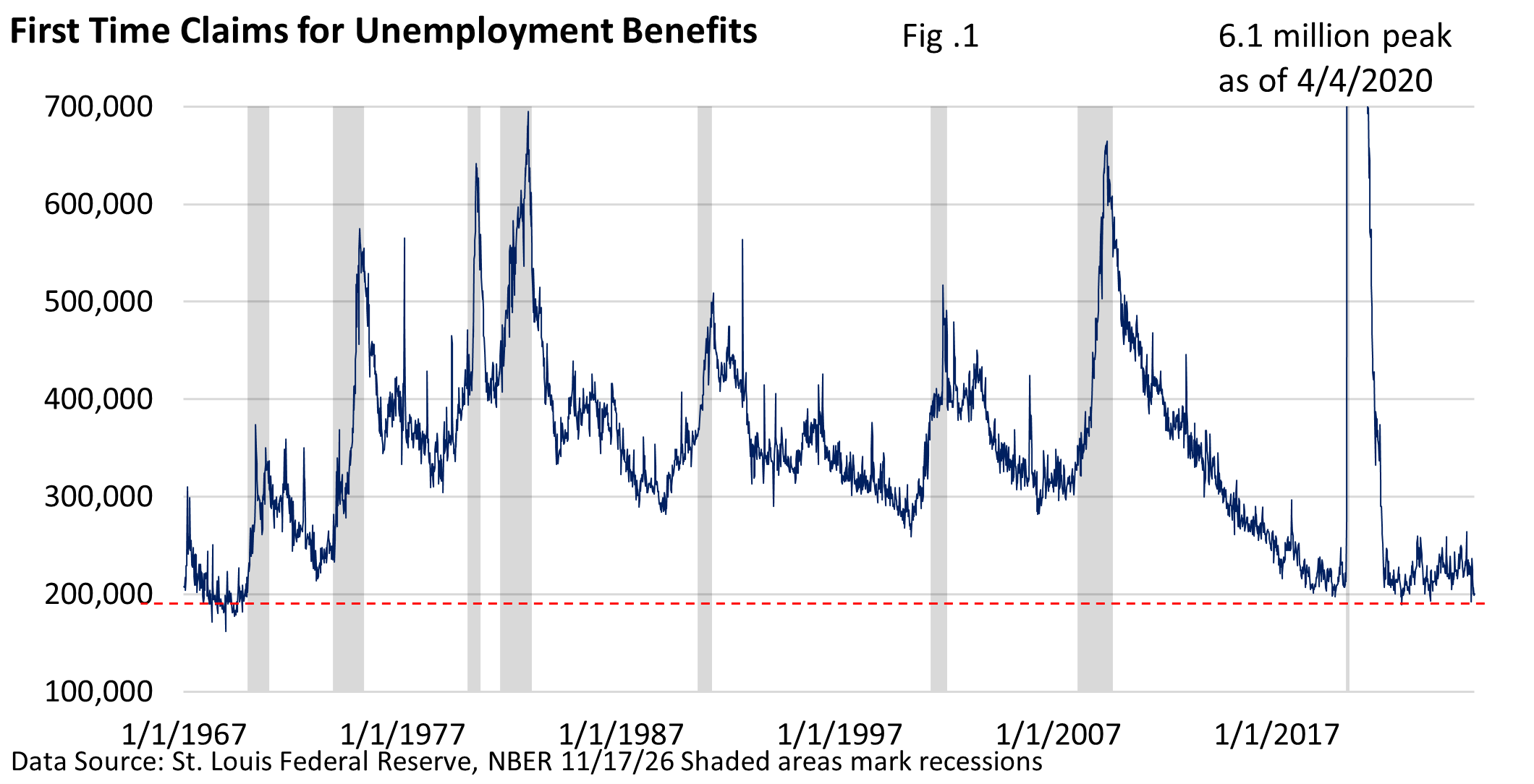

Figure 1 highlights the number of individuals who go online or head to their respective state’s unemployment office and file for benefits following a layoff.

