Well, that was unexpected.

The U.S. Bureau of Labor Statistics reported that the economy added a whopping 254,000 jobs in September, about 100,000 more than economists surveyed by Bloomberg had projected. The unemployment rate, expected to hold steady at 4.2%, slipped to 4.1%.

Additionally, job growth was revised higher for July and August.

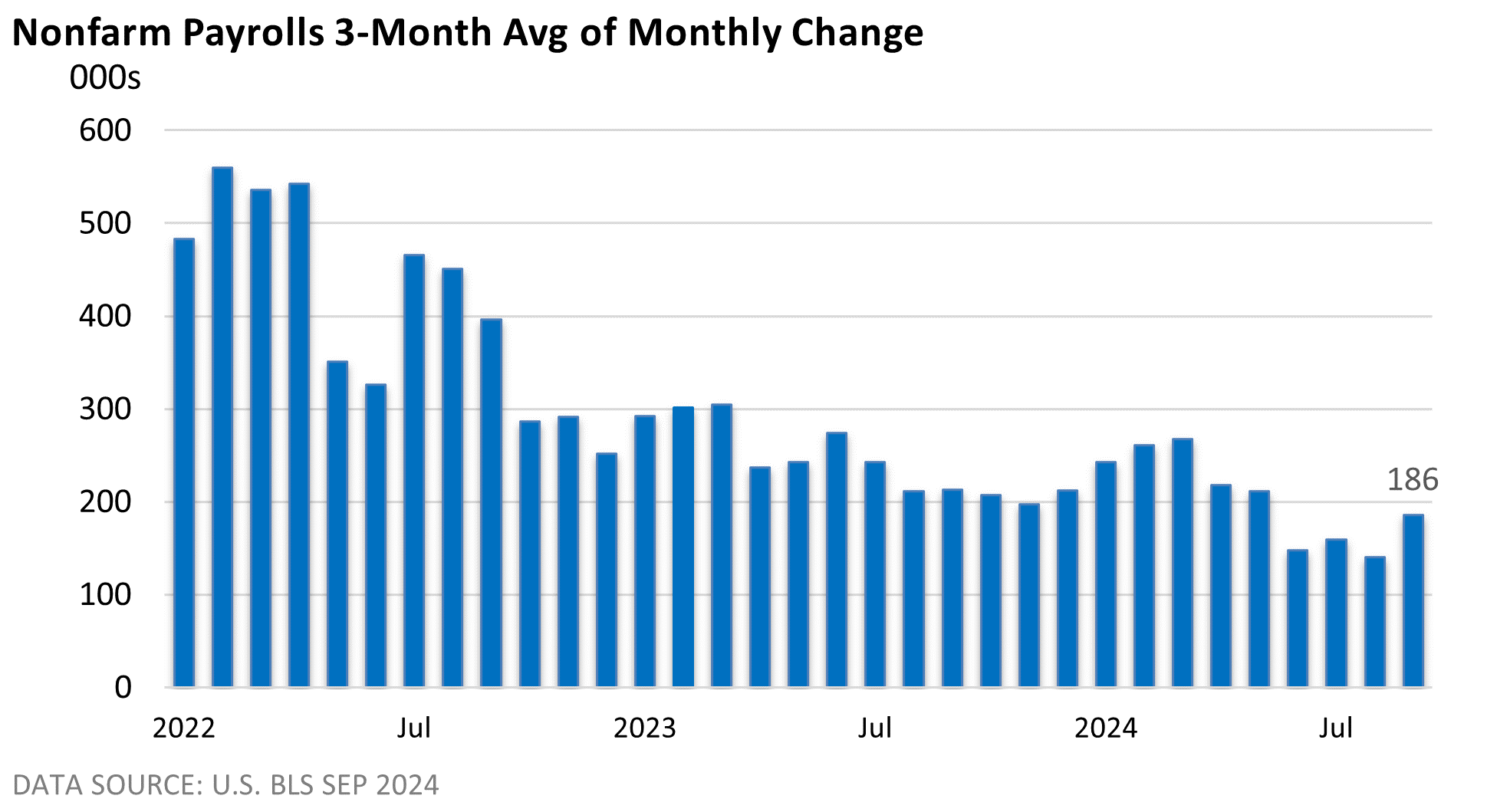

The graphic above illustrates the average change over the last three months of the monthly change in nonfarm payrolls. While the overall trend is lower, the 3-month average of 186,000 jobs through September signals that the economy continues to expand.

No doubt, Fed officials will take notice.

At last month’s meeting, the Fed voted to reduce the fed funds rate by a half-percentage point, primarily because prior employment data had reflected slower job growth, and policymakers were worried that the labor market might soften too much.

So, where might the Fed be headed? Last month’s strength appears to have shut the door on another half-point rate cut at the November 7 meeting. A 25-basis point reduction (bp, 1 bp = 0.01%) seems more likely.

Given the resiliency in the labor market, it could even be argued that September’s 50 bp rate cut was premature.

But, could July and August have been artificially soft (data quirks), and September was simply catch-up and an outlier? Or, might we begin to see more robust job growth? It’s too soon to answer definitively.

We’ll probably get some clarity when the October jobs report is released next month; however, the destruction in the wake of Hurricane Helene could muddy October’s data.