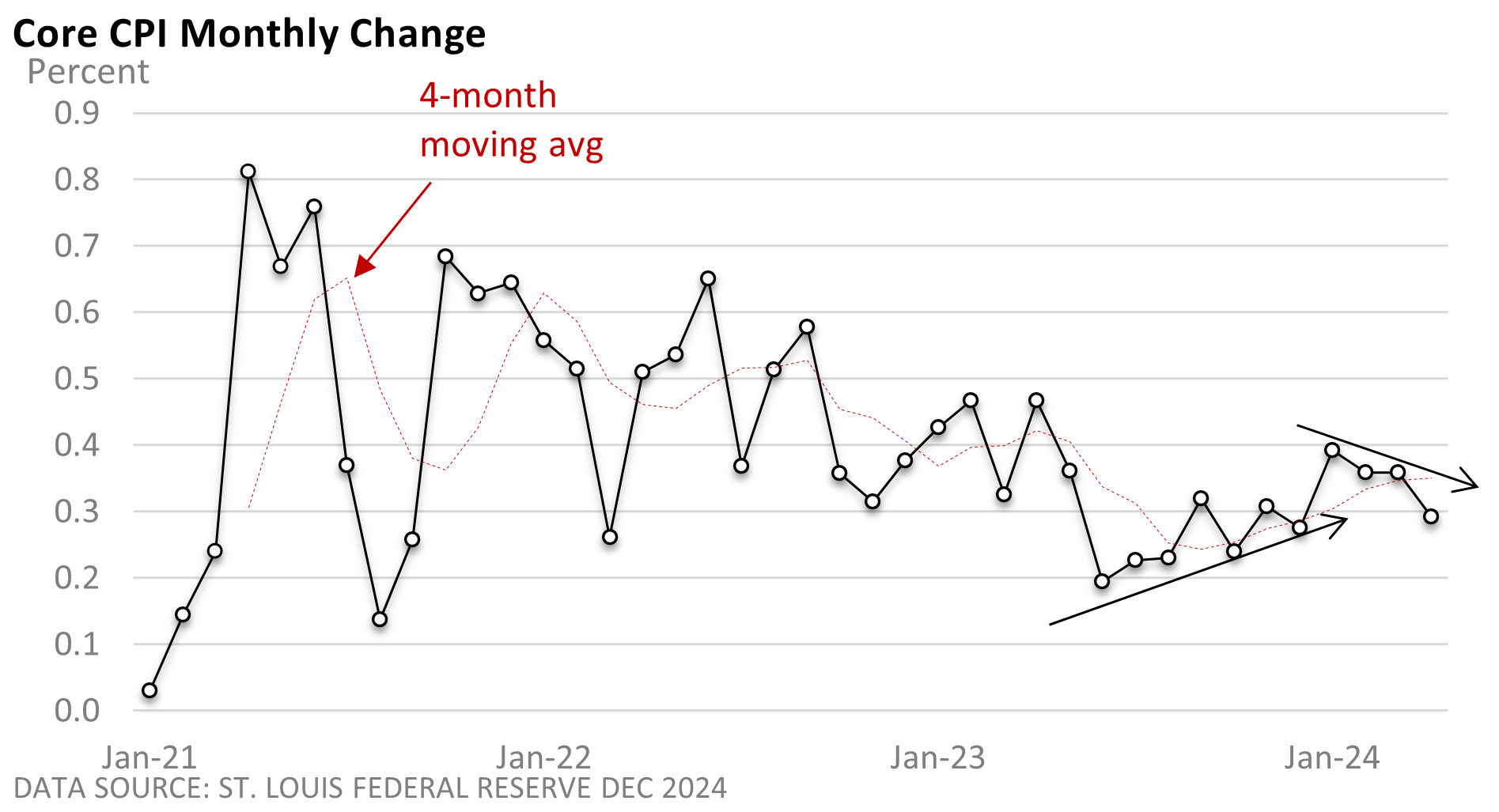

As the graphic illustrates, the monthly change in core inflation gradually turned higher in the second half of 2003, and it peaked in January.

While April’s milder reading is just one month (and it’s difficult to firmly establish a downward trend with April’s reading), the monthly numbers are no longer accelerating. And that’s good news.

But it’s also a hollow victory. A 0.3% rate over the next 12 months, if it were to occur, annualizes to about 4%. Inflation remains too high, and the current rate is not conducive to a reduction in interest rates unless the economy unexpectedly weakens.

However, let’s not be overly pessimistic either.

While a trip to the store or a restaurant may reveal another price hike, a stable fed funds rate and an expanding economy have helped drive stocks to new highs this year. On Friday, the Dow closed at 40,003.59, a new high and the first-ever close above 40,000 (MarketWatch).

That’s in stark contrast to what was happening two years ago.