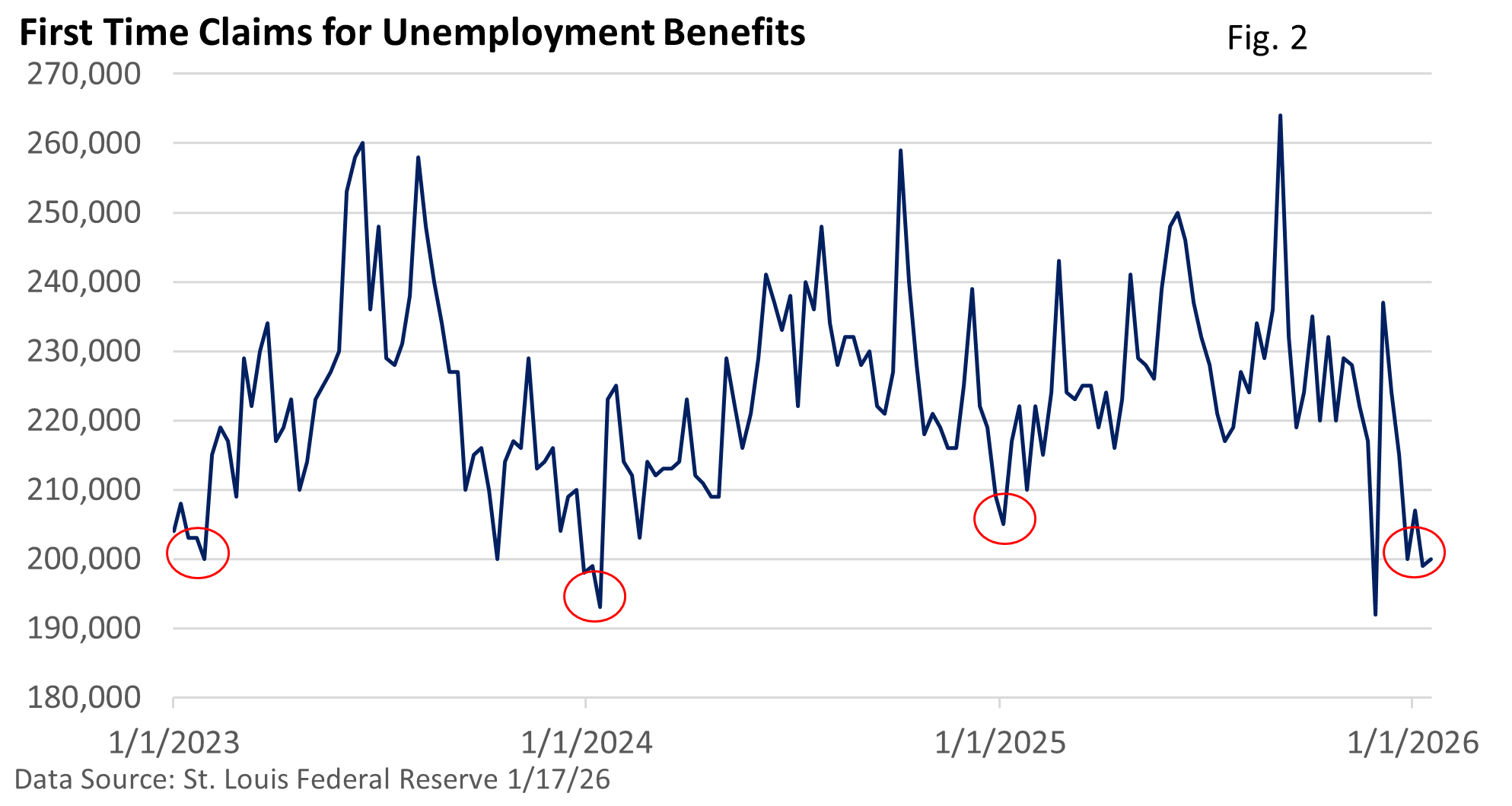

At 200,000 in the week ended January 17, claims are near a historic low.

Not surprisingly, layoffs peak in a recession, and the severity of the recession plays a big role in the level.

Let’s drill down on the last three years—Figure 2.

That said, filings tend to decline in January—Figure 2—which may simply reflect seasonal quirks in the data rather than a recent, positive shift in labor‑market dynamics.

If this seasonal pattern persists, filings may edge modestly higher in the weeks ahead. Still, the move back toward the lower end of the annual range is encouraging and, on its own, does not signal underlying economic weakness.

In summary, layoffs never disappear entirely, but workers filing for benefits remains low.

That is a constructive signal for both the labor market and the broader economy. In turn, sustained economic growth provides underlying support for corporate profits.